- United States

- /

- Diversified Financial

- /

- NYSE:APO

Apollo Global Management (NYSE:APO) Eyes Papa John's In Potential US$60 Per Share Takeover Deal

Reviewed by Simply Wall St

Apollo Global Management (NYSE:APO) was in the spotlight this past quarter, driven by its bid to take Papa John's private, contributing to a 6% share price increase. This M&A buzz highlighted market attention towards Apollo's aggressive acquisition strategy. The company showed interest in acquiring BP's Castrol and Brighthouse Financial, expanding its focus across various sectors. Meanwhile, Apollo's financial performance saw a dip in revenue and net income but a continuation of its share repurchase program and a steady dividend declaration provided support. The company's movements aligned with an 11% market rise over the past 12 months.

The recent M&A activity surrounding Apollo Global Management, alongside its S&P 500 inclusion, has potential implications for future growth narratives. These developments may increase Apollo's market exposure and shareholder base, potentially driving revenue growth. Although Apollo's revenue and net income dipped recently, its ongoing share repurchase program and stable dividends offer some stability, even as industry competitiveness and regulatory pressures remain. The firm's focus on retirement solutions and industrial renaissance creates opportunities for origination and asset management growth.

Long-term, Apollo's shares have demonstrated resilience with a substantial 195.70% total return, including dividends, over the past five years. However, over the past year, Apollo's performance lagged behind the U.S. Diversified Financial industry, which achieved a 23.9% return, compared to Apollo's performance that exceeded the overall U.S. market with an 11.2% rise.

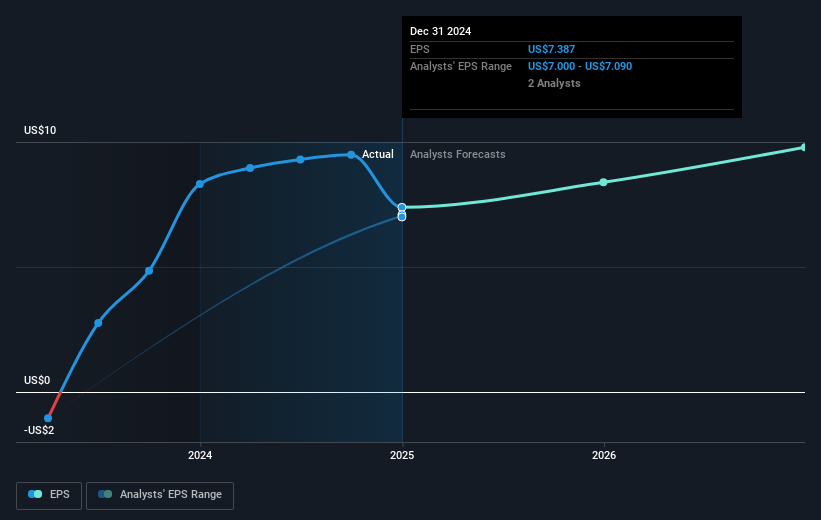

The M&A moves and exposure from the S&P 500 inclusion could affect revenue and earnings forecasts. Analysts currently predict a significant annual revenue decline of 39.3% over the next three years but expect earnings to increase substantially, reaching US$5.6 billion by April 2028. Despite this mixed outlook, the current share price of US$137.55 is approximately 11.1% below the consensus price target of US$154.65, indicating some investor optimism toward potential earnings growth. Such price movements suggest that, while the current environment presents challenges, there is also a measured belief in the long-term growth prospects driven by Apollo's strategic initiatives.

Explore Apollo Global Management's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives