Stock Analysis

Deutsche Bank Aktiengesellschaft's (ETR:DBK) dividend will be increasing from last year's payment of the same period to €0.45 on 21st of May. The payment will take the dividend yield to 3.1%, which is in line with the average for the industry.

See our latest analysis for Deutsche Bank

Deutsche Bank's Payment Expected To Have Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible.

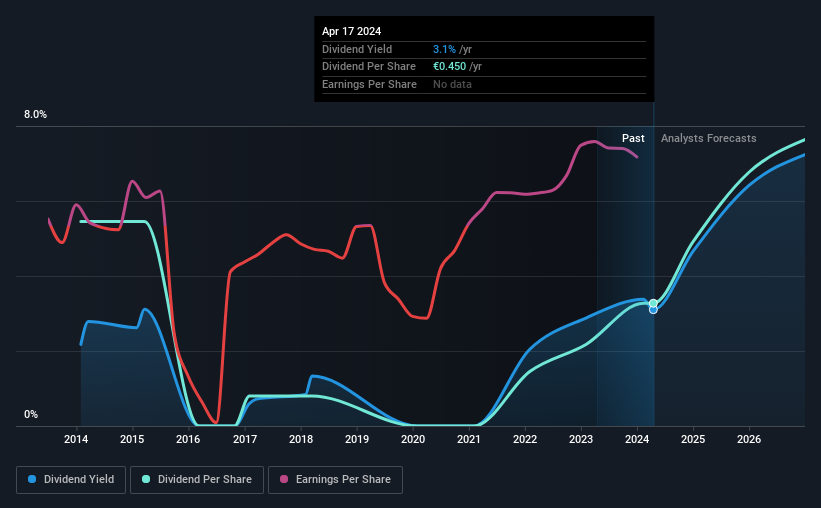

Deutsche Bank has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Using data from its latest earnings report, Deutsche Bank's payout ratio sits at 22%, an extremely comfortable number that shows that it can pay its dividend.

Looking forward, EPS is forecast to rise by 32.0% over the next 3 years. The future payout ratio could be 38% over that time period, according to analyst estimates, which is a good look for the future of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the annual payment back then was €0.75, compared to the most recent full-year payment of €0.45. Doing the maths, this is a decline of about 5.0% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Deutsche Bank has seen EPS rising for the last five years, at 64% per annum. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

Deutsche Bank Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that Deutsche Bank is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Deutsche Bank that investors should take into consideration. Is Deutsche Bank not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Deutsche Bank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DBK

Deutsche Bank

Deutsche Bank Aktiengesellschaft, a stock corporation, provides corporate and investment banking, and asset management products and services to private individuals, corporate entities, and institutional clients in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Undervalued with adequate balance sheet.