Last Update22 Oct 25Fair value Decreased 2.99%

Analysts have lowered their fair value estimate for First Horizon from $25.07 to $24.32 per share. They note that tempered growth expectations and ongoing uncertainty around the company's M&A strategy are key factors in the revision.

Analyst Commentary

Analyst sentiment on First Horizon remains mixed following recent quarterly results and management's updated commentary on its M&A strategy. Many analysts have adjusted their ratings and price targets, reflecting evolving views on the company's future direction and potential value catalysts.

Bullish Takeaways- Several bullish analysts believe First Horizon's lower valuation provides an attractive opportunity for investors, especially after the recent selloff.

- Some view the company as a likely acquisition target and maintain that selling the business could deliver better shareholder value than pursuing acquisitions for growth.

- The reaffirmation of full-year guidance and expectations for improved risk-reward, amid a potentially favorable rate environment, are seen as positives for long-term prospects.

- There is continued confidence in the bank's franchise quality, with potential for operating leverage and revenue growth as the company deepens client relationships.

- Some cautious analysts argue that much of the potential M&A premium has already dissipated, and that full de-risking of the stock is still to come.

- Recent management comments regarding possible acquisitions as a buyer have shifted sentiment, raising concerns about execution risk and near-term growth distractions.

- The likelihood of a sale of the company in the next year is now seen as lower, which limits near-term upside catalysts for the stock price.

- Questions remain about whether organic growth alone can drive revenues and profitability, especially as the company trades at a premium to regional peers.

What's in the News

- First Horizon completed a significant share repurchase by buying back a total of 32,980,711 shares, or 6.33% of outstanding shares, for $688.11 million under its buyback program announced on October 29, 2024 (Key Developments).

- The company reported net charge-offs of $26 million for the third quarter ending September 30, 2025, up from $24 million a year earlier (Key Developments).

- Full-year 2025 revenue guidance was maintained, with the company projecting revenues to be flat or increase by up to 4% (Key Developments).

- First Horizon announced plans to relocate to a new, modern office space on East Boulevard in Charlotte’s South End, consolidating two current offices. The new facility will feature 250 workspaces and numerous amenities, with the move planned for the first half of 2026 (Key Developments).

Valuation Changes

- Fair Value Estimate: Lowered from $25.07 to $24.32 per share, reflecting a minor decrease.

- Discount Rate: Increased slightly from 6.88% to 7.01%, which indicates a modestly higher perceived risk.

- Revenue Growth: Reduced from 6.61% to 5.54%. This shows a notable decrease in expected top-line expansion.

- Net Profit Margin: Improved from 26.70% to 27.44%. This suggests enhanced profitability assumptions.

- Future P/E Ratio: Declined from 13.68x to 12.15x, which signals a lower anticipated valuation multiple for forward earnings.

Key Takeaways

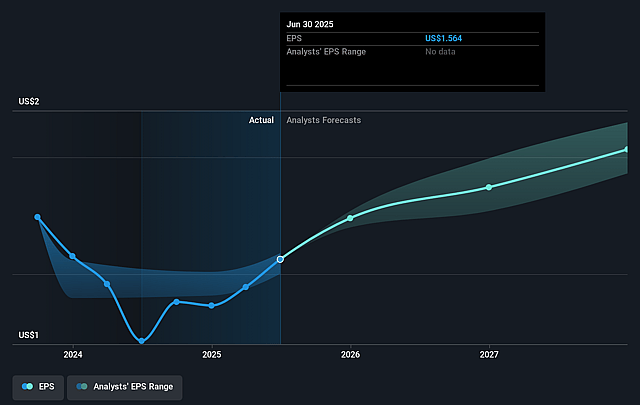

- Effective deposit cost management and strategic capital deployment could drive further net interest margin expansion and enhance earnings per share.

- The company's diversified business model and focus on cost discipline may boost earnings stability and shield against economic fluctuations.

- Economic uncertainty and credit risks may hurt First Horizon’s revenue, net interest margins, and earnings as market volatility and potential recession loom.

Catalysts

About First Horizon- Operates as the bank holding company for First Horizon Bank that provides various financial services.

- First Horizon is managing interest-bearing deposit costs effectively, with a 38 basis point reduction, which could lead to net interest margin expansion and positively impact net interest income.

- The company has opportunities for organic loan growth, particularly through its mortgage warehouse segment, which may enhance overall earnings if economic conditions or rate cuts increase demand.

- First Horizon's strategic capital deployment through a share repurchase program may lead to higher earnings per share (EPS) as outstanding shares are reduced.

- Increased focus on cost discipline and expense management can potentially improve net margins and bolster pre-provision net revenue growth.

- The diversified business model, offering countercyclical revenue support, may shield earnings from macroeconomic volatility and ensure a steady revenue stream across various interest rate environments.

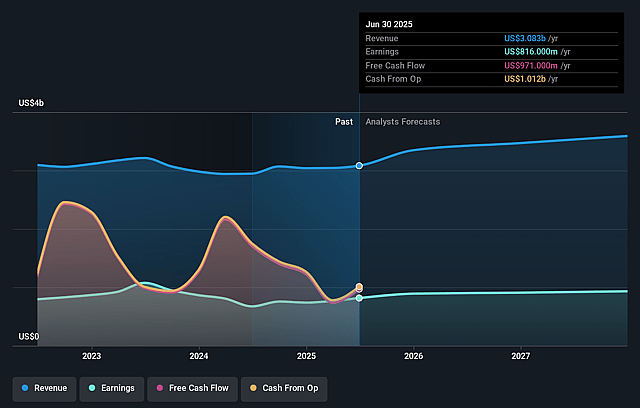

First Horizon Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Horizon's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.5% today to 25.8% in 3 years time.

- Analysts expect earnings to reach $965.0 million (and earnings per share of $2.03) by about September 2028, up from $816.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, down from 14.2x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 4.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

First Horizon Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The economic environment is currently shaped by heightened macroeconomic uncertainty due to tariffs and related policies, which could negatively impact revenue and net interest margins as market volatility persists.

- The risk of a potential recession is acknowledged, as further macroeconomic uncertainty is reflected in increased provision expenses and the potential impact on earnings and credit performance.

- The provision expense increased by $30 million, and the ACL to loans ratio increased by 2 basis points, which indicates caution over possible credit losses and may negatively affect future net margins and earnings.

- There is a decrease in fee income, excluding deferred compensation, by $5 million, and a decline in loan yields could continue to pressure revenues and profitability.

- The net charge-offs increased by $16 million, which, coupled with potential further macroeconomic challenges, could put additional stress on credit quality and earnings performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.641 for First Horizon based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $965.0 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of $22.81, the analyst price target of $24.64 is 7.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.