- Sweden

- /

- Capital Markets

- /

- OM:NAVIGO STAM

3 European Penny Stocks With Market Caps Over €30M

Reviewed by Simply Wall St

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced a downturn, with major stock indexes such as Germany's DAX and Italy's FTSE MIB seeing notable declines. For investors willing to explore beyond the well-known names, penny stocks — often associated with smaller or newer companies — can still present intriguing opportunities. Despite their vintage connotation, these stocks remain relevant for those seeking potential growth backed by solid financial health.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.888 | SEK511.94M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.01 | €63.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.47 | €16.71M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.06 | PLN10.94M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.365 | SEK2.26B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.54 | SEK215.37M | ✅ 2 ⚠️ 2 View Analysis > |

| High (ENXTPA:HCO) | €3.80 | €74.66M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.10 | €289.94M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.982 | €33.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 450 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Digital Workforce Services Oyj (HLSE:DWF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Digital Workforce Services Oyj, along with its subsidiaries, offers business process automation services and technology solutions across Finland, Sweden, Norway, Denmark, Poland, the rest of the European Union and internationally with a market cap of €36.85 million.

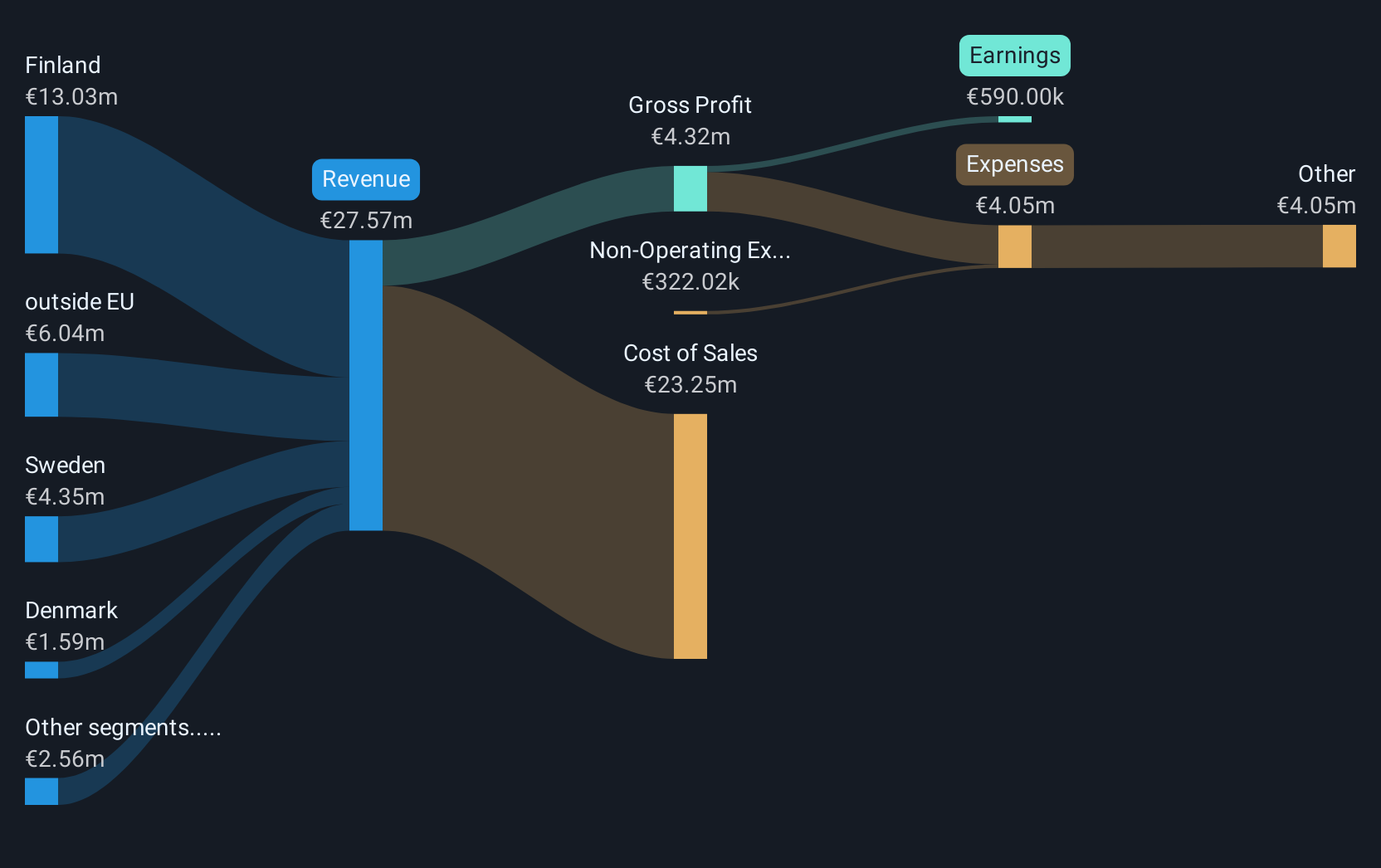

Operations: The company's revenue is derived from Finland (€13.03 million), Sweden (€4.35 million), outside the EU (€6.04 million), Denmark (€1.59 million), Norway (€0.66 million), Poland (€0.08 million), and other EU countries (€1.50 million).

Market Cap: €36.85M

Digital Workforce Services Oyj, with a market cap of €36.85 million, has shown promising financial health for a penny stock. The company is profitable and its short-term assets significantly exceed both short- and long-term liabilities, indicating solid liquidity. It also maintains more cash than total debt, ensuring financial stability. Recent developments include the appointment of a new CFO effective September 2025 and the commencement of share repurchases to potentially support acquisitions or incentive schemes. Despite trading below estimated fair value, DWF's return on equity remains low at 4%, suggesting room for improvement in generating shareholder returns.

- Dive into the specifics of Digital Workforce Services Oyj here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Digital Workforce Services Oyj's future.

Navigo Invest (OM:NAVIGO STAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Navigo Invest AB (publ) is a private equity and venture capital firm that focuses on a variety of investment stages including buyouts, early and later stage investments, with a market cap of SEK342.38 million.

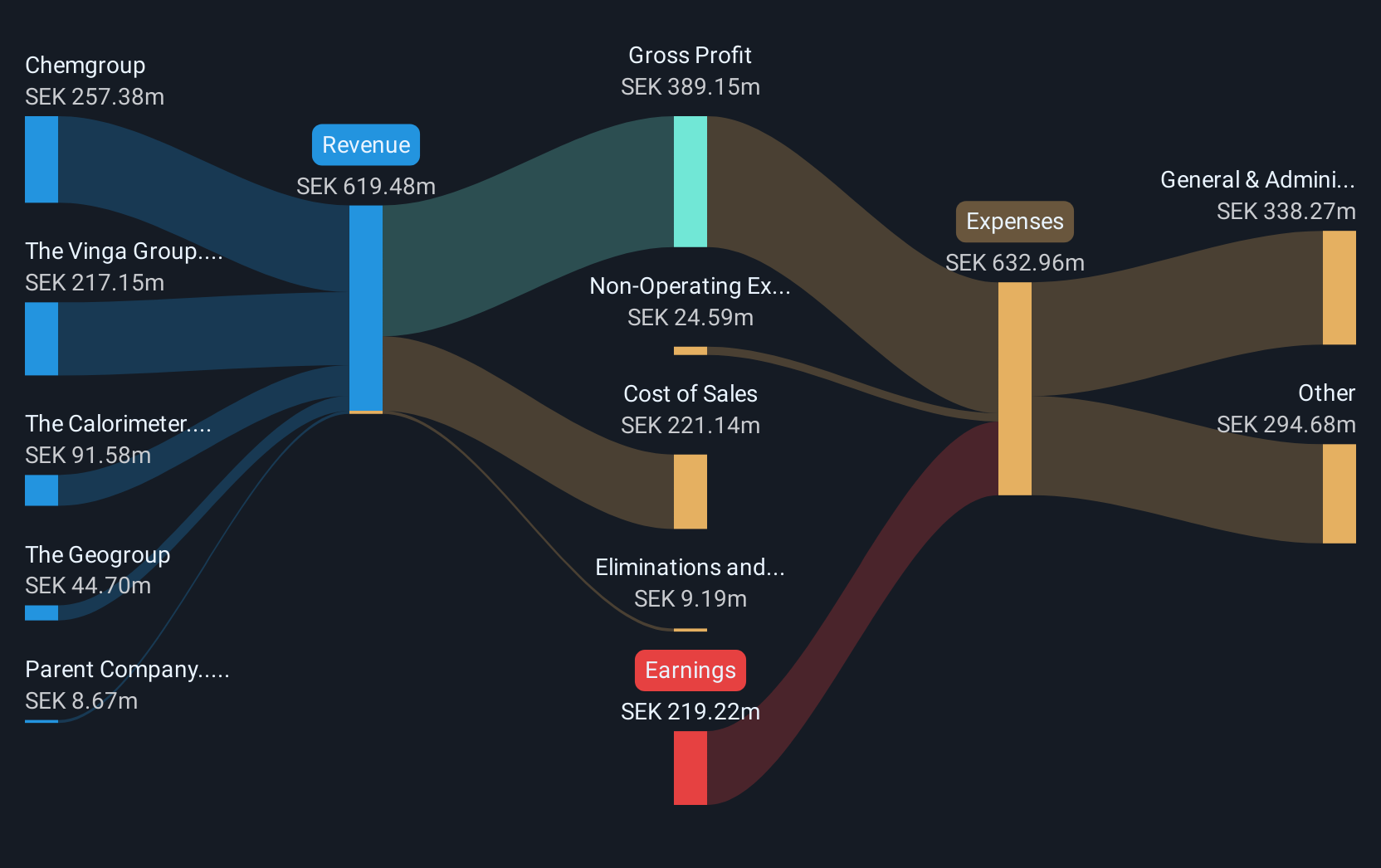

Operations: Navigo Invest's revenue is primarily derived from its Chemgroup segment at SEK257.38 million, followed by the Vinga Group at SEK217.15 million, The Calorimeter at SEK91.58 million, and The Geogroup contributing SEK44.70 million.

Market Cap: SEK342.38M

Navigo Invest AB (publ), with a market cap of SEK342.38 million, has demonstrated financial resilience despite being unprofitable. Its short-term assets of SEK308.1 million exceed both short- and long-term liabilities, indicating robust liquidity. Recent earnings show a positive shift with a net income of SEK5.03 million for Q1 2025, compared to a loss the previous year. The company benefits from an experienced management team and maintains satisfactory debt levels with a net debt to equity ratio of 5.7%. However, its share price remains highly volatile and its return on equity is negative at -17.63%.

- Click here and access our complete financial health analysis report to understand the dynamics of Navigo Invest.

- Understand Navigo Invest's earnings outlook by examining our growth report.

Nosa Plugs (OM:NOSA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nosa Plugs AB is a medical technology company that focuses on manufacturing and selling intranasal breathing products primarily in Europe and North America, with a market cap of SEK171.09 million.

