Stock Analysis

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Spar Nord Bank (CPH:SPNO). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Spar Nord Bank with the means to add long-term value to shareholders.

See our latest analysis for Spar Nord Bank

Spar Nord Bank's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Spar Nord Bank has grown EPS by 54% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

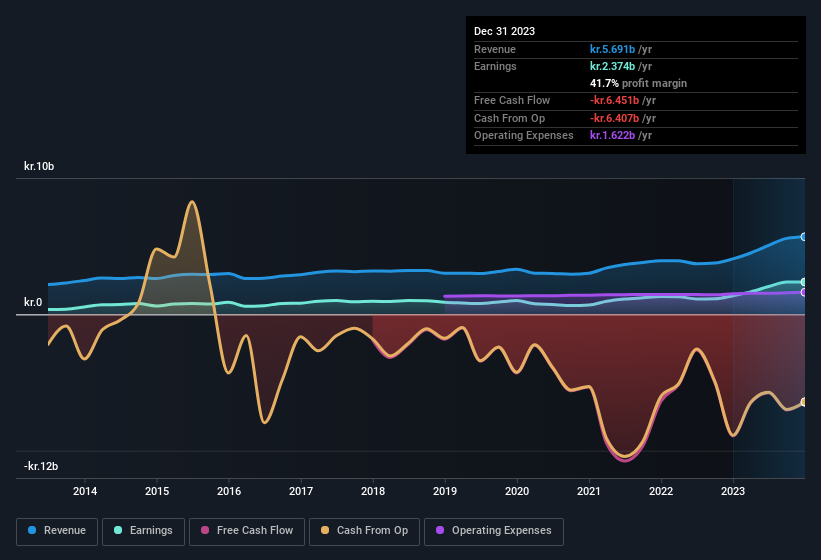

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Spar Nord Bank's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Spar Nord Bank achieved similar EBIT margins to last year, revenue grew by a solid 40% to kr.5.7b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Spar Nord Bank Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Spar Nord Bank shareholders can gain quiet confidence from the fact that insiders shelled out kr.3.4m to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was Independent Director Henrik Sjogreen who made the biggest single purchase, worth kr.1.8m, paying kr.118 per share.

Recent insider purchases of Spar Nord Bank stock is not the only way management has kept the interests of the general public shareholders in mind. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations between kr.7.0b and kr.22b, like Spar Nord Bank, the median CEO pay is around kr.18m.

The Spar Nord Bank CEO received total compensation of just kr.6.2m in the year to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Spar Nord Bank Deserve A Spot On Your Watchlist?

Spar Nord Bank's earnings have taken off in quite an impressive fashion. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Spar Nord Bank may be at an inflection point. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for Spar Nord Bank you should be aware of, and 1 of them makes us a bit uncomfortable.

The good news is that Spar Nord Bank is not the only growth stock with insider buying. Here's a list of growth-focused companies in DK with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Spar Nord Bank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About CPSE:SPNO

Spar Nord Bank

Spar Nord Bank A/S provides various banking products and services to retail and business customers in Denmark.

Undervalued with excellent balance sheet and pays a dividend.