3 Asian Stocks Estimated To Be Up To 40.9% Below Intrinsic Value

Reviewed by Simply Wall St

As trade negotiations between major economies progress, Asian markets have shown resilience, with Chinese and Japanese indices posting gains amid optimism over tariff discussions. In this environment, identifying undervalued stocks can be a strategic move for investors seeking opportunities to capitalize on potential market corrections or growth in these regions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wanguo Gold Group (SEHK:3939) | HK$30.40 | HK$60.10 | 49.4% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥111.83 | CN¥222.46 | 49.7% |

| SpiderPlus (TSE:4192) | ¥500.00 | ¥991.05 | 49.5% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥23.17 | CN¥46.13 | 49.8% |

| Sheng Siong Group (SGX:OV8) | SGD2.10 | SGD4.16 | 49.5% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$177.50 | NT$349.25 | 49.2% |

| Insource (TSE:6200) | ¥923.00 | ¥1827.05 | 49.5% |

| Forum Engineering (TSE:7088) | ¥1222.00 | ¥2414.31 | 49.4% |

| Elan (TSE:6099) | ¥858.00 | ¥1694.90 | 49.4% |

| ALUX (KOSDAQ:A475580) | ₩11360.00 | ₩22580.69 | 49.7% |

Let's dive into some prime choices out of the screener.

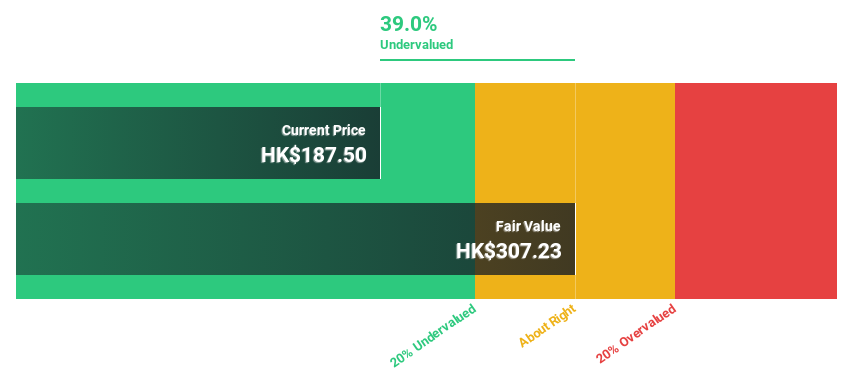

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products across China, the United States, and internationally, with a market cap of approximately HK$167.52 billion.

Operations: The company's revenue primarily comes from its biotechnology segment, generating approximately CN¥9.42 billion.

Estimated Discount To Fair Value: 17%

Innovent Biologics appears undervalued based on discounted cash flow analysis, trading at HK$98 against a fair value estimate of HK$118.1. Despite low forecasted return on equity, the company's earnings growth is expected to outpace the market significantly, driven by innovative therapies like IBI343 for gastric cancer and mazdutide for obesity management. Recent clinical milestones and a successful follow-on equity offering of HK$4.31 billion bolster its financial position and growth potential in Asia's biopharmaceutical landscape.

- Our comprehensive growth report raises the possibility that Innovent Biologics is poised for substantial financial growth.

- Get an in-depth perspective on Innovent Biologics' balance sheet by reading our health report here.

