- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1733

3 Promising Asian Penny Stocks With Market Caps Over US$200M

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed signals, with rate cuts in the U.S. and steady policies in Europe and Japan, investors are keenly observing shifts that could impact growth trajectories. In Asia, the focus on penny stocks—often seen as smaller or emerging companies—remains pertinent for those seeking potential value beyond traditional large-cap investments. While the term 'penny stock' might evoke images of past trading eras, these stocks continue to offer opportunities when backed by strong financials and sound business models.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.96 | HK$2.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.07 | SGD433.66M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.72 | THB2.83B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.43 | SGD13.5B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.38 | THB8.85B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

E-Commodities Holdings (SEHK:1733)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E-Commodities Holdings Limited, along with its subsidiaries, is involved in the processing and trading of coal and other products, with a market cap of approximately HK$2.43 billion.

Operations: The company generates revenue primarily through two segments: Trading of Coal and Other Products, which accounts for HK$28.33 billion, and Rendering of Integrated Supply Chain Services, contributing HK$4.33 billion.

Market Cap: HK$2.43B

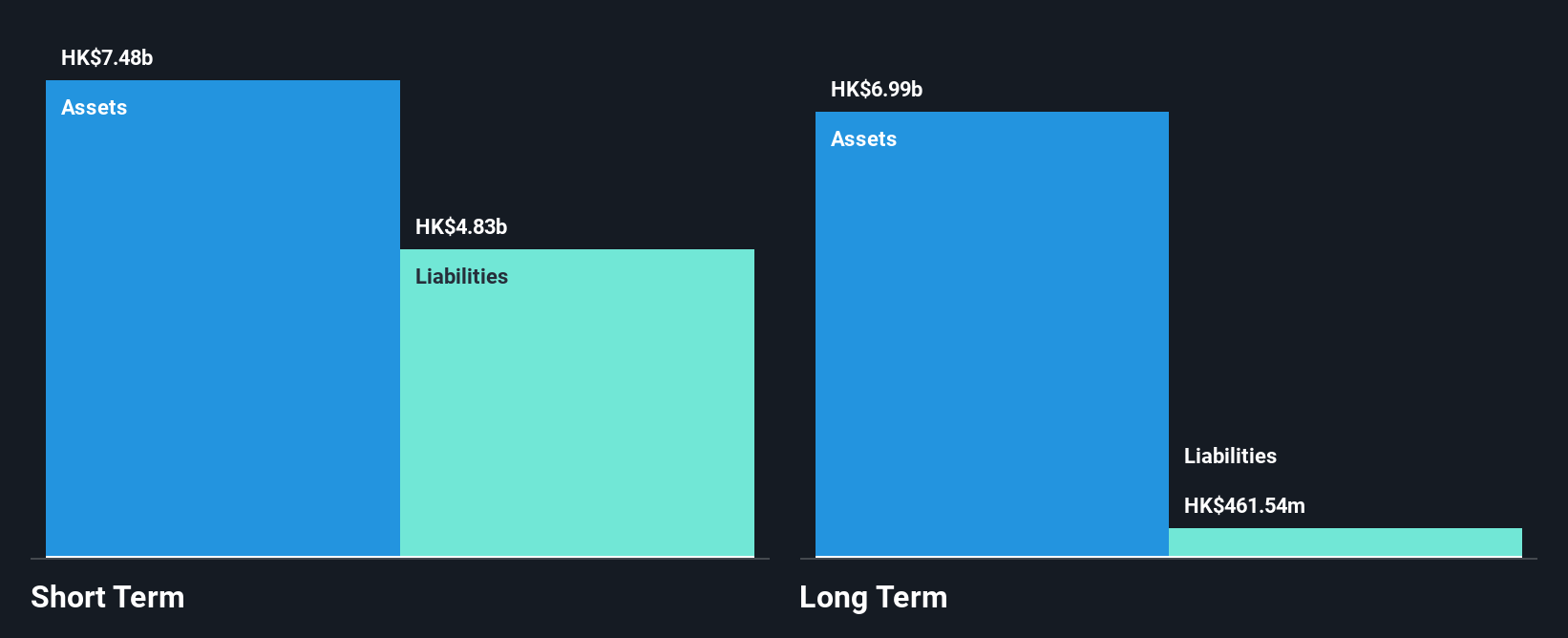

E-Commodities Holdings has demonstrated financial resilience despite challenging market conditions. Its debt to equity ratio has significantly decreased from 65.9% to 18.1% over five years, and its debt is well covered by operating cash flow at 107.9%. However, the company faces headwinds with a decline in revenue and net income for the first half of 2025 due to falling coking coal prices and reduced demand, impacting profit margins which dropped from 4.9% last year to 0.9%. The firm completed a share buyback program, repurchasing shares worth HK$28.65 million, reflecting confidence in its valuation below estimated fair value by approximately 40%.

