- China

- /

- Electrical

- /

- SZSE:002340

3 Asian Stocks Estimated To Be Trading At Up To 48.1% Discount

Reviewed by Simply Wall St

As global markets navigate escalating geopolitical tensions and trade-related concerns, Asian stocks have shown mixed performance, with some indices experiencing declines while others remain relatively stable. Amid this uncertainty, identifying undervalued stocks can be crucial for investors seeking opportunities; these are often characterized by strong fundamentals and potential for recovery despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥43.20 | CN¥85.67 | 49.6% |

| Polaris Holdings (TSE:3010) | ¥223.00 | ¥439.15 | 49.2% |

| PixArt Imaging (TPEX:3227) | NT$221.00 | NT$436.53 | 49.4% |

| Peijia Medical (SEHK:9996) | HK$6.48 | HK$12.71 | 49% |

| J&T Global Express (SEHK:1519) | HK$6.67 | HK$13.29 | 49.8% |

| Guangdong Zhongsheng Pharmaceutical (SZSE:002317) | CN¥15.68 | CN¥31.12 | 49.6% |

| Food & Life Companies (TSE:3563) | ¥6597.00 | ¥13122.02 | 49.7% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.28 | CN¥52.46 | 49.9% |

| cottaLTD (TSE:3359) | ¥440.00 | ¥865.08 | 49.1% |

| BalnibarbiLtd (TSE:3418) | ¥1176.00 | ¥2305.11 | 49% |

Here's a peek at a few of the choices from the screener.

GEM (SZSE:002340)

Overview: GEM Co., Ltd. operates in the recycling industry both in China and internationally, with a market cap of CN¥31.88 billion.

Operations: GEM Co., Ltd.'s revenue segments include operations in the recycling industry across China and international markets.

Estimated Discount To Fair Value: 48.1%

GEM Co., Ltd. is trading at CNY 6.25, significantly below its estimated fair value of CNY 12.04, presenting a potential opportunity for investors focused on undervalued stocks based on cash flows. Despite a recent dividend decrease and concerns over debt coverage by operating cash flow, the company's earnings are forecast to grow substantially at 33.7% annually over the next three years, outpacing the Chinese market's growth rate of 23.2%.

- Insights from our recent growth report point to a promising forecast for GEM's business outlook.

- Navigate through the intricacies of GEM with our comprehensive financial health report here.

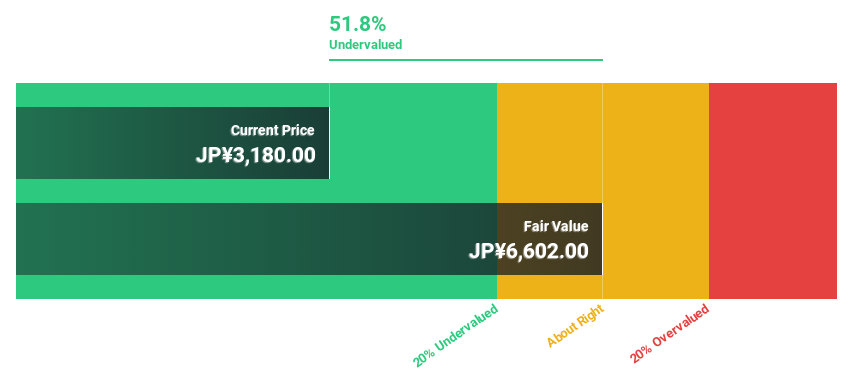

TechnoPro Holdings (TSE:6028)

Overview: TechnoPro Holdings, Inc. operates as a temporary staffing and contract work company in Japan and internationally, with a market cap of ¥428.22 billion.

Operations: TechnoPro Holdings generates revenue primarily from its R&D Outsourcing Business, which accounts for ¥183.09 billion, followed by Construction Management Outsourcing at ¥24.97 billion and Overseas Businesses contributing ¥24.76 billion.

Estimated Discount To Fair Value: 41.9%

TechnoPro Holdings is trading at ¥4110, well below its estimated fair value of ¥7078.34, indicating potential undervaluation based on cash flows. Although the company's revenue growth is moderate at 8.9% annually, it surpasses the Japanese market average of 3.7%. Earnings are expected to grow at 13.9% per year, outpacing the market's 7.5%, despite an unstable dividend track record and slower-than-desired revenue expansion.

- Our comprehensive growth report raises the possibility that TechnoPro Holdings is poised for substantial financial growth.

- Get an in-depth perspective on TechnoPro Holdings' balance sheet by reading our health report here.

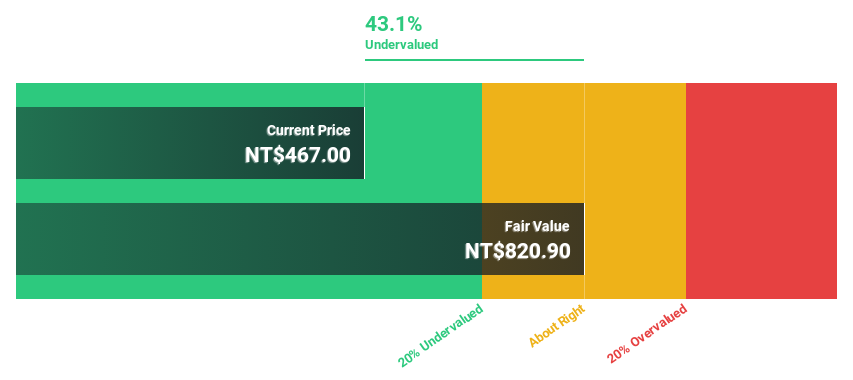

Lai Yih Footwear (TWSE:6890)

Overview: Lai Yih Footwear Co., Ltd. produces and sells vulcanized shoes, athletic footwear, cold-pressed shoes, and specialized functional footwear, with a market cap of NT$78.31 billion.

Operations: The company's revenue primarily comes from the production and sales of sports and leisure footwear, amounting to NT$39.60 billion.

Estimated Discount To Fair Value: 41.6%

Lai Yih Footwear is trading at NT$314, significantly below its estimated fair value of NT$538.07, highlighting potential undervaluation based on cash flows. Despite a volatile share price and a dividend yield of 2.87% not fully covered by free cash flows, earnings grew by 92.1% last year and are forecast to grow at 18.86% annually—outpacing the Taiwan market's average growth rate of 13.9%. Recent executive changes may impact future governance and strategic direction.

- The analysis detailed in our Lai Yih Footwear growth report hints at robust future financial performance.

- Click here to discover the nuances of Lai Yih Footwear with our detailed financial health report.

Where To Now?

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 293 more companies for you to explore.Click here to unveil our expertly curated list of 296 Undervalued Asian Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002340

Good value with reasonable growth potential.

Market Insights

Community Narratives