Stock Analysis

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Carbios SAS (EPA:ALCRB) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Carbios SAS

How Much Debt Does Carbios SAS Carry?

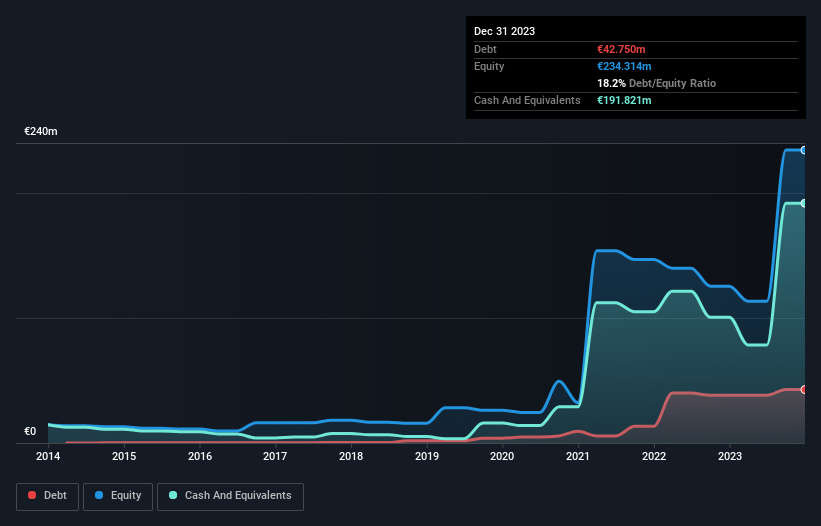

You can click the graphic below for the historical numbers, but it shows that as of December 2023 Carbios SAS had €42.8m of debt, an increase on €38.2m, over one year. However, its balance sheet shows it holds €191.8m in cash, so it actually has €149.1m net cash.

How Healthy Is Carbios SAS' Balance Sheet?

The latest balance sheet data shows that Carbios SAS had liabilities of €21.5m due within a year, and liabilities of €46.2m falling due after that. Offsetting these obligations, it had cash of €191.8m as well as receivables valued at €6.0k due within 12 months. So it can boast €124.1m more liquid assets than total liabilities.

This excess liquidity is a great indication that Carbios SAS' balance sheet is almost as strong as Fort Knox. Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, Carbios SAS boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Carbios SAS can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

It seems likely shareholders hope that Carbios SAS can significantly advance the business plan before too long, because it doesn't have any significant revenue at the moment.

So How Risky Is Carbios SAS?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Carbios SAS had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of €23m and booked a €27m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of €149.1m. That kitty means the company can keep spending for growth for at least two years, at current rates. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Carbios SAS you should be aware of, and 3 of them are concerning.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're helping make it simple.

Find out whether Carbios SAS is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ENXTPA:ALCRB

Carbios SAS

Carbios SAS, a green chemistry company, researches and develops industrial bioprocesses for the biodegradation and bio recycling of polymers.

Excellent balance sheet with limited growth.