Stock Analysis

- Taiwan

- /

- Metals and Mining

- /

- TWSE:2023

A Piece Of The Puzzle Missing From Yieh Phui Enterprise Co., Ltd.'s (TWSE:2023) Share Price

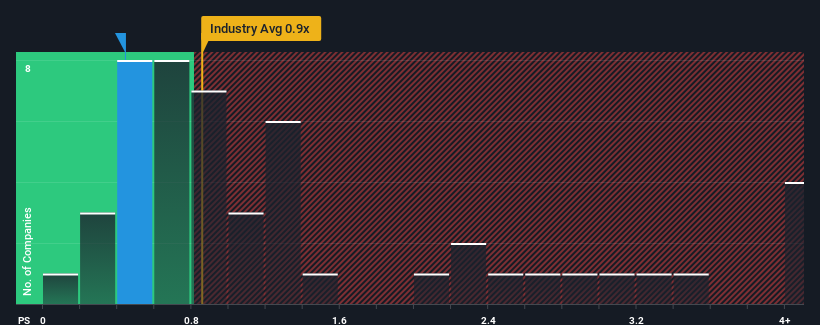

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Metals and Mining industry in Taiwan, you could be forgiven for feeling indifferent about Yieh Phui Enterprise Co., Ltd.'s (TWSE:2023) P/S ratio of 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Yieh Phui Enterprise

How Has Yieh Phui Enterprise Performed Recently?

As an illustration, revenue has deteriorated at Yieh Phui Enterprise over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Yieh Phui Enterprise's earnings, revenue and cash flow.How Is Yieh Phui Enterprise's Revenue Growth Trending?

Yieh Phui Enterprise's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. Still, the latest three year period has seen an excellent 32% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 5.3%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Yieh Phui Enterprise's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Yieh Phui Enterprise's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Yieh Phui Enterprise revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Yieh Phui Enterprise that you should be aware of.

If these risks are making you reconsider your opinion on Yieh Phui Enterprise, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Yieh Phui Enterprise is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TWSE:2023

Yieh Phui Enterprise

Yieh Phui Enterprise Co., Ltd., together with its subsidiaries, processes, manufactures, markets, imports and exports, and trades in steel products in Taiwan, rest of Asia, the United States, Europe, and internationally.

Slightly overvalued unattractive dividend payer.