Stock Analysis

- Portugal

- /

- Oil and Gas

- /

- ENXTLS:GALP

Benign Growth For Galp Energia, SGPS, S.A. (ELI:GALP) Underpins Its Share Price

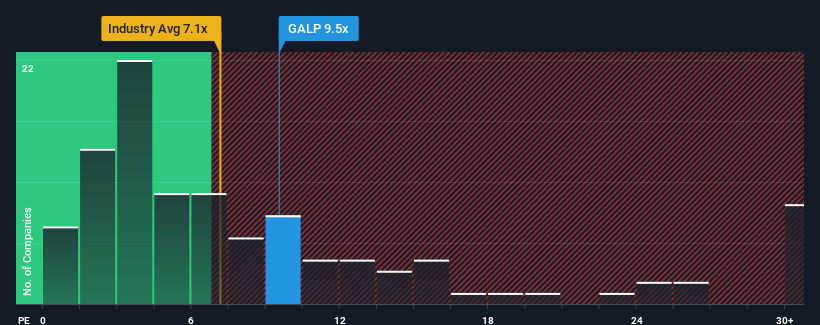

When close to half the companies in Portugal have price-to-earnings ratios (or "P/E's") above 12x, you may consider Galp Energia, SGPS, S.A. (ELI:GALP) as an attractive investment with its 9.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Galp Energia SGPS' negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Galp Energia SGPS

How Is Galp Energia SGPS' Growth Trending?

Galp Energia SGPS' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 5.7% per annum as estimated by the analysts watching the company. Meanwhile, the broader market is forecast to expand by 5.6% per year, which paints a poor picture.

In light of this, it's understandable that Galp Energia SGPS' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Galp Energia SGPS' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Galp Energia SGPS' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Galp Energia SGPS (1 is potentially serious!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether Galp Energia SGPS is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:GALP

Galp Energia SGPS

Galp Energia, SGPS, S.A. operates as an integrated energy operator in Portugal and internationally.

Proven track record with adequate balance sheet and pays a dividend.