Stock Analysis

- Belgium

- /

- Consumer Durables

- /

- ENXTBR:BELYS

Belysse Group NV (EBR:BELYS) Shares Fly 29% But Investors Aren't Buying For Growth

The Belysse Group NV (EBR:BELYS) share price has done very well over the last month, posting an excellent gain of 29%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

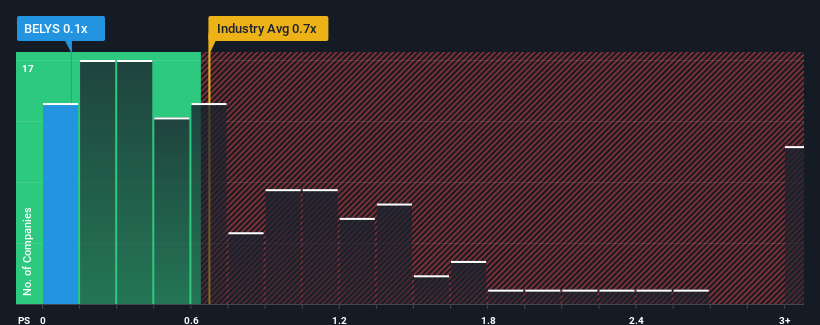

In spite of the firm bounce in price, it would still be understandable if you think Belysse Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Belgium's Consumer Durables industry have P/S ratios above 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Belysse Group

How Has Belysse Group Performed Recently?

Recent times haven't been great for Belysse Group as its revenue has been falling quicker than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Belysse Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Belysse Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 0.4% per annum over the next three years. With the industry predicted to deliver 5.9% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Belysse Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Belysse Group's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Belysse Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Belysse Group (1 makes us a bit uncomfortable!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Belysse Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ENXTBR:BELYS

Belysse Group

Belysse Group NV engages in the production and sale of textile floor coverings for commercial and residential applications in Europe, North America, and internationally.

Undervalued with moderate growth potential.