- China

- /

- Entertainment

- /

- SZSE:002555

3 Asian Dividend Stocks Offering Up To 8.9% Yield

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate, impacting global markets and causing fluctuations in oil prices, Asian economies are navigating through these challenges with a focus on stabilizing trade relations and managing inflationary pressures. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those looking to mitigate risk while benefiting from regular payouts.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.55% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.40% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.19% | ★★★★★★ |

| NCD (TSE:4783) | 4.15% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.29% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.38% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.08% | ★★★★★★ |

| Daicel (TSE:4202) | 5.02% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

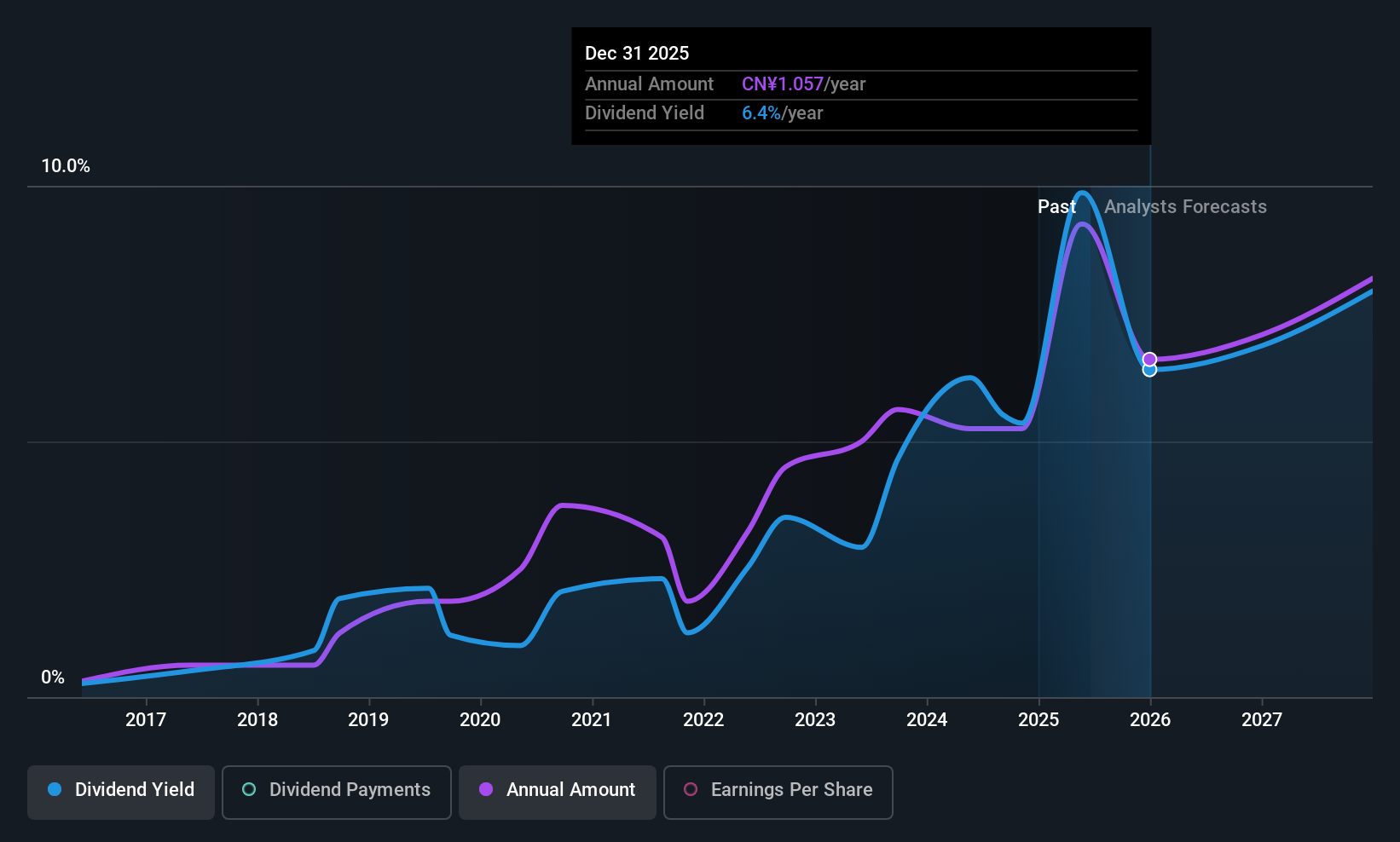

37 Interactive Entertainment Network Technology Group (SZSE:002555)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: 37 Interactive Entertainment Network Technology Group Co., Ltd. develops, distributes, and operates online games in China with a market cap of CN¥36.31 billion.

Operations: 37 Interactive Entertainment Network Technology Group Co., Ltd. generates its revenue primarily through the development, distribution, and operation of online games in China.

Dividend Yield: 8.9%

37 Interactive Entertainment Network Technology Group offers a high dividend yield of 8.94%, placing it in the top 25% of dividend payers in China. However, its dividends are not well covered by free cash flow, with a high cash payout ratio of 178.3%. Despite earnings growth and recent dividend affirmations, including CNY 2.10 per 10 shares for Q1 2025, the company's dividends have been volatile over the past decade.