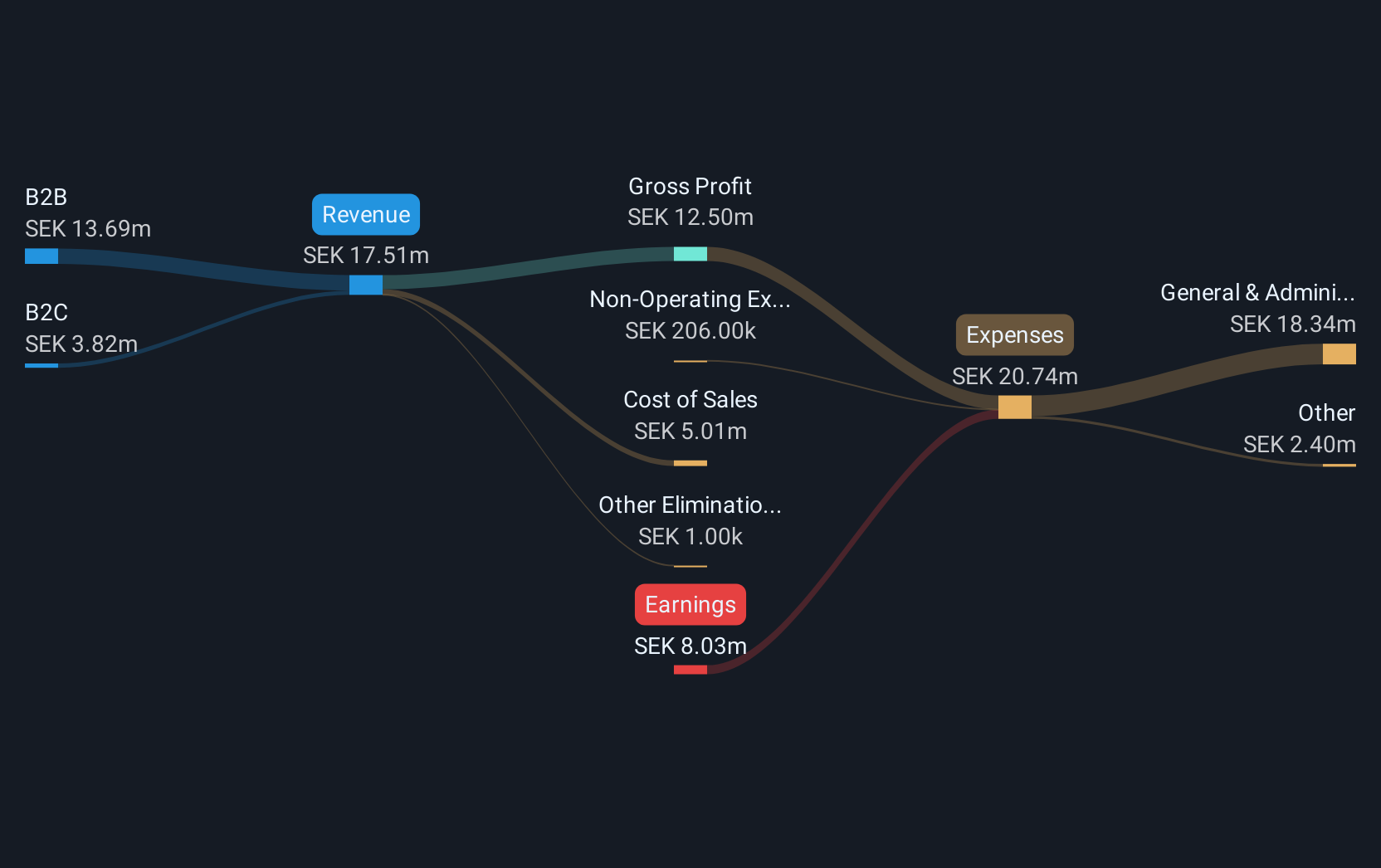

Operations: The company generates revenue from two primary segments: SEK13.69 million from B2B and SEK3.82 million from B2C sales.

Market Cap: SEK171.09M

Nosa Plugs AB, with a market cap of SEK171.09 million, has shown significant revenue growth, reaching SEK4.23 million in Q1 2025 compared to SEK2.94 million the previous year. Despite being unprofitable and having a negative return on equity of -52.9%, it maintains more cash than debt and covers its short-term liabilities with assets of SEK12.3 million against liabilities of SEK4.5 million. The company has not diluted shareholders recently and forecasts suggest earnings could grow by over 100% annually, although volatility remains high at 11% weekly—higher than most Swedish stocks.

- Get an in-depth perspective on Nosa Plugs' performance by reading our balance sheet health report here.

- Evaluate Nosa Plugs' prospects by accessing our earnings growth report.

Next Steps

- Dive into all 450 of the European Penny Stocks we have identified here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigo Invest might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NAVIGO STAM

Navigo Invest

A private equity and venture capital firm specializing in buyouts, early stage, later stage, acquisition, growth capital, middle markets, turnaround and mature stage investments.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives