Stock Analysis

- Netherlands

- /

- Construction

- /

- ENXTAM:BAMNB

Earnings Working Against Koninklijke BAM Groep nv's (AMS:BAMNB) Share Price

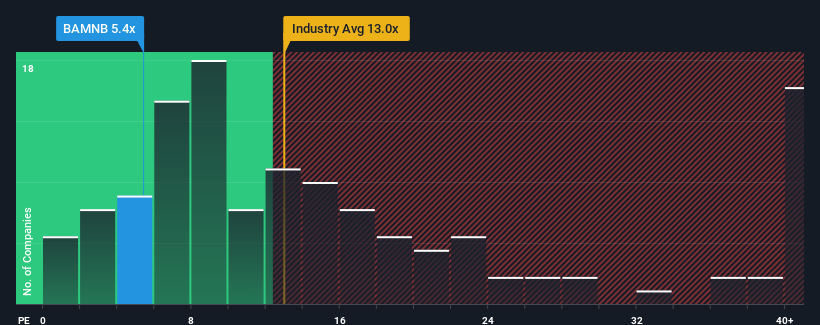

With a price-to-earnings (or "P/E") ratio of 5.4x Koninklijke BAM Groep nv (AMS:BAMNB) may be sending very bullish signals at the moment, given that almost half of all companies in the Netherlands have P/E ratios greater than 17x and even P/E's higher than 33x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Koninklijke BAM Groep's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Koninklijke BAM Groep

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Koninklijke BAM Groep would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.9%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 3.6% per annum as estimated by the two analysts watching the company. With the market predicted to deliver 14% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Koninklijke BAM Groep's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Koninklijke BAM Groep's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Koninklijke BAM Groep's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Koninklijke BAM Groep (1 can't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Koninklijke BAM Groep is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ENXTAM:BAMNB

Koninklijke BAM Groep

Koninklijke BAM Groep nv, together with its subsidiaries, provides products and services in the construction and property, civil engineering, and public private partnerships (PPP) sectors worldwide.

Undervalued with excellent balance sheet.