- Navigate through the intricacies of 37 Interactive Entertainment Network Technology Group with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, 37 Interactive Entertainment Network Technology Group's share price might be too pessimistic.

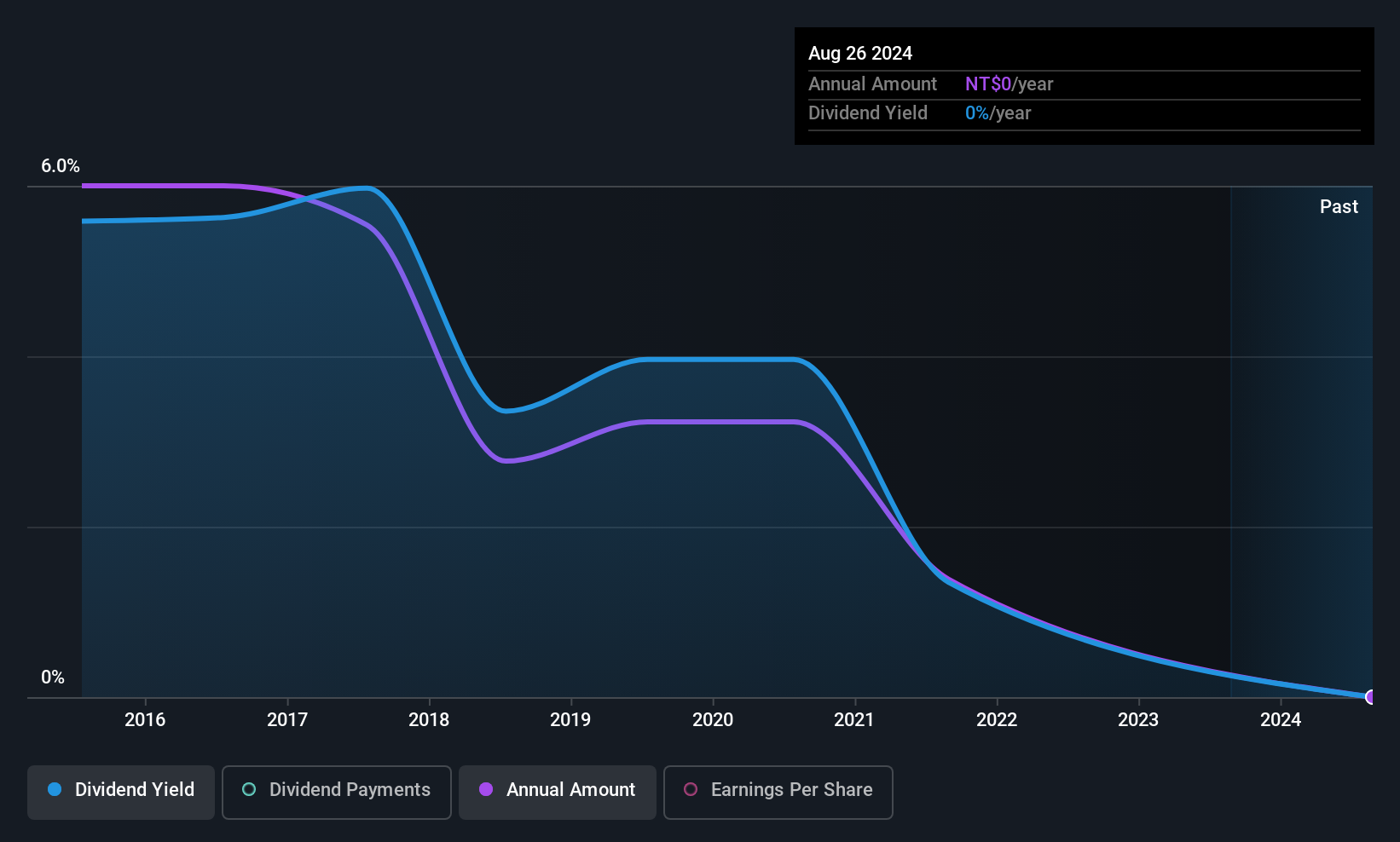

New Era Electronics (TPEX:4909)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: New Era Electronics Co., Ltd designs, manufactures, assembles, and sells printed circuit boards (PCBs) in Taiwan and internationally with a market cap of NT$6.78 billion.

Operations: New Era Electronics Co., Ltd generates revenue from its Electronic Components & Parts segment, amounting to NT$2.35 billion.

Dividend Yield: 8.3%

New Era Electronics offers a dividend yield of 8.26%, ranking in the top 25% of Taiwan's market. Despite this, its dividend history is marked by volatility and unreliability over the past decade. The company's recent earnings report showed significant declines, with net income dropping to TWD 3.74 million from TWD 164.14 million year-on-year, raising concerns about future payouts despite dividends being covered by earnings and cash flows at payout ratios of 67.8% and 62.8%, respectively.

- Take a closer look at New Era Electronics' potential here in our dividend report.

- Our valuation report unveils the possibility New Era Electronics' shares may be trading at a discount.

