Stock Analysis

- New Zealand

- /

- Telecom Services and Carriers

- /

- NZSE:CNU

Chorus Limited's (NZSE:CNU) Shares May Have Run Too Fast Too Soon

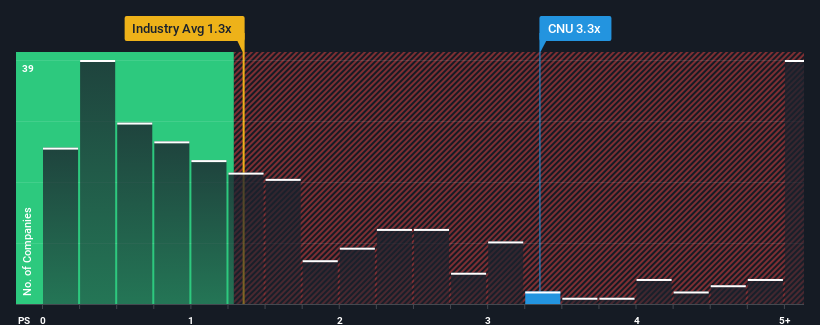

When you see that almost half of the companies in the Telecom industry in New Zealand have price-to-sales ratios (or "P/S") below 1.4x, Chorus Limited (NZSE:CNU) looks to be giving off some sell signals with its 3.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Chorus

What Does Chorus' Recent Performance Look Like?

Recent revenue growth for Chorus has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Chorus will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Chorus?

The only time you'd be truly comfortable seeing a P/S as high as Chorus' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Looking ahead now, revenue is anticipated to climb by 3.1% per year during the coming three years according to the seven analysts following the company. That's shaping up to be similar to the 3.6% per annum growth forecast for the broader industry.

In light of this, it's curious that Chorus' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Chorus' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Chorus' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Chorus (at least 2 which are concerning), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Chorus is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:CNU

Chorus

Chorus Limited, together with its subsidiaries, provides fixed line communications infrastructure services in New Zealand.

Reasonable growth potential and slightly overvalued.