As we head into the second half of 2025, the Canadian market is navigating a complex landscape shaped by ongoing trade negotiations and potential tariff adjustments. For investors seeking opportunities in smaller or emerging companies, penny stocks—though an older term—remain a compelling area for exploration. These stocks can offer growth potential at lower price points, particularly when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.70 | CA$640.27M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.26 | CA$692.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.49 | CA$190.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$532.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.88 | CA$20.61M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.29 | CA$96.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.19 | CA$119.51M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$184.07M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.99 | CA$5.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 889 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

PharmaTher Holdings (CNSX:PHRM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PharmaTher Holdings Ltd. is a specialty pharmaceutical company focused on developing and commercializing pharmaceuticals with novel delivery methods to improve patient outcomes, with a market cap of CA$20.80 million.

Operations: PharmaTher Holdings Ltd. has not reported any specific revenue segments.

Market Cap: CA$20.8M

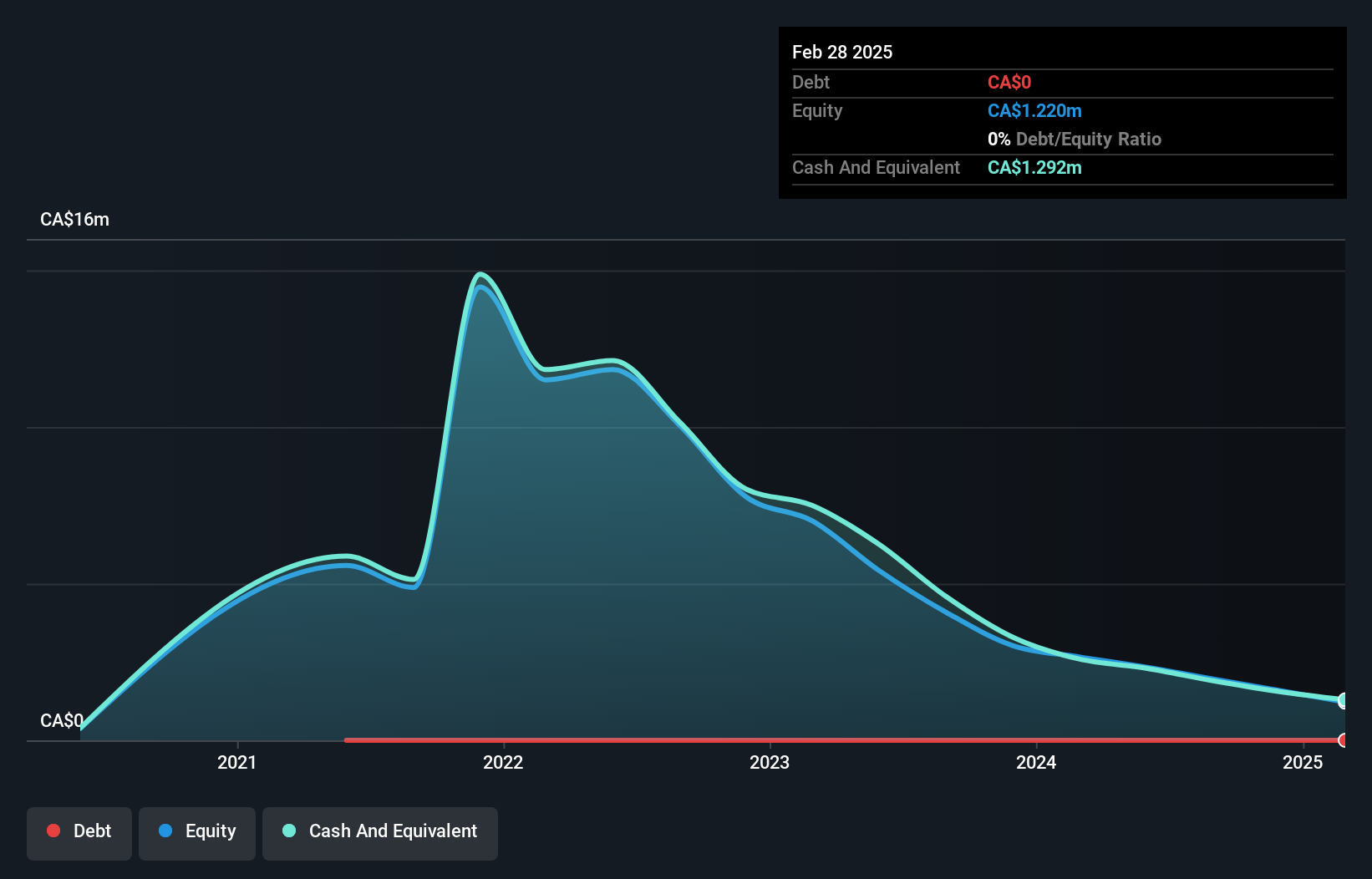

PharmaTher Holdings Ltd., with a market cap of CA$20.80 million, remains pre-revenue but is strategically positioned in the ketamine space. The company recently launched KetaVault, a portal offering comprehensive ketamine data to partners, potentially accelerating clinical trials and regulatory submissions. This aligns with the anticipated FDA approval for its ketamine product by August 9, 2025. PharmaTher's financial position shows no debt and sufficient short-term assets to cover liabilities; however, it has less than a year of cash runway if cash flow continues to decline at historical rates. Despite recent losses, these strategic moves could enhance future prospects.

- Jump into the full analysis health report here for a deeper understanding of PharmaTher Holdings.

- Understand PharmaTher Holdings' track record by examining our performance history report.

