Stock Analysis

- Germany

- /

- Trade Distributors

- /

- XTRA:BNR

Brenntag SE's (ETR:BNR) Business Is Yet to Catch Up With Its Share Price

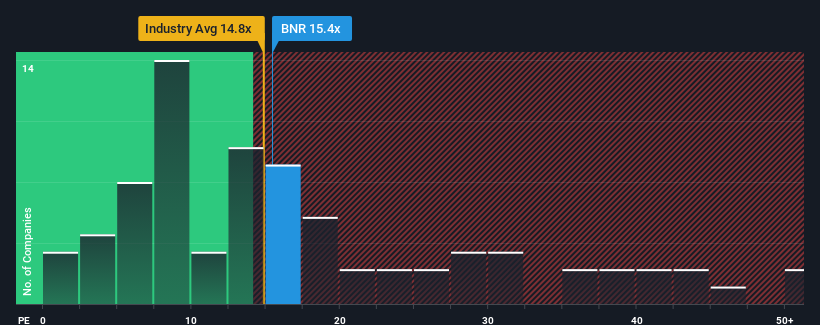

With a median price-to-earnings (or "P/E") ratio of close to 17x in Germany, you could be forgiven for feeling indifferent about Brenntag SE's (ETR:BNR) P/E ratio of 15.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Brenntag as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for Brenntag

How Is Brenntag's Growth Trending?

The only time you'd be comfortable seeing a P/E like Brenntag's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 64% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 9.2% per year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 14% per year growth forecast for the broader market.

With this information, we find it interesting that Brenntag is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Brenntag currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Brenntag with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Brenntag is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:BNR

Brenntag

Brenntag SE purchases and supplies various industrial and specialty chemicals, and ingredients in Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet established dividend payer.