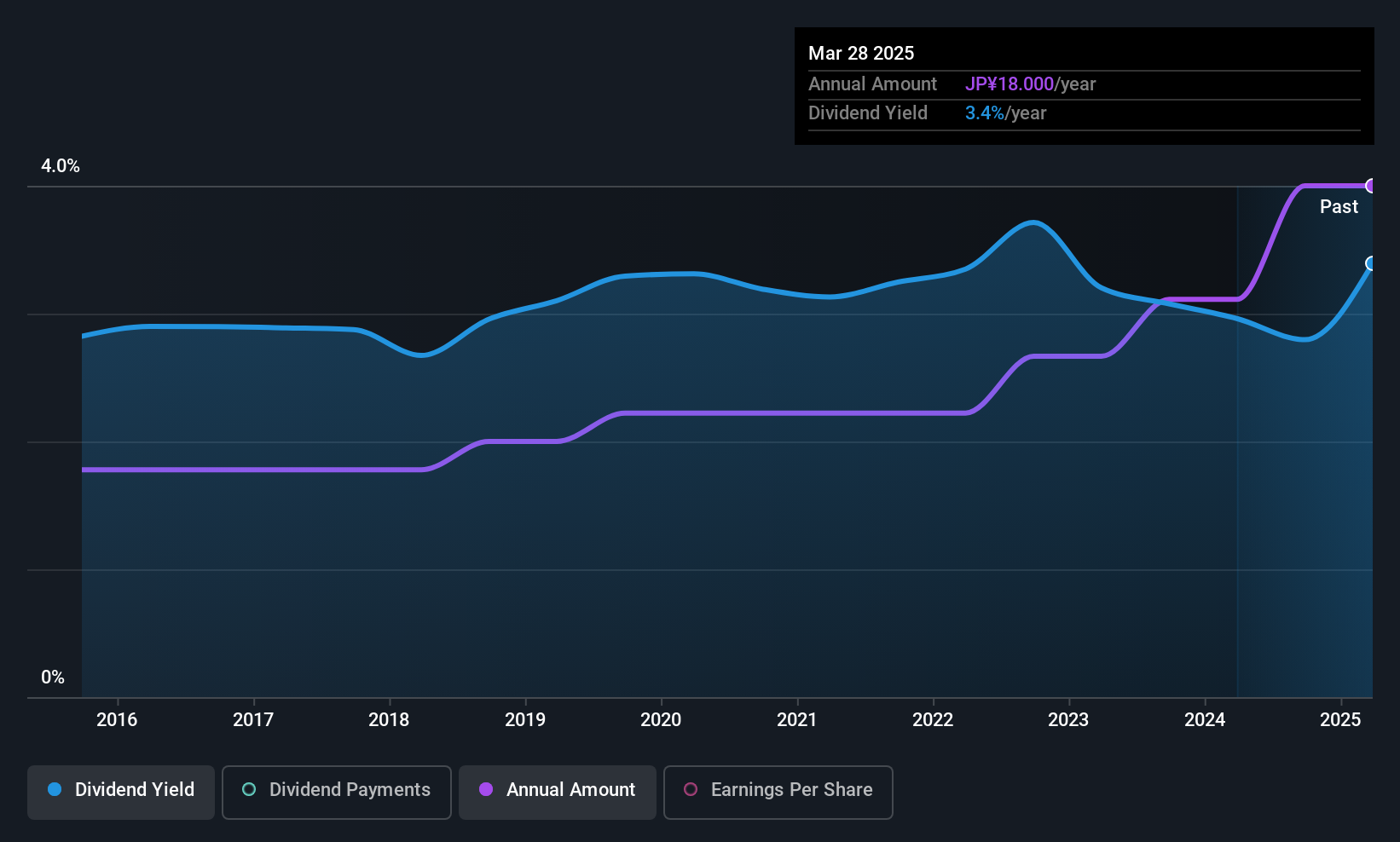

Hokkaido Gas (TSE:9534)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hokkaido Gas Co., Ltd. operates in the gas, heat, and power supply sectors in Japan with a market capitalization of ¥51.65 billion.

Operations: Hokkaido Gas Co., Ltd.'s revenue is derived from its Gas segment at ¥104.86 billion, Electric Power at ¥29.13 billion, and Energy Related activities contributing ¥39.60 billion.

Dividend Yield: 3.4%

Hokkaido Gas offers a dividend yield of 3.41%, which is below the top quartile in Japan. Despite a recent decrease from JPY 45 to JPY 10 per share, dividends remain covered by earnings and cash flows with low payout ratios of 16.1% and 13.5%, respectively, indicating sustainability. The company has maintained stable dividends over the past decade but faces challenges due to high debt levels and strategic investments for growth, impacting its financial flexibility for future increases.

- Delve into the full analysis dividend report here for a deeper understanding of Hokkaido Gas.

- Our expertly prepared valuation report Hokkaido Gas implies its share price may be lower than expected.

Taking Advantage

- Reveal the 1253 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 37 Interactive Entertainment Network Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002555

37 Interactive Entertainment Network Technology Group

Develops, distributes, and operates online games in China.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives