Stock Analysis

- United Arab Emirates

- /

- Professional Services

- /

- ADX:BAYANAT

Bayanat AI PLC's (ADX:BAYANAT) Popularity With Investors Could Be Under Threat From Overpricing

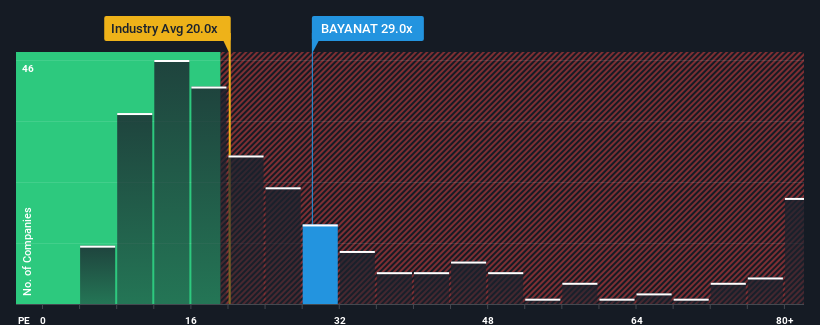

When close to half the companies in the United Arab Emirates have price-to-earnings ratios (or "P/E's") below 14x, you may consider Bayanat AI PLC ( ADX:BAYANAT ) as a stock to avoid entirely with its 29x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For instance, Bayanat AI's receding earnings per share (EPS) in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Bayanat AI

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bayanat AI will help you shine a light on its historical performance.

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Bayanat AI's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.4% decrease to the company's earnings per share. As a result, earnings per share from three years ago has also fallen 74% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings on a per-share basis over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 1.6% shows it's an unpleasant look.

However, if we look at an overall picture of earnings, the company has done much better, growing earnings 14.9% over the last year. Over the last 3 years earnings has also jumped up 30.6%.

With this information, we can understand why Bayanat AI is trading at a P/E higher than the market. However for more peace of mind, we'd like to also see EPS growth as well as underlying earnings growth. If EPS doesn't begin to trend upwards, there's a chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative EPS growth rates.

The Bottom Line On Bayanat AI's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bayanat AI currently could be trading on a higher than expected P/E since its recent EPS growth have been in decline over the medium-term. Right now, we are only comfortable with the high P/E if earnings continues its upwards trajectory.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Bayanat AI you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether Bayanat AI is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ADX:BAYANAT

Bayanat AI

Bayanat AI PLC, through its subsidiary, Bayanat GIQ PJSC, operates as an artificial intelligence (AI) powered geospatial intelligence company in the United Arab Emirates.

Flawless balance sheet and overvalued.