As we navigate through the complexities of the global markets in April 2024, it's worth turning our attention to the French market. With recent economic indicators suggesting a potential shift in monetary policy and an uptick in manufacturing output, investors may find opportunities within France's dividend-paying stocks. In this volatile environment, a good stock could be one that offers regular dividends to provide a steady income stream. This is particularly relevant given current market uncertainties and inflationary pressures. In this article, we will explore three such French dividend stocks that have shown resilience amidst these challenging conditions.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Rubis (ENXTPA:RUI) | 5.74% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 9.01% | ★★★★★★ |

| Métropole Télévision (ENXTPA:MMT) | 8.78% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.30% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 4.37% | ★★★★★☆ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 7.17% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 3.58% | ★★★★★☆ |

| Jacquet Metals (ENXTPA:JCQ) | 5.54% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.07% | ★★★★★☆ |

| CBo Territoria (ENXTPA:CBOT) | 6.45% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

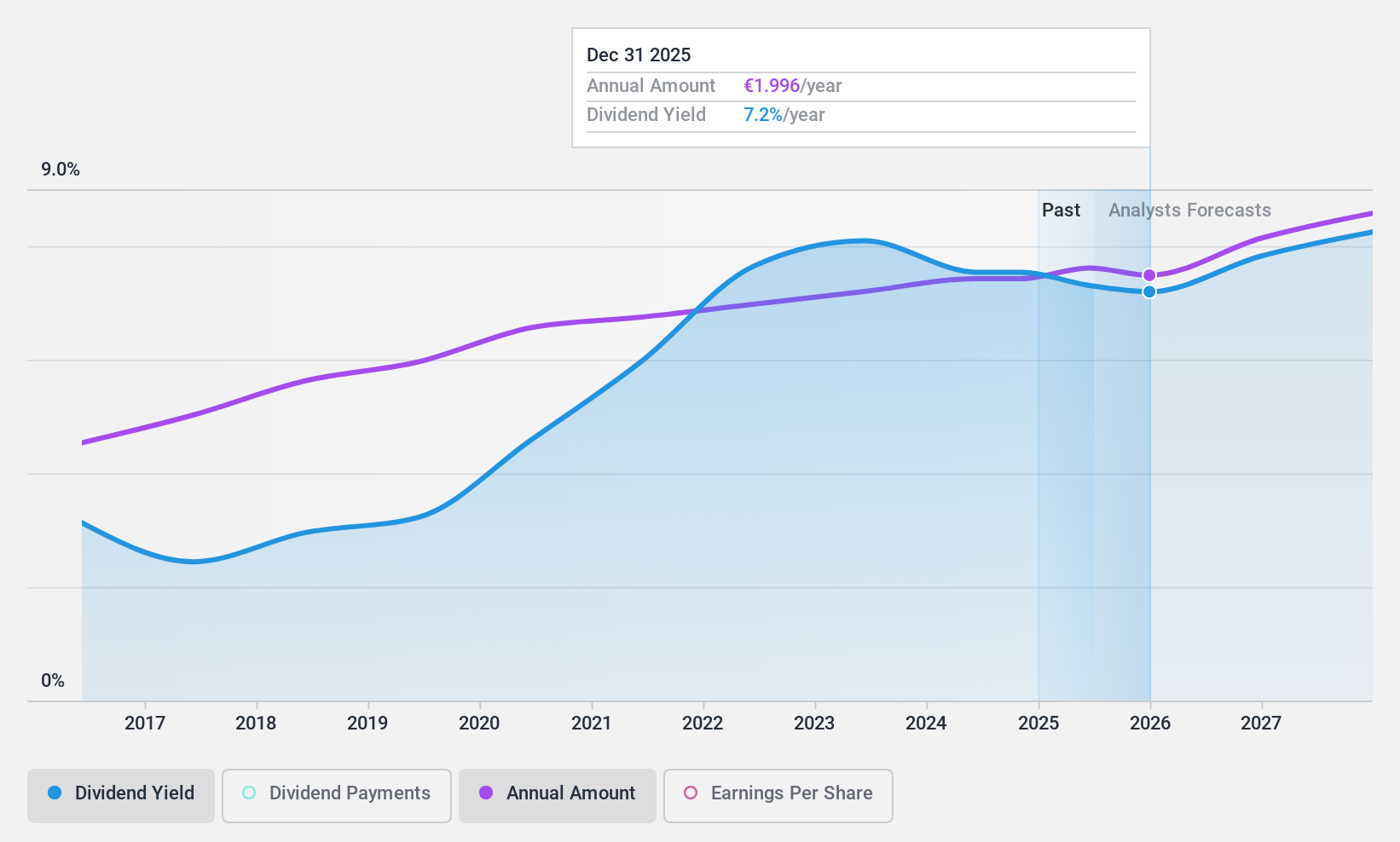

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative, a French banking institution, offers a variety of financial services and products to diverse customer groups including individuals, professionals, farmers, businesses and private banking clients; it has a market cap of €1.03 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates its revenue primarily from two segments, with Retail Banking in France contributing €505.07 million and Non-Business Activities adding another €80.01 million to the total earnings.

Dividend Yield: 5.2%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's dividend yield at 5.24% is slightly below the top quartile of French dividend payers (5.33%). The company's dividends have shown stability and growth over the past decade, supported by a low payout ratio of 30.9%. However, its recent net income fell to €175.58 million from €217.73 million a year ago, and there is insufficient data to predict dividend coverage in three years' time.

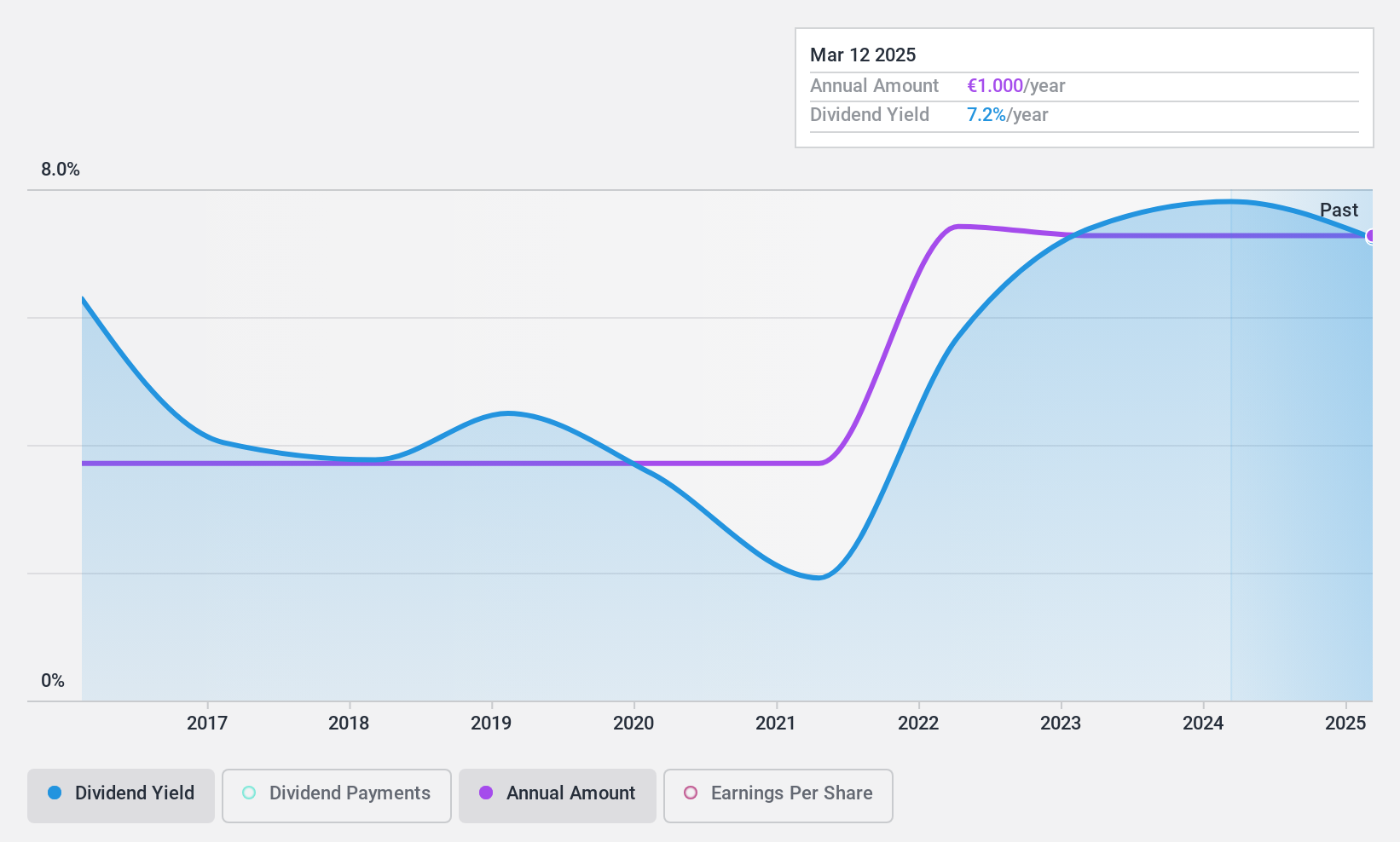

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA, a company with a market cap of €126.99 million, operates globally and is known for its design, manufacture, and marketing of swimming pools and related products primarily in France.

Operations: Piscines Desjoyaux SA generates its revenue primarily from the Swimming Pools segment, which brought in €138.65 million, while a minor portion of the revenue comes from Real Estate, amounting to €0.094 million.

Dividend Yield: 7.1%

Piscines Desjoyaux's dividend yield of 7.07% places it in the top 25% of French dividend payers. The company's dividends have displayed stability and growth over the past decade, with a payout ratio of 55.6%. However, its high cash payout ratio of 98.7% signals that dividends are not well covered by cash flows. Despite a lower Price-To-Earnings ratio (7.9x) than the French market (15.5x), investors should be mindful that earnings and/or cash flows do not cover its dividend payments.

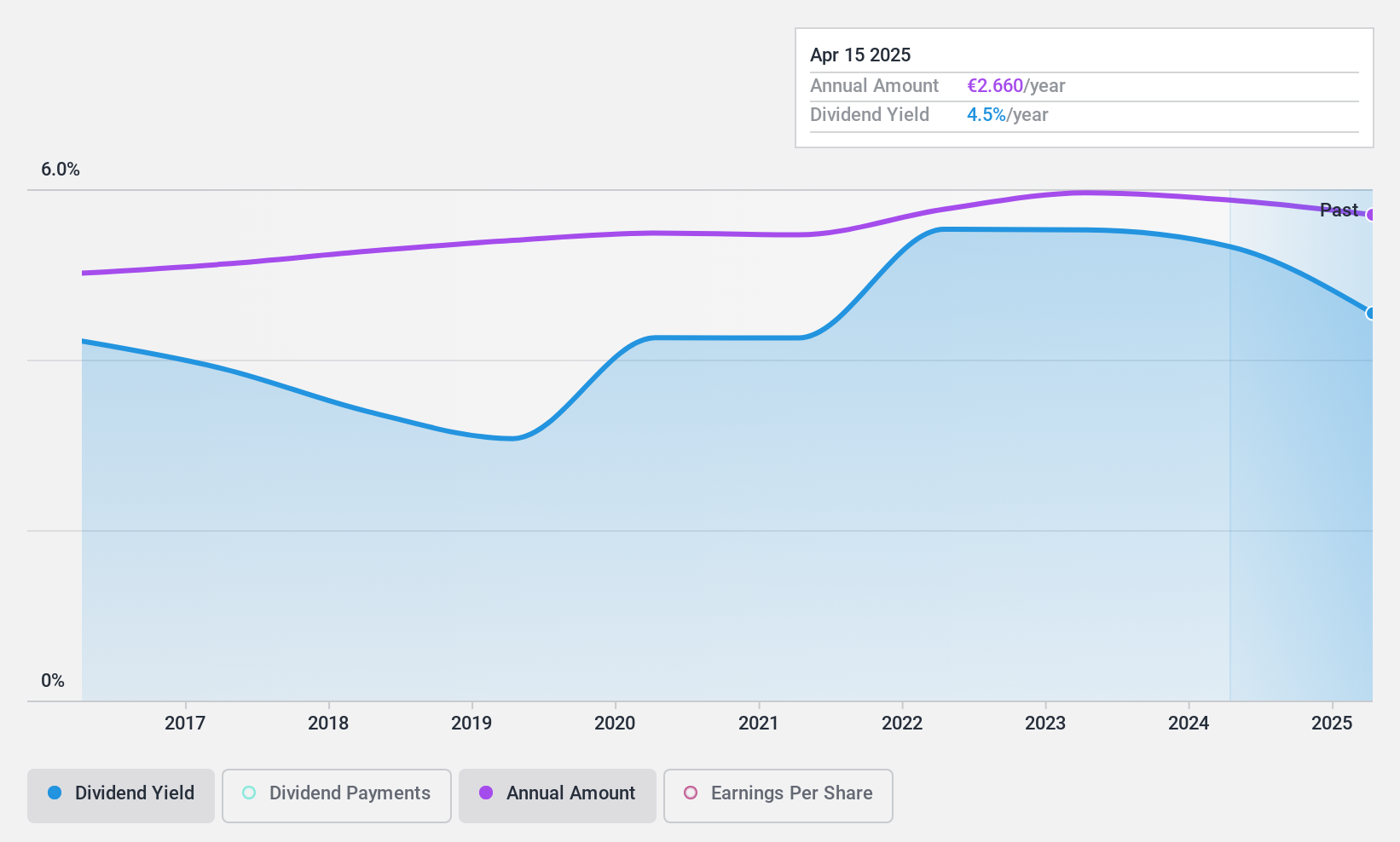

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis, operating under the ticker ENXTPA:RUI, is a company that specializes in managing bulk liquid storage facilities for commercial and industrial clients across Europe, Africa, and the Caribbean, with a market capitalization of approximately €3.45 billion.

Operations: Rubis, recognized by the ticker ENXTPA:RUI, generates its revenue primarily from two segments: Energy Distribution which contributes €6.58 billion and Renewable Electricity Production that adds another €48.64 million to the company's earnings.

Dividend Yield: 5.7%

Rubis's dividend yield of 5.74% ranks in the top 25% of French dividend payers, with a decade-long history of stable and growing payments. Covered by both earnings (payout ratio: 75%) and cash flows (cash payout ratio: 70.9%), its dividends are deemed reliable. However, the company's high debt level warrants caution. Trading at an estimated value that is 32.4% below fair value, Rubis also recently engaged in talks for a potential acquisition deal valued at €375 million.

Where To Now?

- Investigate our full lineup of 30 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Piscines Desjoyaux is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St

About ENXTPA:ALPDX

Piscines Desjoyaux

Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products in France and internationally.

Excellent balance sheet established dividend payer.