Stock Analysis

- Taiwan

- /

- Auto Components

- /

- TWSE:4566

GLOBAL TEK FABRICATION's (TWSE:4566) Dividend Will Be Reduced To NT$1.43

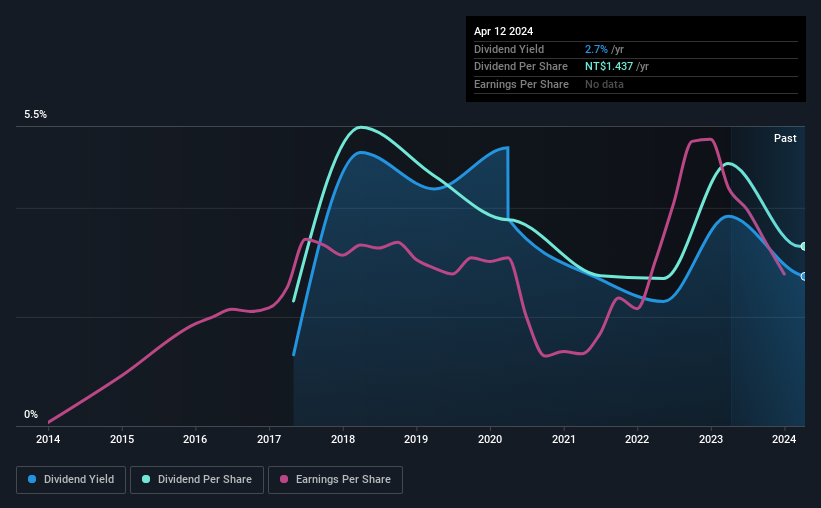

GLOBAL TEK FABRICATION CO., Ltd. (TWSE:4566) has announced that on 17th of May, it will be paying a dividend ofNT$1.43, which a reduction from last year's comparable dividend. Despite the cut, the dividend yield of 2.7% will still be comparable to other companies in the industry.

View our latest analysis for GLOBAL TEK FABRICATION

GLOBAL TEK FABRICATION's Payment Has Solid Earnings Coverage

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. The last dividend was quite easily covered by GLOBAL TEK FABRICATION's earnings. This means that a large portion of its earnings are being retained to grow the business.

EPS is set to fall by 2.9% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 51%, which is definitely feasible to continue.

GLOBAL TEK FABRICATION's Dividend Has Lacked Consistency

Looking back, GLOBAL TEK FABRICATION's dividend hasn't been particularly consistent. This makes us cautious about the consistency of the dividend over a full economic cycle. The annual payment during the last 7 years was NT$1.00 in 2017, and the most recent fiscal year payment was NT$1.44. This implies that the company grew its distributions at a yearly rate of about 5.3% over that duration. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's not great to see that GLOBAL TEK FABRICATION's earnings per share has fallen at approximately 2.9% per year over the past five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

We should note that GLOBAL TEK FABRICATION has issued stock equal to 12% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On GLOBAL TEK FABRICATION's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for GLOBAL TEK FABRICATION that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether GLOBAL TEK FABRICATION is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TWSE:4566

GLOBAL TEK FABRICATION

GLOBAL TEK FABRICATION CO., Ltd. manufactures and sells precision parts and subassemblies in China.

Excellent balance sheet and fair value.