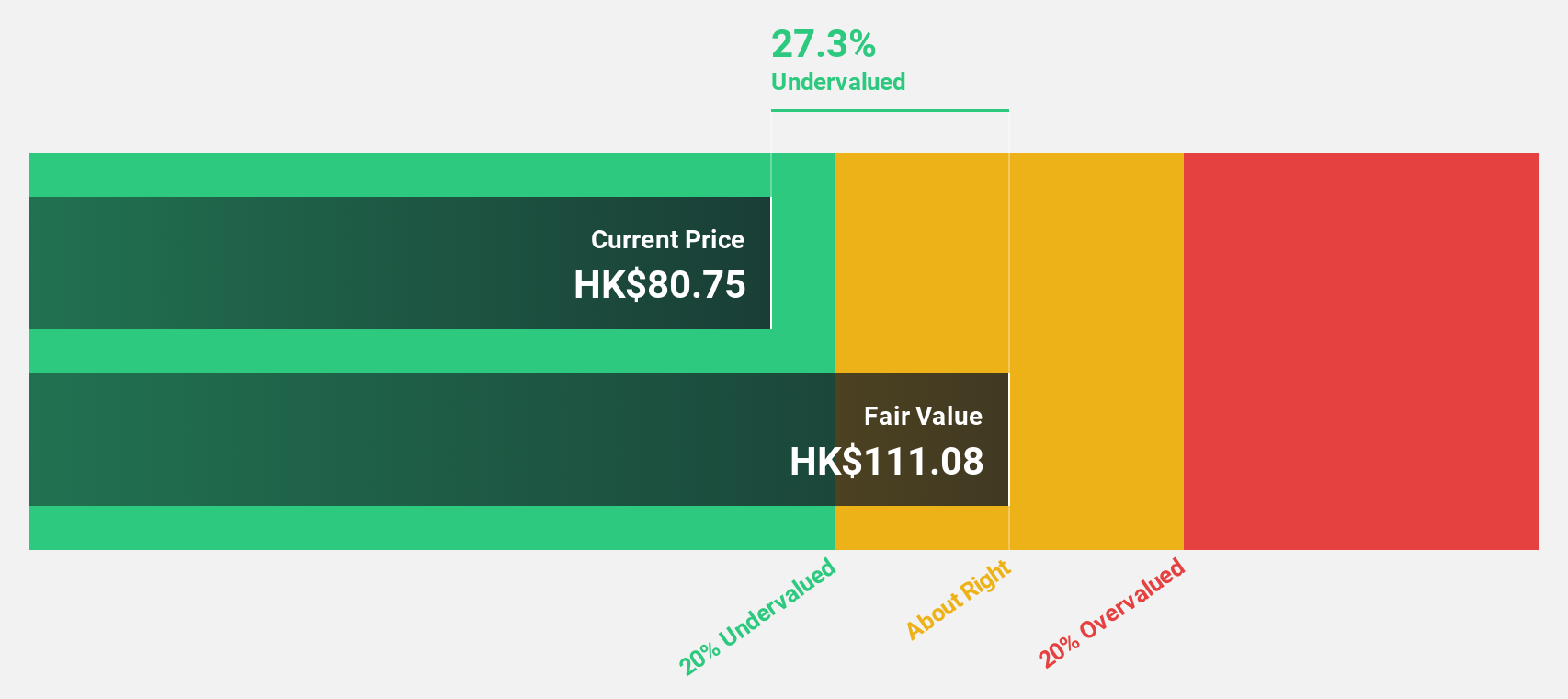

Shanghai Conant Optical (SEHK:2276)

Overview: Shanghai Conant Optical Co., Ltd. manufactures and sells resin spectacle lenses across Mainland China, the Americas, Asia, Europe, Oceania, and Africa with a market cap of HK$21.02 billion.

Operations: The company's revenue primarily comes from the manufacturing and sales of resin spectacle lenses, amounting to CN¥2.06 billion.

Estimated Discount To Fair Value: 40.9%

Shanghai Conant Optical is trading at HK$43.8, significantly below its fair value estimate of HK$74.1, suggesting undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow faster than the Hong Kong market at 19% annually, supported by strong sales in high refractive index products. Recent guidance indicates a net profit increase of at least 30% for the first half of 2025, driven by increased average selling prices and product mix improvements.

- According our earnings growth report, there's an indication that Shanghai Conant Optical might be ready to expand.

- Take a closer look at Shanghai Conant Optical's balance sheet health here in our report.

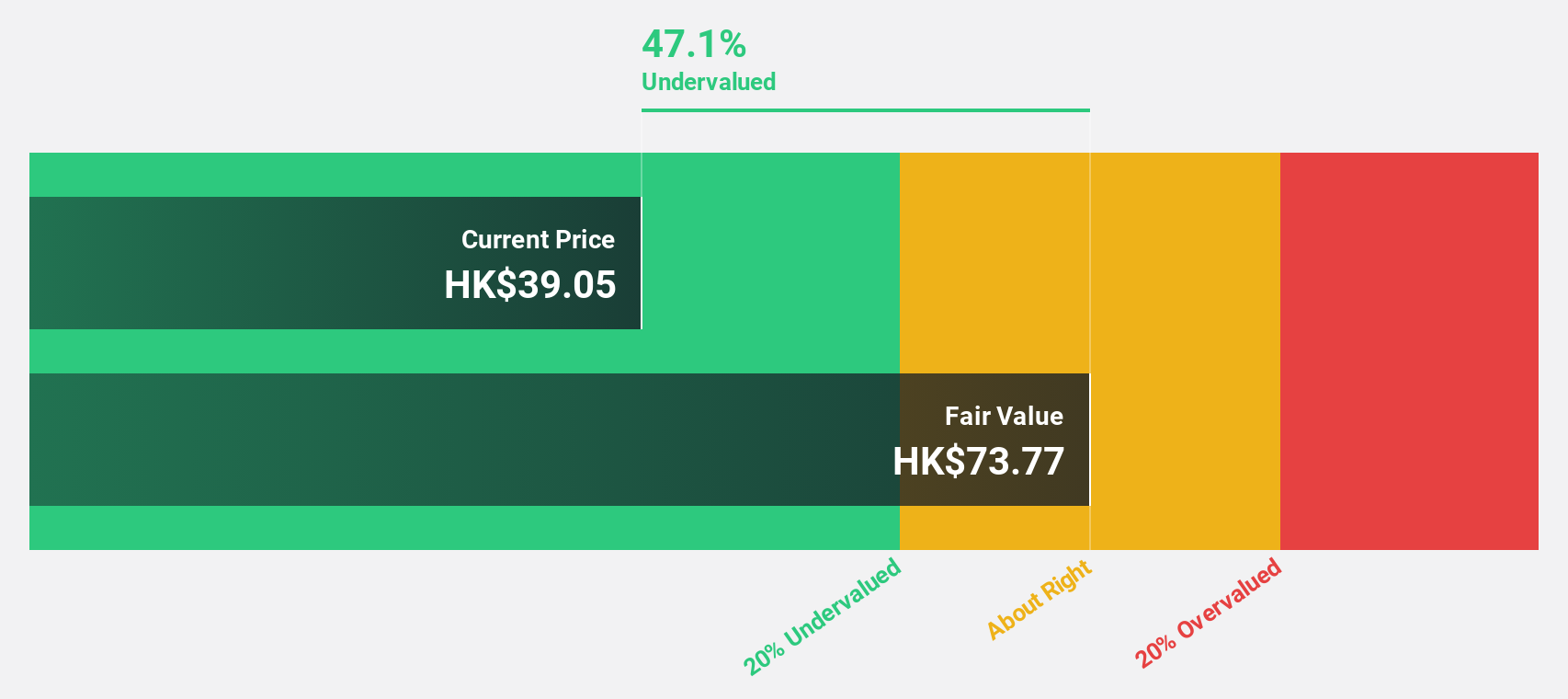

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs in oncology and immunology both in China and internationally, with a market capitalization of approximately HK$95.07 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to approximately CN¥1.93 billion.

Estimated Discount To Fair Value: 24.7%

Sichuan Kelun-Biotech Biopharmaceutical is trading at HK$416, below its estimated fair value of HK$552.16, reflecting potential undervaluation based on cash flows. Revenue growth is projected at 28.4% annually, surpassing the Hong Kong market's average and highlighting robust expansion prospects. The company anticipates becoming profitable within three years, with earnings expected to grow by 37% per year. Recent developments include a follow-on equity offering of HK$1.96 billion and significant progress in clinical trials for innovative cancer treatments.

- Our expertly prepared growth report on Sichuan Kelun-Biotech Biopharmaceutical implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Sichuan Kelun-Biotech Biopharmaceutical's balance sheet health report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 268 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs in oncology, immunology, and other therapeutic areas in the People’s Republic of China and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives