- Canada

- /

- Healthcare Services

- /

- TSX:VMD

Analysts Just Published A Bright New Outlook For Viemed Healthcare, Inc.'s (TSE:VMD)

Viemed Healthcare, Inc. (TSE:VMD) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. Investor sentiment seems to be improving too, with the share price up 6.5% to US$9.57 over the past 7 days. It will be interesting to see if this latest upgrade is enough to kickstart further buying interest in the stock.

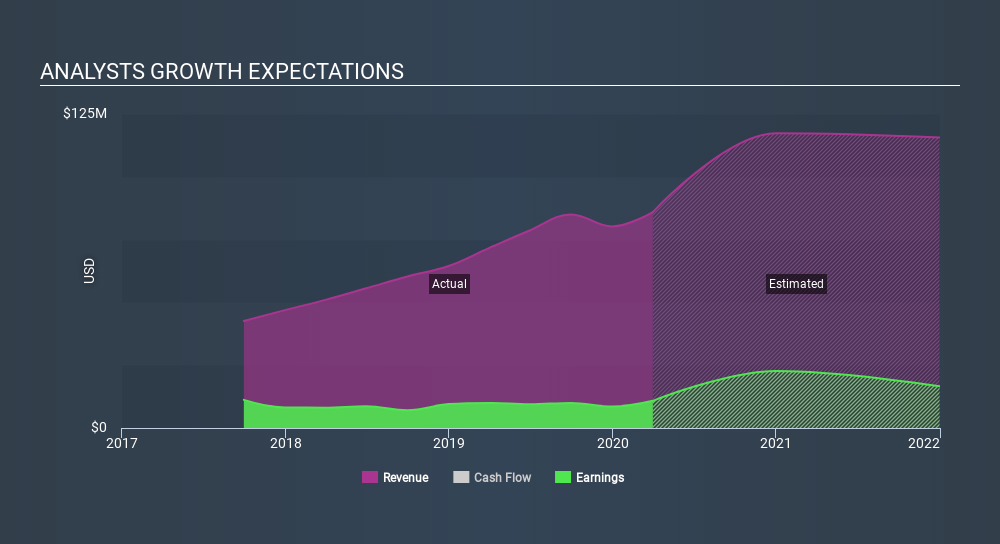

Following the upgrade, the most recent consensus for Viemed Healthcare from its three analysts is for revenues of US$117m in 2020 which, if met, would be a sizeable 37% increase on its sales over the past 12 months. Per-share earnings are expected to jump 94% to US$0.56. Previously, the analysts had been modelling revenues of US$101m and earnings per share (EPS) of US$0.36 in 2020. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

View our latest analysis for Viemed Healthcare

With these upgrades, we're not surprised to see that the analysts have lifted their price target 20% to US$11.24 per share. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Viemed Healthcare, with the most bullish analyst valuing it at US$12.00 and the most bearish at US$10.69 per share. Even so, with a relatively close grouping of analyst estimates, it looks to us as though the analysts are quite confident in their valuations, suggesting that Viemed Healthcare is an easy business to forecast or that the underlying assumptions are knowable.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Viemed Healthcare's rate of growth is expected to accelerate meaningfully, with the forecast 37% revenue growth noticeably faster than its historical growth of 20% over the past year. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Viemed Healthcare is expected to grow much faster than its industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Viemed Healthcare could be worth investigating further.

Analysts are clearly in love with Viemed Healthcare at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as concerns around earnings quality. You can learn more, and discover the 1 other warning sign we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:VMD

Viemed Healthcare

Through its subsidiaries, provides home medical equipment (HME) and post-acute respiratory healthcare services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives