Stock Analysis

Further weakness as Mobvista (HKG:1860) drops 12% this week, taking three-year losses to 73%

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Mobvista Inc. (HKG:1860) investors who have held the stock for three years as it declined a whopping 73%. That'd be enough to cause even the strongest minds some disquiet. The more recent news is of little comfort, with the share price down 33% in a year. Unfortunately the share price momentum is still quite negative, with prices down 19% in thirty days. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

Since Mobvista has shed HK$539m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Mobvista

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Mobvista moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 22% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Mobvista further; while we may be missing something on this analysis, there might also be an opportunity.

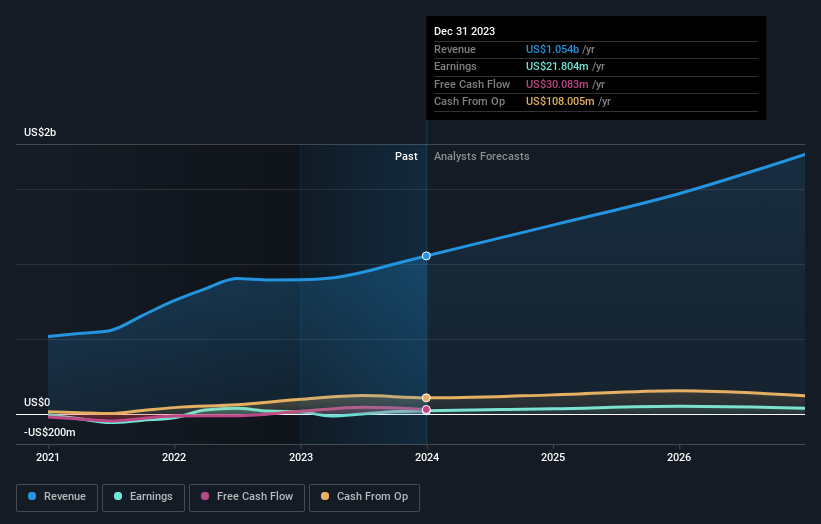

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Mobvista has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Mobvista stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 12% in the twelve months, Mobvista shareholders did even worse, losing 33%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Mobvista .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Mobvista is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1860

Mobvista

Mobvista Inc., together with its subsidiaries, engages in the provision of advertising and marketing technology services required to develop the mobile internet ecosystem to customers worldwide.

Excellent balance sheet with reasonable growth potential.