The ASX 200 has been trading flat, with sectors like Financials and Real Estate performing well while Materials and IT stocks have faced challenges. Despite the somewhat stagnant market conditions, penny stocks continue to attract attention as potential investment opportunities. Though often seen as speculative, these smaller or newer companies can offer significant value when backed by strong financials, making them intriguing options for investors seeking hidden gems in the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.31 | A$108.97M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.615 | A$117.37M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.72 | A$419.37M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.19 | A$2.5B | ✅ 4 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.71 | A$452.14M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.19 | A$751.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.11 | A$709.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.69 | A$218.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.26 | A$154.69M | ✅ 3 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.735 | A$139.74M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,008 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AnteoTech (ASX:ADO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AnteoTech Limited is engaged in the development, manufacturing, commercialization, and distribution of products for clean energy technology and life science markets across various regions including Australia, Asia, Europe, North America, and Latin America; it has a market cap of A$35.17 million.

Operations: AnteoTech generates revenue through the development of its intellectual property, with a reported amount of -A$0.55 million.

Market Cap: A$35.17M

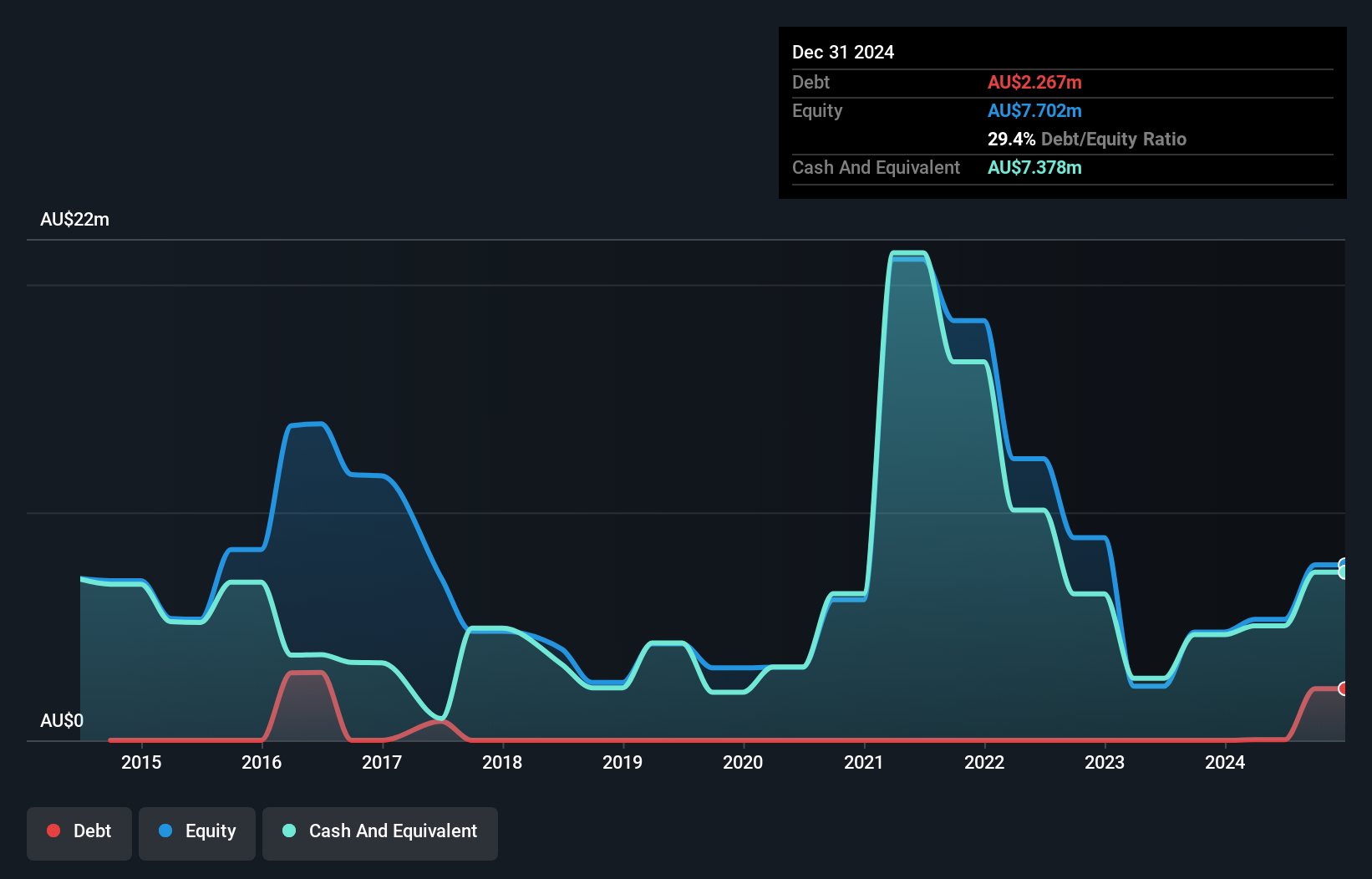

AnteoTech Limited, with a market cap of A$35.17 million, is pre-revenue and currently unprofitable, generating less than US$1 million in revenue. Despite its financial challenges, the company has more cash than debt and short-term assets exceeding liabilities. Recent leadership changes include the appointment of Ms. Merrill Gray as Interim CEO to advance product commercialization in clean energy and life sciences markets. The stock's volatility has increased over the past year, reflecting uncertainty but also potential for growth if strategic initiatives succeed under new leadership amidst a volatile share price environment.

- Navigate through the intricacies of AnteoTech with our comprehensive balance sheet health report here.

- Assess AnteoTech's previous results with our detailed historical performance reports.

EZZ Life Science Holdings (ASX:EZZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EZZ Life Science Holdings Limited is involved in the formulation, production, marketing, and sale of health and wellbeing products across Australia, New Zealand, Mainland China, and internationally with a market cap of A$108.97 million.

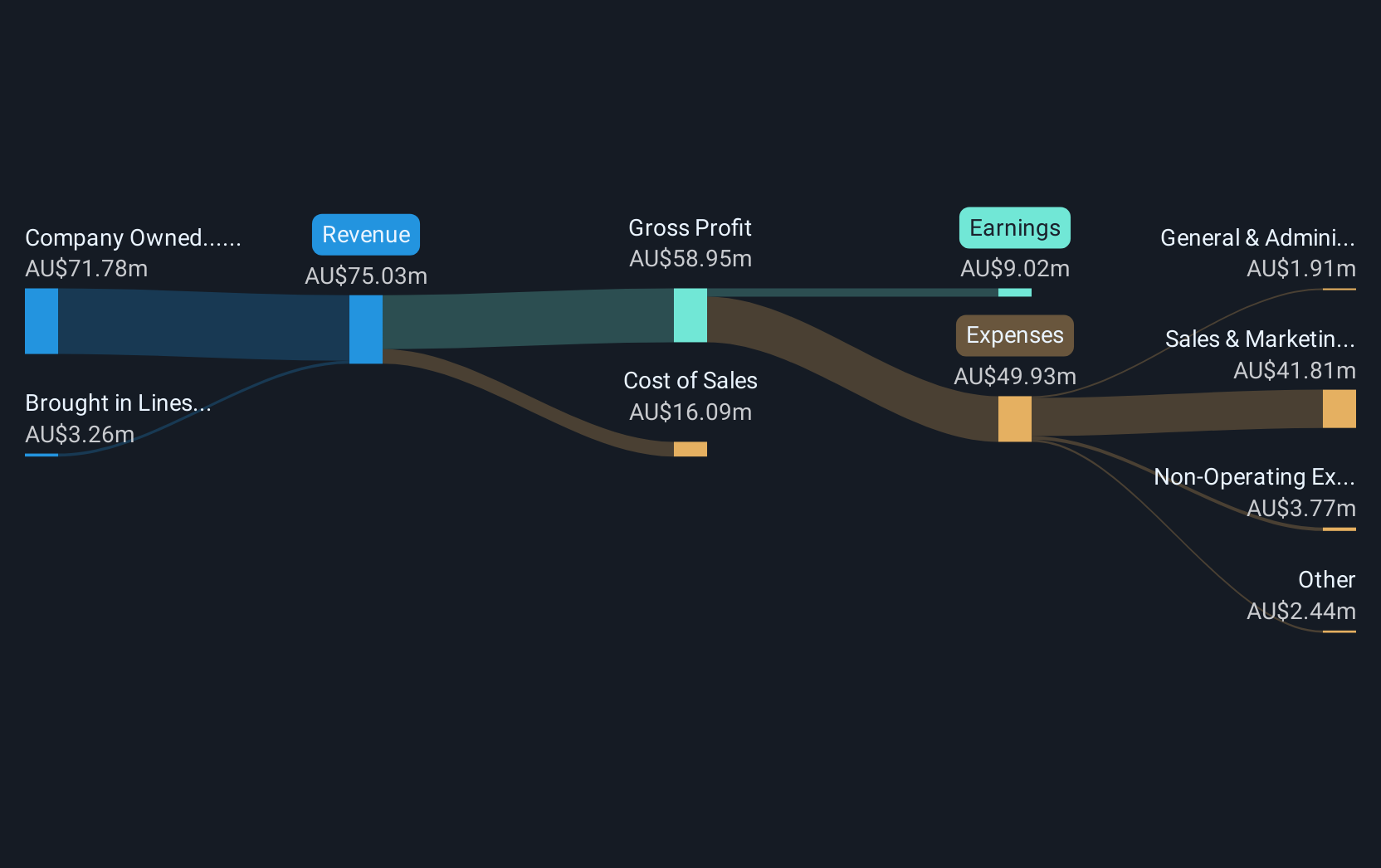

Operations: The company's revenue is primarily generated from Company Owned products, contributing A$71.78 million, and Brought in Lines, which add A$3.26 million.

Market Cap: A$108.97M

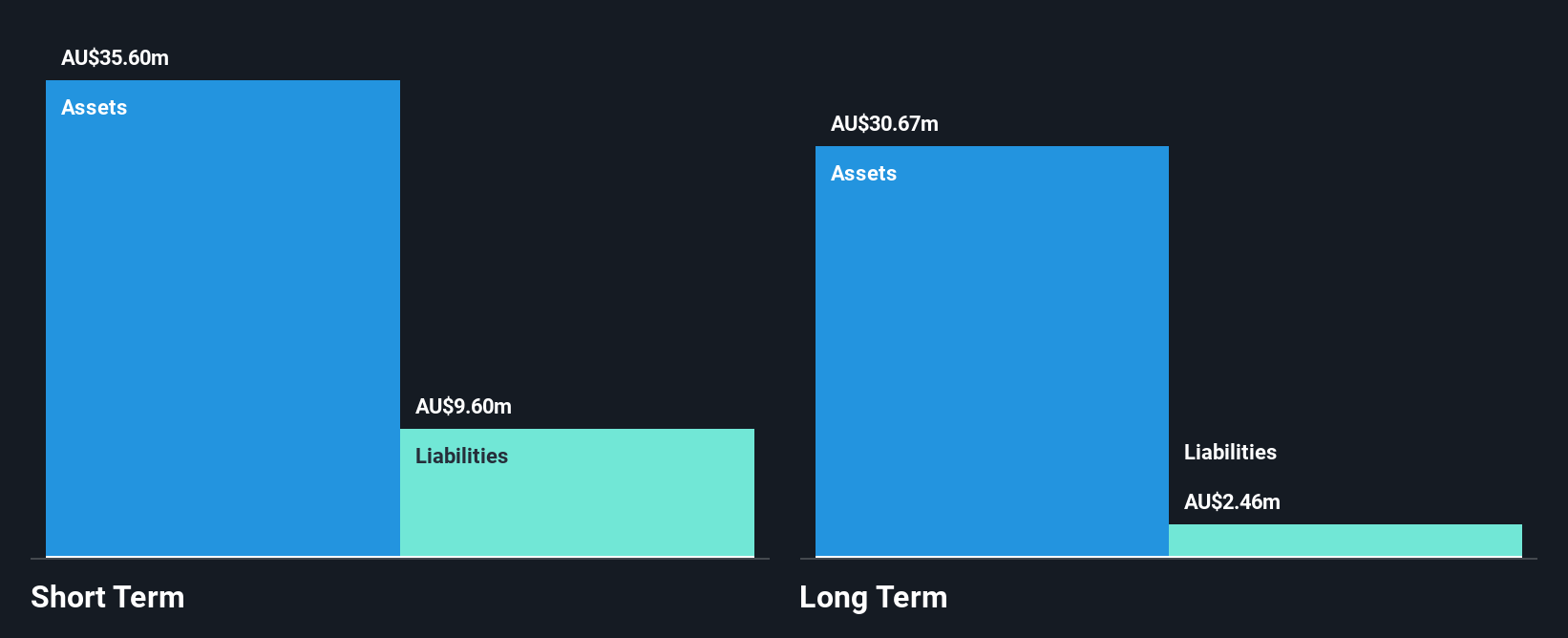

EZZ Life Science Holdings, with a market cap of A$108.97 million, has demonstrated robust financial health and growth potential. The company reported significant earnings growth of 159.7% over the past year, surpassing industry averages. It maintains a strong balance sheet with short-term assets exceeding both short and long-term liabilities, and it operates debt-free, eliminating concerns about interest coverage or cash flow constraints. EZZ's high return on equity of 37.5% underscores its operational efficiency while trading at a substantial discount to its fair value suggests attractive valuation prospects for investors seeking opportunities in the life sciences sector.

- Click here and access our complete financial health analysis report to understand the dynamics of EZZ Life Science Holdings.

- Explore EZZ Life Science Holdings' analyst forecasts in our growth report.

XRF Scientific (ASX:XRF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XRF Scientific Limited manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries across Australia, Canada, and Europe with a market cap of A$240.32 million.

Operations: The company's revenue is derived from three main segments: Consumables (A$18.86 million), Precious Metals (A$21.48 million), and Capital Equipment (A$22.20 million).

Market Cap: A$240.32M

XRF Scientific Limited, with a market cap of A$240.32 million, presents a compelling profile within the penny stock landscape due to its stable financial footing and growth trajectory. The company has shown consistent earnings growth, averaging 22.8% annually over the past five years, although recent growth slowed to 11.7%. Its seasoned management and board contribute to strategic stability. Financially prudent, XRF's short-term assets significantly exceed liabilities, and it maintains more cash than total debt, ensuring robust liquidity. Trading below estimated fair value enhances its appeal for investors seeking undervalued opportunities in the scientific and industrial sectors.

- Take a closer look at XRF Scientific's potential here in our financial health report.

- Gain insights into XRF Scientific's future direction by reviewing our growth report.

Key Takeaways

- Click this link to deep-dive into the 1,008 companies within our ASX Penny Stocks screener.

- Ready For A Different Approach? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ADO

AnteoTech

Develops, manufactures, commercializes, and distributes products for clean energy technology and life science markets primarily in Australia, Asia, Europe, North America, and Latin America.

Moderate with adequate balance sheet.

Market Insights

Community Narratives