In the current market climate, with Japan's economy showing signs of growth and its stock markets gaining over the week, it's an opportune time to explore dividend stocks. A good dividend stock in this context would be one that can potentially offer steady income and stability amidst global uncertainties, while also capitalizing on the positive momentum in Japan's economy.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.69% | ★★★★★★ |

| SOLXYZ (TSE:4284) | 3.68% | ★★★★★★ |

| Japan Oil Transportation (TSE:9074) | 3.54% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.14% | ★★★★★★ |

| Innotech (TSE:9880) | 3.86% | ★★★★★★ |

| CMC (TSE:2185) | 3.46% | ★★★★★★ |

| Star Micronics (TSE:7718) | 3.38% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.28% | ★★★★★★ |

| Toyo Kanetsu K.K (TSE:6369) | 3.51% | ★★★★★★ |

Click here to see the full list of 422 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

YAMADA Consulting GroupLtd (TSE:4792)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YAMADA Consulting Group Co., Ltd. is a global consulting firm offering a wide array of services in Japan, Asia, the United States and other international markets, with a market capitalization of approximately ¥36.88 billion.

Operations: YAMADA Consulting Group Co., Ltd., a global consulting firm, generates its revenue by providing diverse consulting services across Japan, Asia, the United States and other international markets.

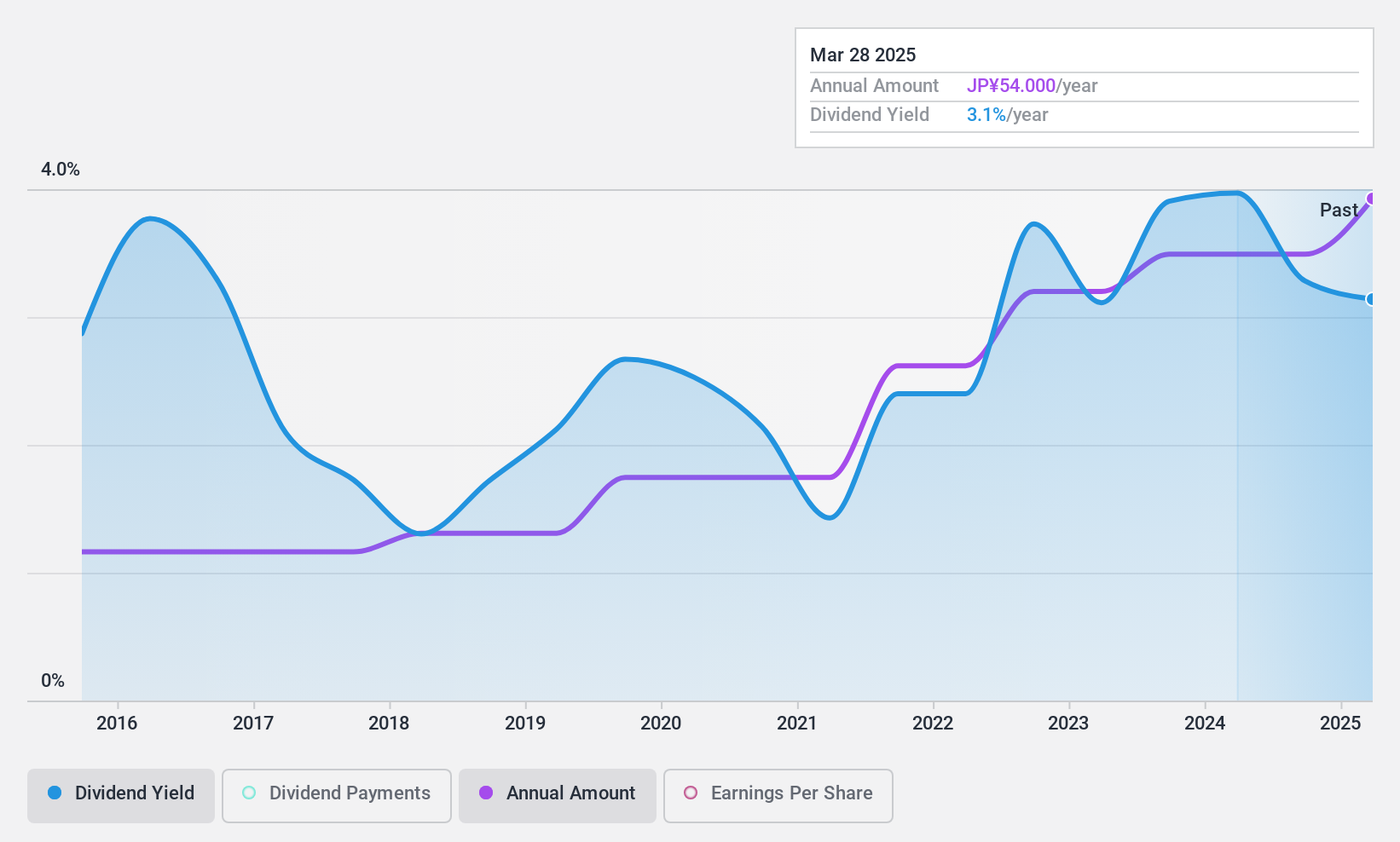

Dividend Yield: 3.6%

YAMADA Consulting Group's dividend payments have shown volatility over the past decade, although they have increased overall. Its dividend yield of 3.57% is in the top tier of Japanese market payers, and both earnings and cash flows adequately cover these payments with payout ratios of 47.9% and 53.3% respectively. Recently, YAMADA raised its fiscal year guidance and increased its year-end dividend to JPY 42 per share from a previous forecast of JPY 34 per share.

Tsugami (TSE:6101)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Tsugami Corporation, a company with a market cap of ¥60.15 billion, is engaged in the manufacturing and selling of precision machine tools along with its subsidiaries in Japan.

Operations: Tsugami Corporation, a precision machine tools manufacturer in Japan with a market capitalisation of ¥60.15 billion, does not have detailed revenue segments available for review.

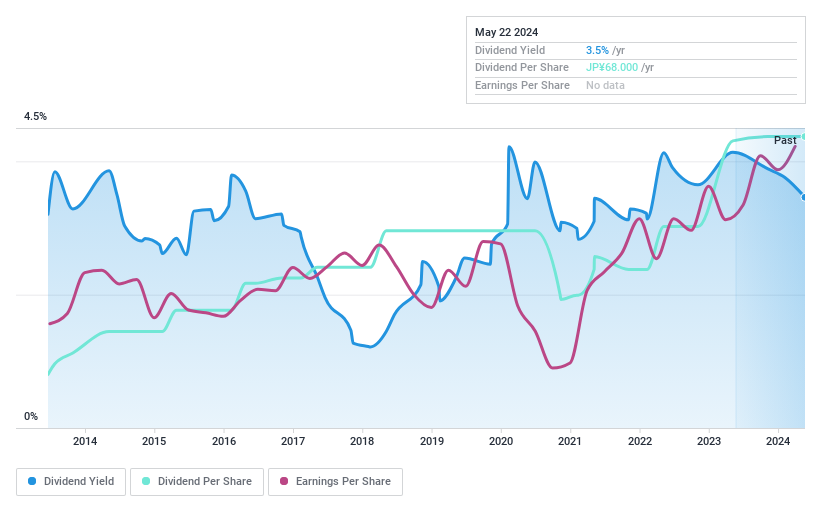

Dividend Yield: 3.8%

Tsugami's robust dividend yield of 3.79% places it in the top quarter of Japanese market payers. Over the last decade, its dividends have shown consistency and growth, backed by a low cash payout ratio of 18.4% and earnings payout ratio at 43.8%. The company's Price-To-Earnings ratio stands below the market average at 11.5x, indicating good value. Recently, Tsugami completed a share buyback worth ¥492.52 million which could potentially enhance shareholder returns.

Yamato International (TSE:8127)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yamato International Inc., a company that specializes in the manufacturing and selling of textile products in Japan, has a market capitalization of approximately ¥7.05 billion.

Operations: Yamato International Inc., known for its textile production, does not provide specific details on its revenue segments.

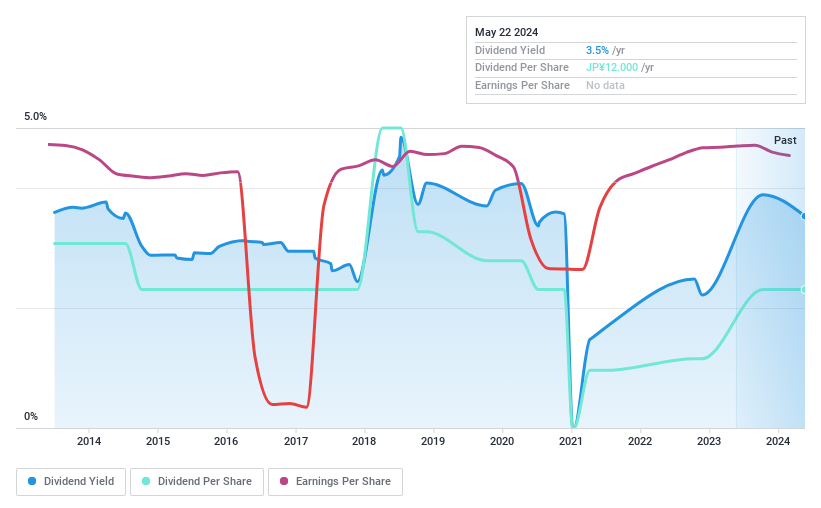

Dividend Yield: 3.6%

Yamato International's dividend yield of 3.57% ranks in the top quarter of Japanese market payers, outperforming the average of 3.18%. However, its decade-long track record reveals an unstable and declining trend in dividend payments, with a notable annual drop exceeding 20%. Despite this volatility, Yamato's dividends are well-supported by a reasonable earnings payout ratio of 60.4% and cash payout ratio at 55.8%, suggesting potential for future stability.

Where To Now?

- Investigate our full lineup of 422 Top Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Tsugami is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St

About TSE:6101

Tsugami

Tsugami Corporation, together with its subsidiaries, manufactures and sells precision machine tools in Japan.

6 star dividend payer with excellent balance sheet.