Stock Analysis

Bank Polska Kasa Opieki S.A.'s (WSE:PEO) CEO Looks Due For A Compensation Raise

Key Insights

- Bank Polska Kasa Opieki will host its Annual General Meeting on 17th of April

- Salary of zł1.25m is part of CEO Leszek Skiba's total remuneration

- Total compensation is 82% below industry average

- Bank Polska Kasa Opieki's EPS grew by 81% over the past three years while total shareholder return over the past three years was 188%

The solid performance at Bank Polska Kasa Opieki S.A. (WSE:PEO) has been impressive and shareholders will probably be pleased to know that CEO Leszek Skiba has delivered. At the upcoming AGM on 17th of April, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

Check out our latest analysis for Bank Polska Kasa Opieki

Comparing Bank Polska Kasa Opieki S.A.'s CEO Compensation With The Industry

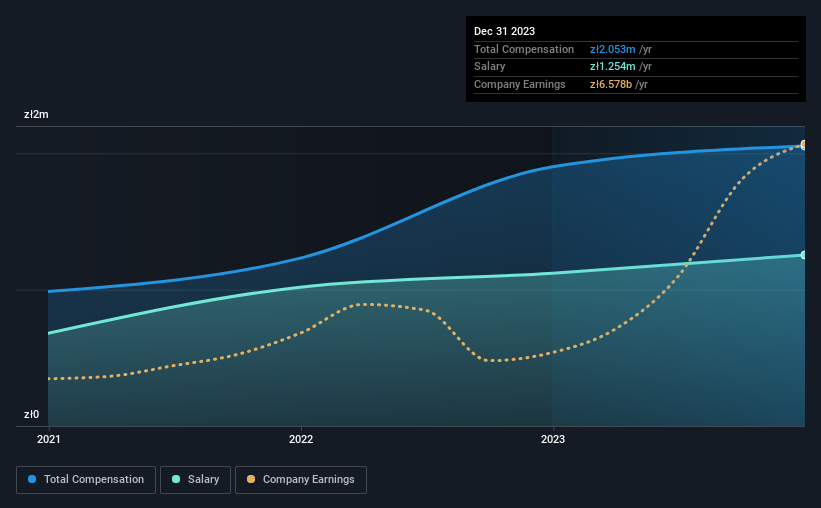

At the time of writing, our data shows that Bank Polska Kasa Opieki S.A. has a market capitalization of zł49b, and reported total annual CEO compensation of zł2.1m for the year to December 2023. That's a fairly small increase of 8.0% over the previous year. We note that the salary portion, which stands at zł1.25m constitutes the majority of total compensation received by the CEO.

On comparing similar companies in the Polish Banks industry with market capitalizations above zł32b, we found that the median total CEO compensation was zł11m. This suggests that Leszek Skiba is paid below the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | zł1.3m | zł1.1m | 61% |

| Other | zł799k | zł781k | 39% |

| Total Compensation | zł2.1m | zł1.9m | 100% |

On an industry level, around 63% of total compensation represents salary and 37% is other remuneration. There isn't a significant difference between Bank Polska Kasa Opieki and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Bank Polska Kasa Opieki S.A.'s Growth

Over the past three years, Bank Polska Kasa Opieki S.A. has seen its earnings per share (EPS) grow by 81% per year. In the last year, its revenue is up 59%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Bank Polska Kasa Opieki S.A. Been A Good Investment?

Most shareholders would probably be pleased with Bank Polska Kasa Opieki S.A. for providing a total return of 188% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Bank Polska Kasa Opieki (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're helping make it simple.

Find out whether Bank Polska Kasa Opieki is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PEO

Bank Polska Kasa Opieki

Bank Polska Kasa Opieki S.A., a commercial bank, provides a range of banking products and services to retail and corporate clients in Poland and internationally.

Undervalued with solid track record and pays a dividend.