Stock Analysis

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Zodiac Energy (NSE:ZODIAC), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Zodiac Energy

How Fast Is Zodiac Energy Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Zodiac Energy's EPS has grown 29% each year, compound, over three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

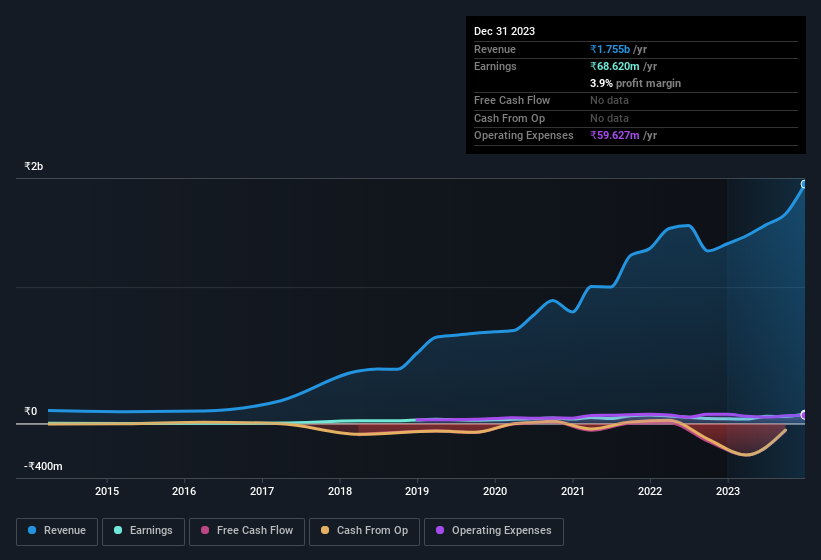

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Zodiac Energy is growing revenues, and EBIT margins improved by 2.6 percentage points to 7.9%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Zodiac Energy is no giant, with a market capitalisation of ₹6.6b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Zodiac Energy Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Zodiac Energy insiders spent ₹5.1m on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. We also note that it was the Non-Executive Director, Jaxay Shah, who made the biggest single acquisition, paying ₹4.9m for shares at about ₹378 each.

On top of the insider buying, we can also see that Zodiac Energy insiders own a large chunk of the company. To be exact, company insiders hold 77% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at ₹5.1b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Zodiac Energy Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Zodiac Energy's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Zodiac Energy (1 is a bit concerning) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Zodiac Energy, you'll probably love this curated collection of companies in IN that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Zodiac Energy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZODIAC

Zodiac Energy

Zodiac Energy Limited installs solar power generation plants and related items in India.

Solid track record with mediocre balance sheet.