Stock Analysis

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Ringkjøbing Landbobank (CPH:RILBA), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Ringkjøbing Landbobank

Ringkjøbing Landbobank's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Ringkjøbing Landbobank has achieved impressive annual EPS growth of 37%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

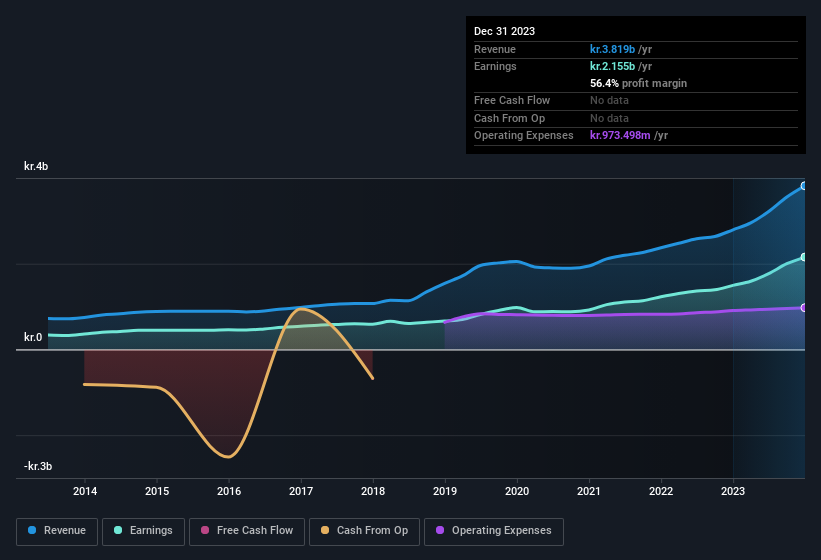

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Ringkjøbing Landbobank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Ringkjøbing Landbobank achieved similar EBIT margins to last year, revenue grew by a solid 37% to kr.3.8b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Ringkjøbing Landbobank's future EPS 100% free.

Are Ringkjøbing Landbobank Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Ringkjøbing Landbobank shareholders can gain quiet confidence from the fact that insiders shelled out kr.2.1m to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Independent Chairman, Martin Pedersen, who made the biggest single acquisition, paying kr.1.9m for shares at about kr.952 each.

Along with the insider buying, another encouraging sign for Ringkjøbing Landbobank is that insiders, as a group, have a considerable shareholding. Indeed, they hold kr.167m worth of its stock. This considerable investment should help drive long-term value in the business. Even though that's only about 0.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, John Fisker is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between kr.14b and kr.45b, like Ringkjøbing Landbobank, the median CEO pay is around kr.18m.

Ringkjøbing Landbobank offered total compensation worth kr.9.4m to its CEO in the year to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Ringkjøbing Landbobank Worth Keeping An Eye On?

Ringkjøbing Landbobank's earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Ringkjøbing Landbobank deserves timely attention. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Ringkjøbing Landbobank. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Ringkjøbing Landbobank, you'll probably love this curated collection of companies in DK that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Ringkjøbing Landbobank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About CPSE:RILBA

Ringkjøbing Landbobank

Ringkjøbing Landbobank A/S provides various banking products and services in Denmark.

Flawless balance sheet with solid track record.