Stock Analysis

- Israel

- /

- Oil and Gas

- /

- TASE:UPSL

Further Upside For Upsellon Brands Holdings Ltd (TLV:UPSL) Shares Could Introduce Price Risks After 27% Bounce

Upsellon Brands Holdings Ltd (TLV:UPSL) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

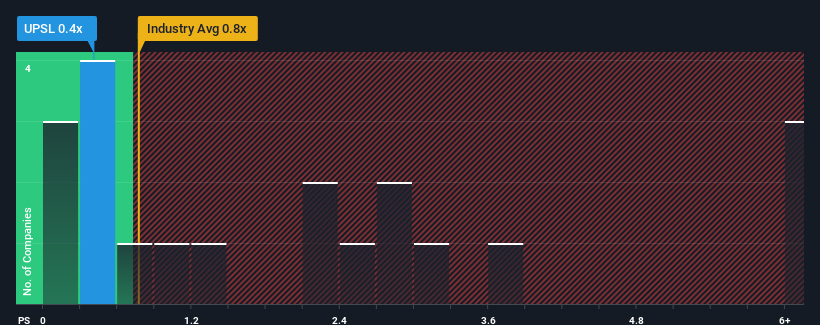

Although its price has surged higher, when close to half the companies operating in Israel's Oil and Gas industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Upsellon Brands Holdings as an enticing stock to check out with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Upsellon Brands Holdings

What Does Upsellon Brands Holdings' Recent Performance Look Like?

As an illustration, revenue has deteriorated at Upsellon Brands Holdings over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Upsellon Brands Holdings' earnings, revenue and cash flow.How Is Upsellon Brands Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Upsellon Brands Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 8.8% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to shrink 1.3% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it very odd that Upsellon Brands Holdings is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does Upsellon Brands Holdings' P/S Mean For Investors?

Upsellon Brands Holdings' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Upon analysing the past data, we see it is unexpected that Upsellon Brands Holdings is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Upsellon Brands Holdings (3 are concerning!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Upsellon Brands Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TASE:UPSL

Upsellon Brands Holdings

Upsellon Brands Holdings Ltd engages in acquisition, marketing, and improvement of private labels, products, and virtual stores that operate under amazon's trading platform.

Flawless balance sheet and good value.