Stock Analysis

- Brazil

- /

- Hospitality

- /

- BOVESPA:CVCB3

CVC Brasil Operadora e Agência de Viagens S.A. (BVMF:CVCB3) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

The CVC Brasil Operadora e Agência de Viagens S.A. (BVMF:CVCB3) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 26% in that time.

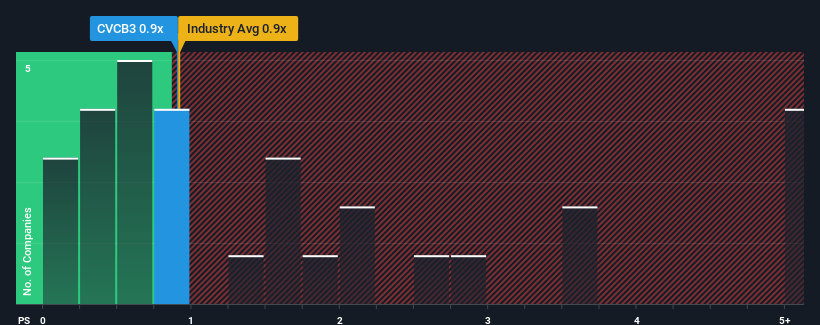

Although its price has dipped substantially, you could still be forgiven for thinking CVC Brasil Operadora e Agência de Viagens is a stock not worth researching with a price-to-sales ratios (or "P/S") of 0.9x, considering almost half the companies in Brazil's Hospitality industry have P/S ratios below 0.3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CVC Brasil Operadora e Agência de Viagens

How Has CVC Brasil Operadora e Agência de Viagens Performed Recently?

CVC Brasil Operadora e Agência de Viagens could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on CVC Brasil Operadora e Agência de Viagens will help you uncover what's on the horizon.How Is CVC Brasil Operadora e Agência de Viagens' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like CVC Brasil Operadora e Agência de Viagens' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Pleasingly, revenue has also lifted 129% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 7.6% each year over the next three years. With the industry predicted to deliver 15% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that CVC Brasil Operadora e Agência de Viagens' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On CVC Brasil Operadora e Agência de Viagens' P/S

Despite the recent share price weakness, CVC Brasil Operadora e Agência de Viagens' P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for CVC Brasil Operadora e Agência de Viagens, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 3 warning signs we've spotted with CVC Brasil Operadora e Agência de Viagens (including 2 which make us uncomfortable).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether CVC Brasil Operadora e Agência de Viagens is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CVCB3

CVC Brasil Operadora e Agência de Viagens

CVC Brasil Operadora e Agência de Viagens S.A., together with its subsidiaries, provides tourism services in Brazil and internationally.

Reasonable growth potential and slightly overvalued.