Progressive Planet Solutions (TSXV:PLAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Progressive Planet Solutions Inc., along with its subsidiaries, focuses on acquiring and exploring mineral properties in Canada and the United States, with a market cap of CA$18.66 million.

Operations: The company's revenue of CA$19.36 million is derived from the acquisition and exploration of mineral properties in Canada and the United States.

Market Cap: CA$18.66M

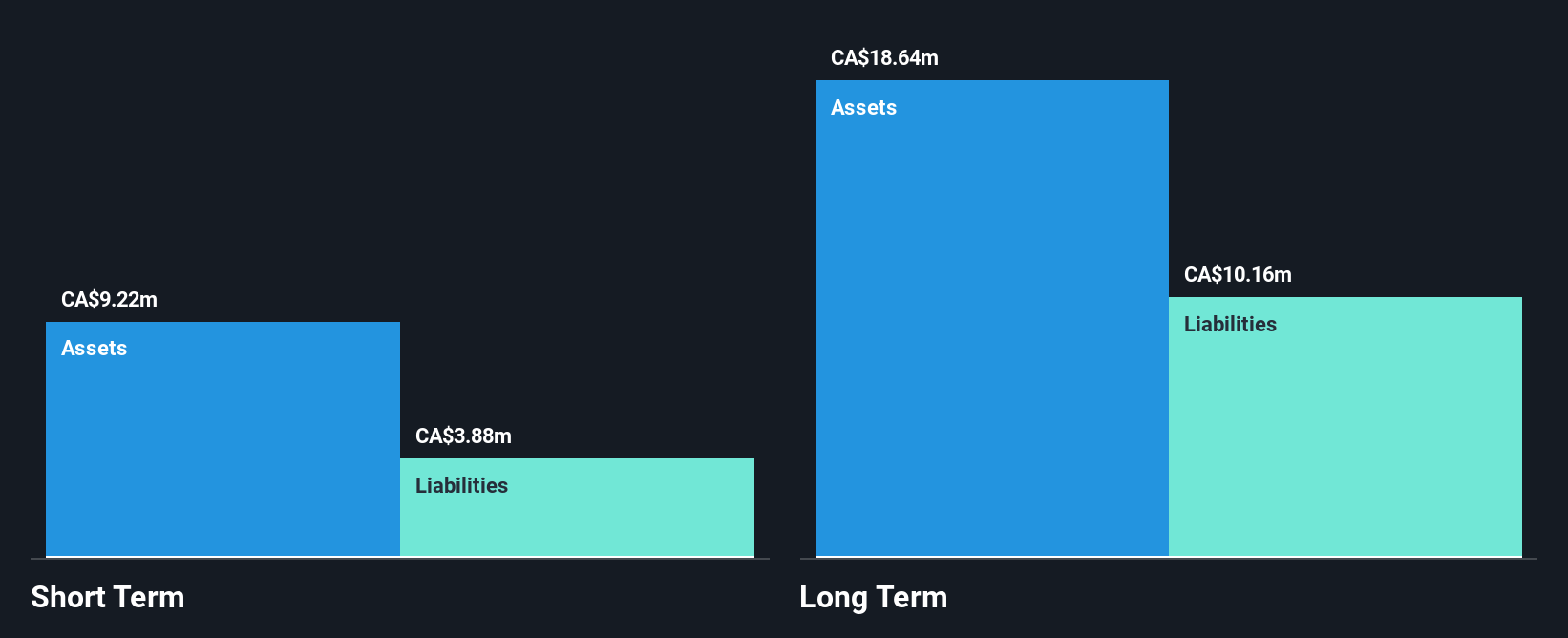

Progressive Planet Solutions Inc., with a market cap of CA$18.66 million, has recently become profitable, demonstrating significant progress in its financial performance. The company secured a CA$1.14 million grant from the British Columbia Innovative Clean Energy Fund to advance its PozGlass pilot plant, which converts post-consumer glass into a low-carbon cement alternative. This initiative aligns with industry trends towards sustainable solutions and has already attracted interest from Lafarge Canada for future production. While the company's short-term assets adequately cover immediate liabilities, long-term liabilities remain slightly uncovered, presenting potential challenges as it scales operations.

- Click here to discover the nuances of Progressive Planet Solutions with our detailed analytical financial health report.

- Explore historical data to track Progressive Planet Solutions' performance over time in our past results report.

Revival Gold (TSXV:RVG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Revival Gold Inc. is a Canadian gold mineral exploration and development company with a market cap of CA$103.21 million.

Operations: Revival Gold Inc. has not reported any revenue segments.

Market Cap: CA$103.21M

Revival Gold Inc., with a market cap of CA$103.21 million, remains pre-revenue and unprofitable, which is typical for early-stage mining companies. Recent developments include the completion of a comprehensive soil sampling program and archaeological surveys at its Mercur Gold Project in Utah, as well as preparations for significant drilling activities planned for 2025. Despite its financial challenges, including less than a year of cash runway, the company maintains no long-term liabilities and has experienced management and board teams. Analysts anticipate potential stock price growth; however, profitability is not expected in the near term.

- Navigate through the intricacies of Revival Gold with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Revival Gold's future.

Turning Ideas Into Actions

- Access the full spectrum of 889 TSX Penny Stocks by clicking on this link.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:PHRM

PharmaTher Holdings

A specialty pharmaceutical company, develops and commercialize specialty pharmaceuticals exhibiting the adoption and permitting novel delivery methods to enhance patient outcomes.

Excellent balance sheet slight.

Market Insights

Community Narratives