Stock Analysis

- India

- /

- Renewable Energy

- /

- NSEI:PTC

Exploring VST Industries And Two Other Noteworthy Dividend Stocks In India

Reviewed by Kshitija Bhandaru

Over the past week, India's market has experienced a 2.1% decline, yet it still boasts an impressive 45% increase over the last year with earnings projected to grow by 18% annually. In this climate, a good stock could be one that offers consistent dividends - like VST Industries and two other noteworthy companies we will explore in this article.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.55% | ★★★★★☆ |

| Balmer Lawrie Investments (BSE:532485) | 5.05% | ★★★★★☆ |

| Swaraj Engines (NSEI:SWARAJENG) | 3.80% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.52% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.05% | ★★★★★☆ |

| VST Industries (BSE:509966) | 4.03% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.02% | ★★★★★☆ |

| Ruchira Papers (NSEI:RUCHIRA) | 4.17% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.72% | ★★★★★☆ |

| Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.77% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

VST Industries (BSE:509966)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VST Industries Limited, with a market cap of ₹57.46 billion, is an India-based company that operates internationally, specializing in the manufacture, trade and marketing of cigarettes and other tobacco products.

Operations: VST Industries Limited, a global player in the tobacco industry, primarily generates its revenue from the sale of Tobacco and Related Products, which amounted to ₹13.47 billion.

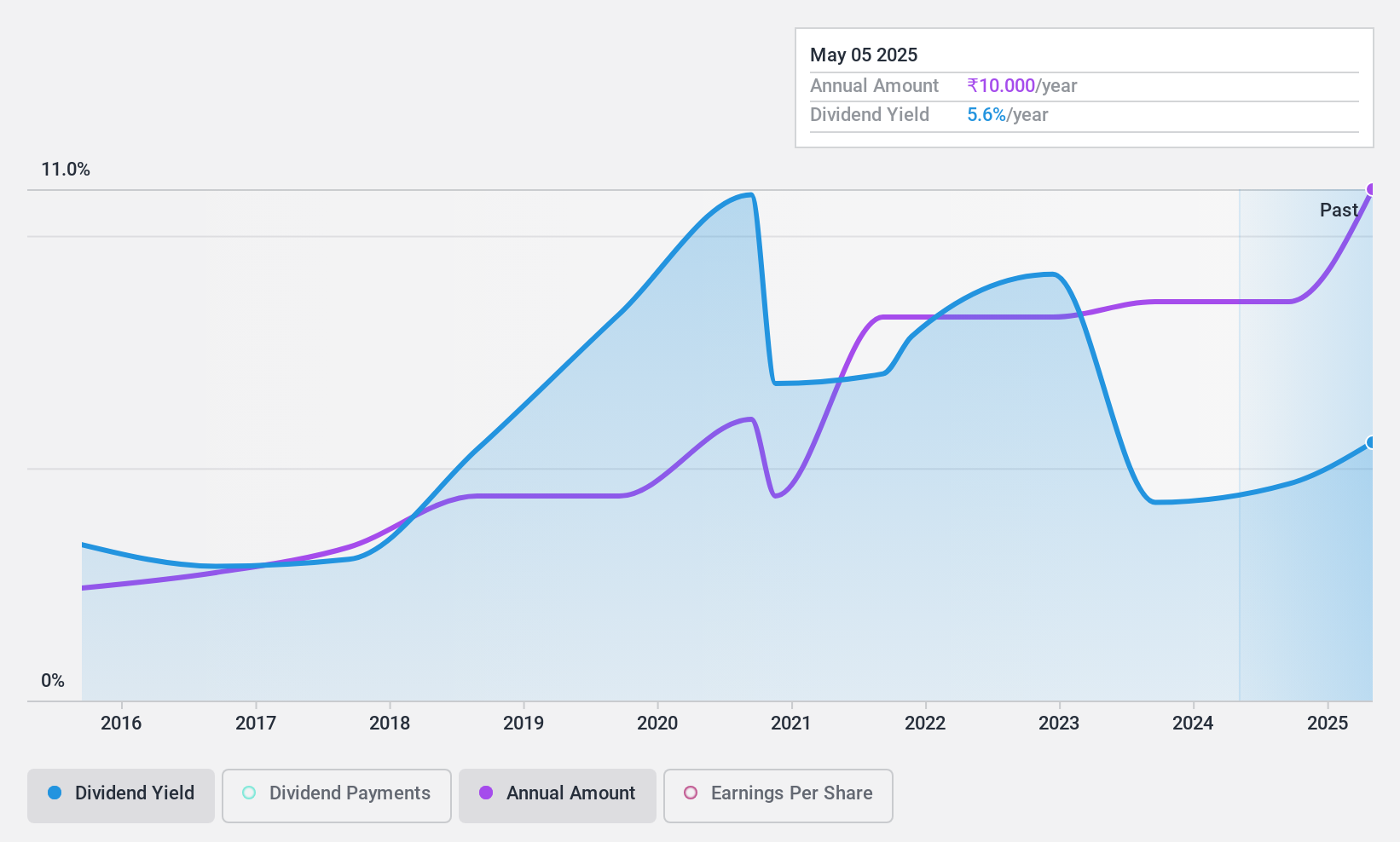

Dividend Yield: 4%

VST Industries' dividend payments have grown over the past decade, and its 4.03% yield ranks in the top 25% of Indian market dividend payers. Despite a reasonable payout ratio of 70.8%, concerns arise as the company has no free cash flows to cover dividends, indicating potential sustainability issues. Recent executive changes saw Mr. Sanjay Wali appointed as COO, bringing extensive experience from Procter & Gamble and Godfrey Philips among others.

- Click here and access our complete dividend analysis report to understand the dynamics of VST Industries.

Our expertly prepared valuation report VST Industries implies its share price may be too high.

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, a company with its subsidiaries, operates in the power trading sector across India, Nepal, Bhutan, and Bangladesh with a market cap of ₹62.04 billion.

Operations: PTC India Limited generates its revenue primarily from two segments, power trading which contributes ₹163.77 billion and financing business that adds another ₹7.85 billion to the company's earnings.

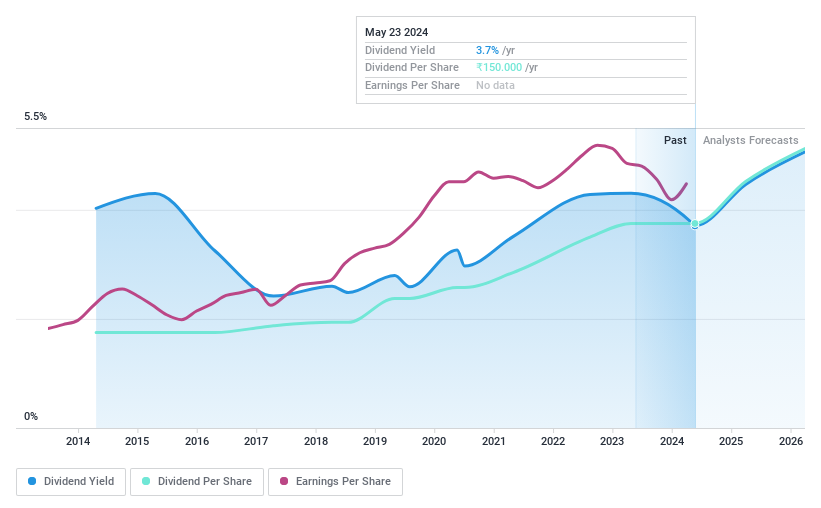

Dividend Yield: 3.7%

PTC India's dividends, backed by a modest cash payout ratio of 7.7% and earnings payout ratio of 51.8%, have seen growth over the past decade. However, an unstable track record and insufficient coverage of interest payments by earnings present potential risks. The firm's price-to-earnings ratio stands at a favourable 12.2x compared to the Indian market average of 30.5x. Recent board changes include the appointment of Mr Rajiv Kumar Rohilla as Non-Executive Nominee Director on March 28, 2024.

Oil and Natural Gas (NSEI:ONGC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited is an Indian multinational company that carries out exploration, development, and production of crude oil and natural gas both domestically and internationally, with a market capitalization of approximately ₹3.56 trillion.

Operations: Oil and Natural Gas Corporation Limited generates its revenue primarily from refining and marketing in India, contributing approximately ₹56.06 billion, followed by exploration and production activities both onshore (₹4.44 billion) and offshore (₹9.54 billion), while its operations outside India contribute around ₹0.97 billion to the total revenue.

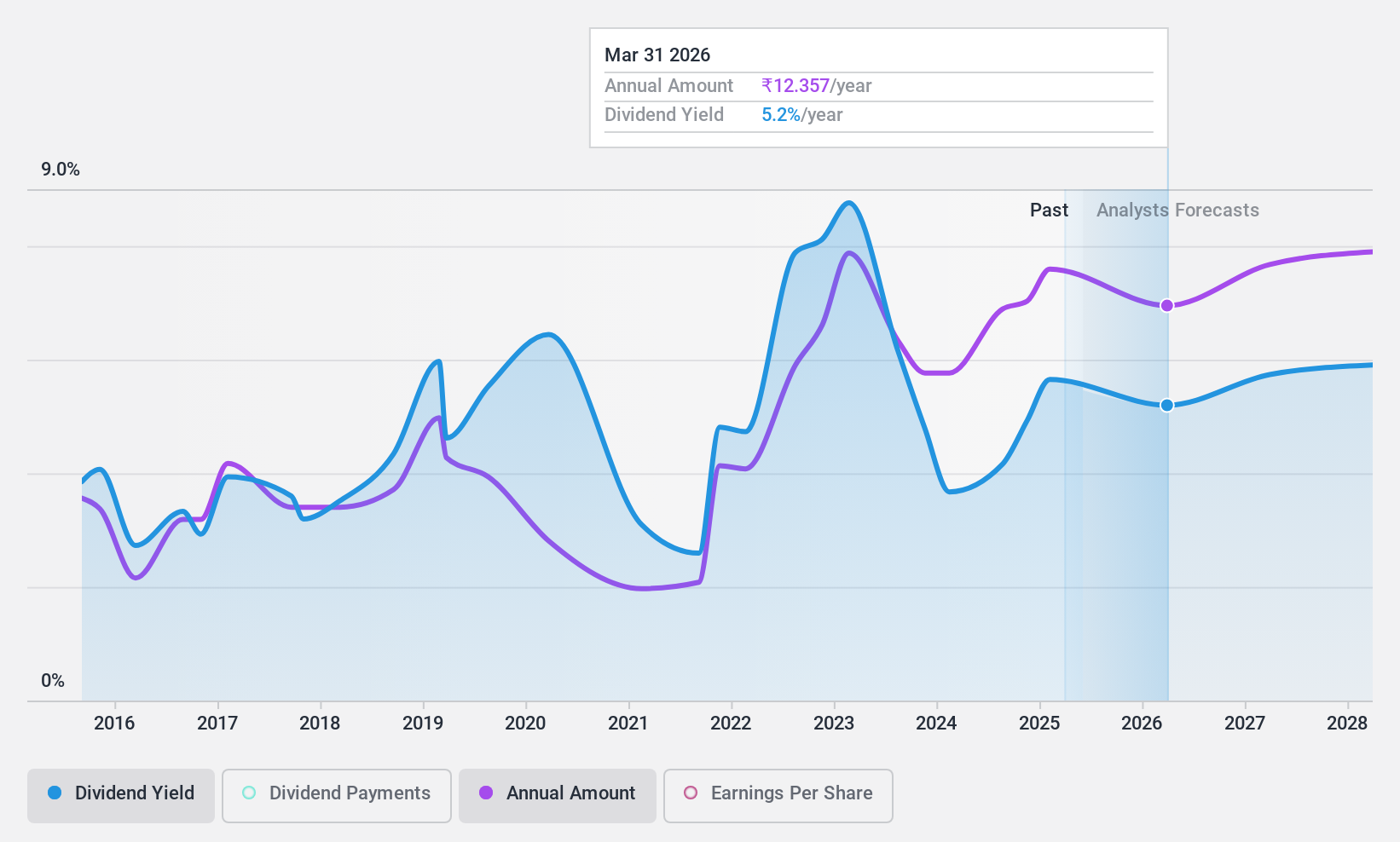

Dividend Yield: 3.6%

Oil and Natural Gas Corporation's (ONGC) dividends, with a payout ratio of 30.8% from earnings and 21.7% from cash flows, are sustainable. Despite an unstable track record over the past decade, ONGC's dividend yield of 3.62% places it in the top quartile of Indian market dividend payers. The company recently signed a Memorandum of Understanding (MoU) with GAIL (India) Limited and Shell Energy India to explore hydrocarbon import opportunities, aligning with India's Atmanirbhar Bharat mission for self-reliance in manufacturing.

- Navigate through the intricacies of Oil and Natural Gas with our comprehensive dividend report here.

Turning Ideas Into Actions

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether PTC India is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PTC

PTC India

PTC India Limited, together with its subsidiaries, engages in the trading of power in India, Nepal, Bhutan, and Bangladesh.

Established dividend payer with adequate balance sheet.