- Dive into the specifics of E-Commodities Holdings here with our thorough balance sheet health report.

- Gain insights into E-Commodities Holdings' past trends and performance with our report on the company's historical track record.

Qingci Games (SEHK:6633)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qingci Games Inc. is an investment holding company that develops, publishes, and operates mobile games across various international markets including China, Japan, the US, and others with a market cap of approximately HK$2.03 billion.

Operations: The company's revenue primarily comes from its Computer Graphics segment, generating CN¥532.52 million.

Market Cap: HK$2.03B

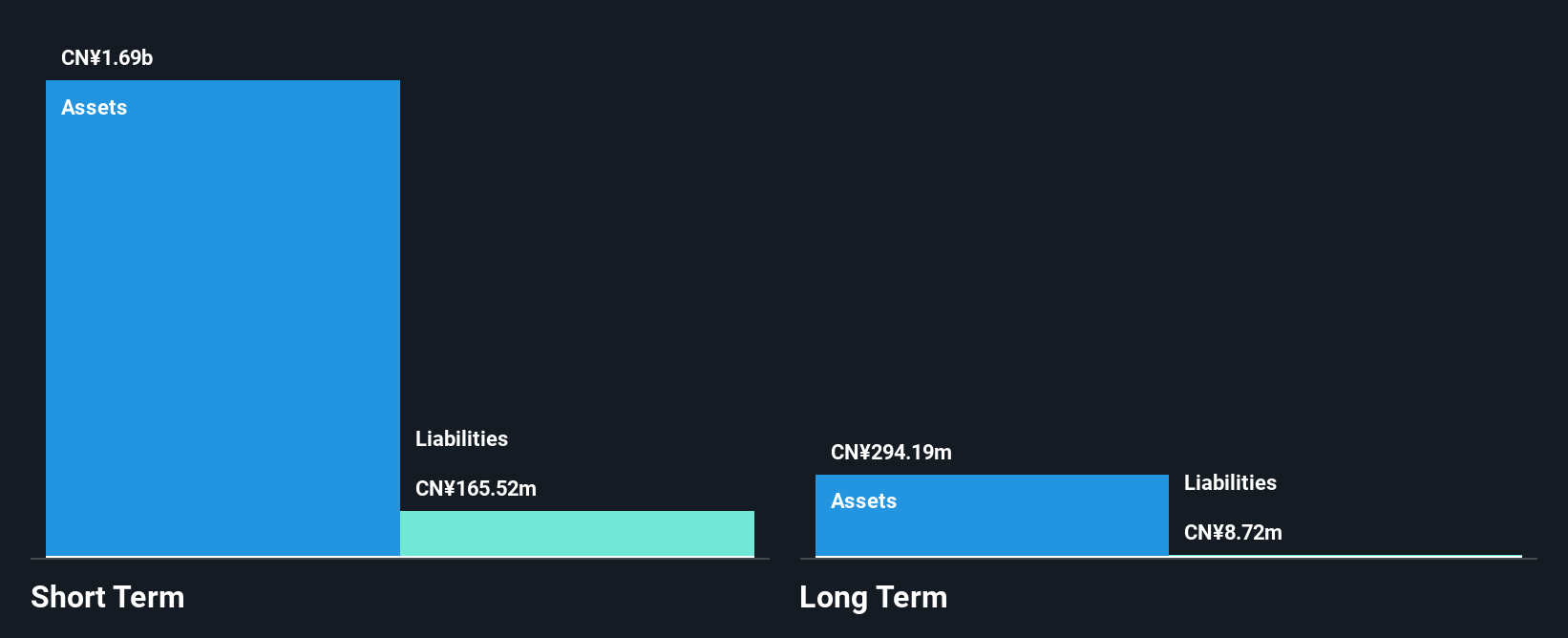

Qingci Games Inc. has shown financial stability with a strong cash position exceeding its total debt, and operating cash flow covering debt by a very large margin. The company recently reported an increase in net income to CN¥70.26 million for the first half of 2025, despite a decline in sales from the previous year. Shareholders have not faced significant dilution, and both short-term and long-term liabilities are well covered by assets. However, earnings were impacted by a significant one-off gain of CN¥58 million. The board and management team are experienced, supporting strategic decision-making capabilities moving forward.

- Take a closer look at Qingci Games' potential here in our financial health report.

- Assess Qingci Games' previous results with our detailed historical performance reports.

Jiangsu Huifeng Bio Agriculture (SZSE:002496)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Huifeng Bio Agriculture Co., Ltd. operates in the agricultural sector, focusing on the production and distribution of agrochemical products, with a market cap of CN¥2.61 billion.

Operations: Jiangsu Huifeng Bio Agriculture Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.61B

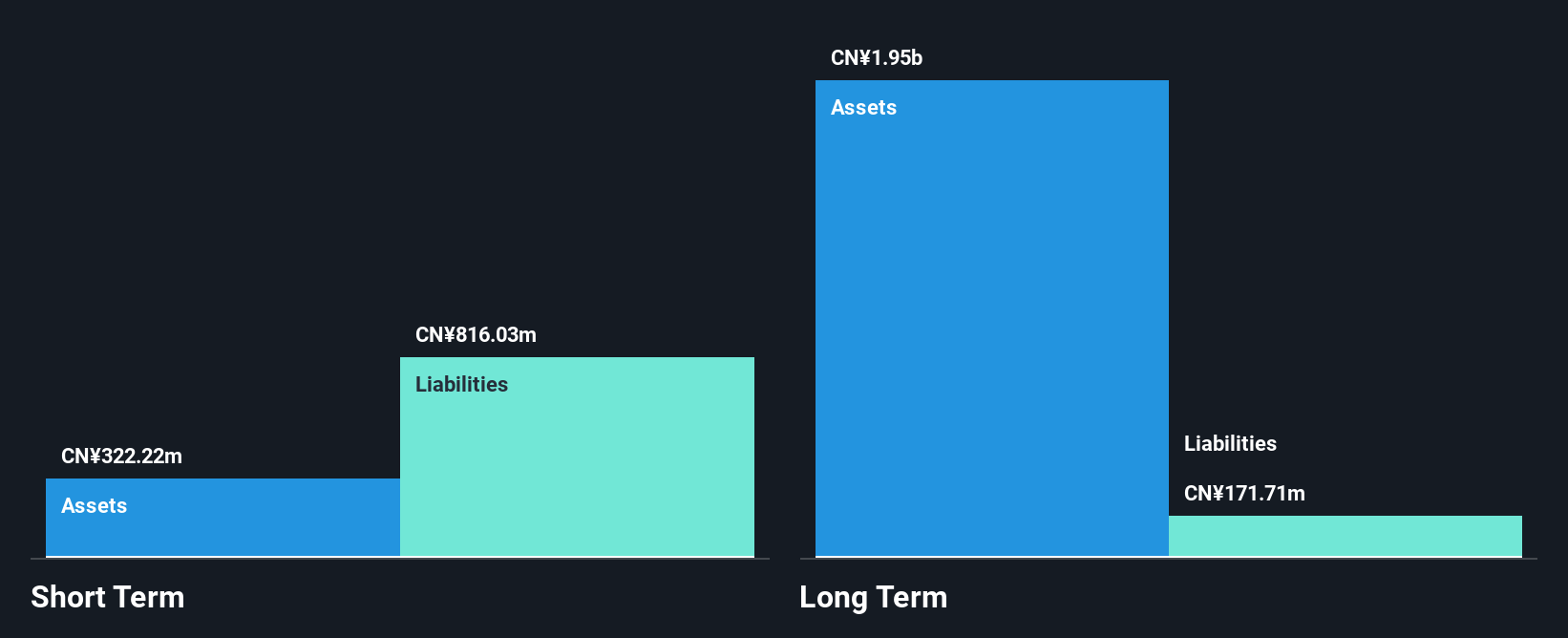

Jiangsu Huifeng Bio Agriculture Co., Ltd. has faced challenges with profitability despite reporting increased sales of CN¥219.13 million for the nine months ending September 2025, up from CN¥153.56 million a year earlier. The company remains unprofitable with a net loss of CN¥3.23 million compared to a net income of CN¥1.3 million in the prior year period, reflecting ongoing operational difficulties. While short-term assets do not cover liabilities, long-term liabilities are exceeded by assets, and debt levels have improved over time with a satisfactory net debt to equity ratio of 21%. Management and board experience support strategic oversight amidst financial volatility.

- Jump into the full analysis health report here for a deeper understanding of Jiangsu Huifeng Bio Agriculture.

- Examine Jiangsu Huifeng Bio Agriculture's past performance report to understand how it has performed in prior years.

Key Takeaways

- Embark on your investment journey to our 959 Asian Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E-Commodities Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1733

E-Commodities Holdings

Engages in the processing and trading of coal and other products.

Flawless balance sheet and good value.

Market Insights

Community Narratives