Stock Analysis

Banco Santander-Chile (SNSE:BSANTANDER) Is Reducing Its Dividend To CLP1.84

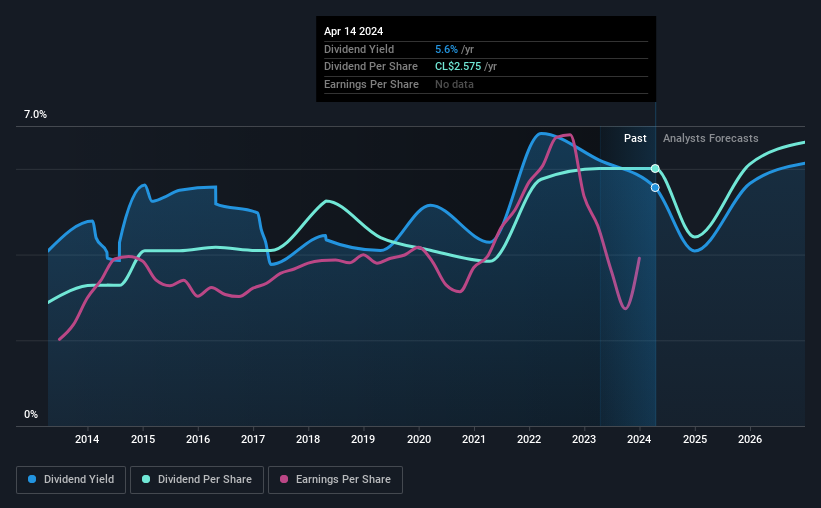

Banco Santander-Chile (SNSE:BSANTANDER) is reducing its dividend to CLP1.84 on the 24th of Aprilwhich is 28% less than last year's comparable payment of CLP2.57. This means that the annual payment will be 5.6% of the current stock price, which is in line with the average for the industry.

View our latest analysis for Banco Santander-Chile

Banco Santander-Chile's Dividend Forecasted To Be Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable.

Having distributed dividends for at least 10 years, Banco Santander-Chile has a long history of paying out a part of its earnings to shareholders. Despite this history however, the company's latest earnings report actually shows that it didn't have enough earnings to cover its dividends. This is an alarming sign for the sustainability of its dividends, as it may mean that Banco Santander-Chileis pulling cash from elsewhere to keep its shareholders happy.

The next 3 years are set to see EPS grow by 64.6%. Despite the current payout ratio being slightly elevated, analysts estimate the future payout ratio will be 56% over the same time period, which would make us comfortable with the sustainability of the dividend.

Banco Santander-Chile Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of CLP1.24 in 2014 to the most recent total annual payment of CLP2.57. This works out to be a compound annual growth rate (CAGR) of approximately 7.6% a year over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend's Growth Prospects Are Limited

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Banco Santander-Chile hasn't seen much change in its earnings per share over the last five years.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. Dividend payments have been pretty consistent for a while, but we do think the payout ratios are a little bit high. We don't think Banco Santander-Chile is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Banco Santander-Chile that investors should know about before committing capital to this stock. Is Banco Santander-Chile not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Banco Santander-Chile is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:BSANTANDER

Banco Santander-Chile

Banco Santander-Chile, together with its subsidiaries, provides commercial and retail banking services in Chile.

Average dividend payer with mediocre balance sheet.