Last Update 10 Feb 26

TFG: Hold Downgrade And Reset P/E Assumptions Will Support Future Upside

Analysts have trimmed their price expectations for Foschini Group, cutting the target to ZAR 93. They are now more cautious on the shares, citing updated assumptions for discount rates, revenue growth, profit margins and future P/E multiples.

Analyst Commentary

Recent research has shifted to a more neutral stance on Foschini Group, with the move to a Hold rating and a ZAR 93 target price reflecting a balance between execution risks and potential upside.

Bullish Takeaways

- The ZAR 93 target suggests that analysts still see support for the current valuation, assuming the company can deliver on updated revenue and margin assumptions.

- Bullish analysts view the trimmed expectations as a reset that could make future execution against these assumptions more achievable, rather than aiming for overly optimistic scenarios.

- The use of revised discount rates and P/E multiples indicates that some of the risk is now more explicitly priced in, which can reduce the chance of large valuation surprises if conditions remain consistent with the new assumptions.

Bearish Takeaways

- Bearish analysts see the downgrade to Hold as a signal that the prior upside case is less compelling, with less room for positive surprises under the new ZAR 93 target.

- More cautious views on revenue growth and profit margins suggest that execution risk is a key concern, particularly if the company struggles to meet the updated expectations embedded in the target price.

- Lower assumed future P/E multiples point to reduced confidence that investors will be willing to pay the same valuation premium as before, which can limit share price appreciation even if earnings track the revised forecasts.

- The adjustment to discount rates highlights perceived risk in the cash flow outlook, encouraging some investors to wait for clearer signs of delivery before taking a more positive stance.

Valuation Changes

- Fair Value: The fair value estimate remains unchanged at ZAR 116.21, suggesting no adjustment to the central valuation anchor used in the analysis.

- Discount Rate: The discount rate has fallen slightly from 24.15% to 23.23%, indicating a modestly lower required return in the updated model.

- Revenue Growth: Revenue growth assumptions are effectively stable, moving marginally from 6.70% to 6.69% in the latest update.

- Net Profit Margin: The net profit margin assumption has risen slightly from 6.38% to 6.38%, reflecting a small change in expected profitability levels.

- Future P/E: The future P/E multiple has been trimmed from 15.25x to 14.91x, pointing to a more cautious stance on how much investors might be willing to pay for earnings.

Key Takeaways

- Strategic investments and acquisitions are expected to increase market share, revenue, and profitability across multiple regions and product categories.

- Supply chain optimization and local manufacturing efficiencies are anticipated to enhance net margins and improve overall operating performance.

- Challenging economic conditions and reliance on cost optimization pose risks to Foschini Group's revenue growth and profitability across its major markets.

Catalysts

About Foschini Group- Operates retail stores in South Africa and internationally.

- The Foschini Group is expected to gain market share in current retail verticals and adjacent categories due to recent investments in TFG Africa, potentially boosting future revenue growth.

- Gross margin recovery in TFG Africa, along with strengthened local manufacturing and efficiencies from new distribution centers, is expected to enhance net margins and earnings.

- The acquisition of White Stuff in the U.K. is anticipated to boost TFG's revenue and profitability due to its casual lifestyle products and international expansion opportunities.

- Continued expansion of Tapestry's brands and Jet's successful revamp program indicate strong future revenue growth, with potential improvements in net margins due to locally manufactured products.

- The company's strategic focus on optimizing its supply chain and leveraging technology, including the Bash platform, is likely to improve operating efficiencies, positively impacting earnings.

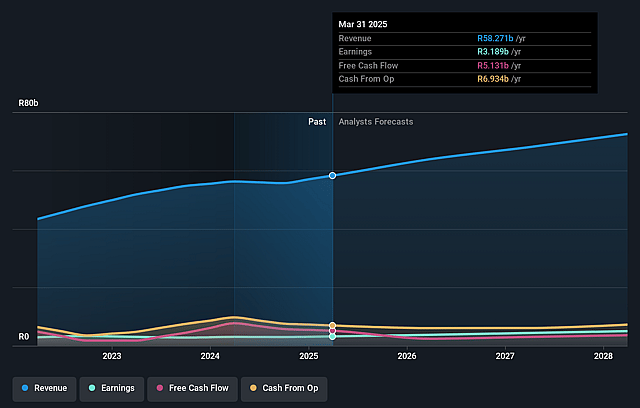

Foschini Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Foschini Group's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.5% today to 6.9% in 3 years time.

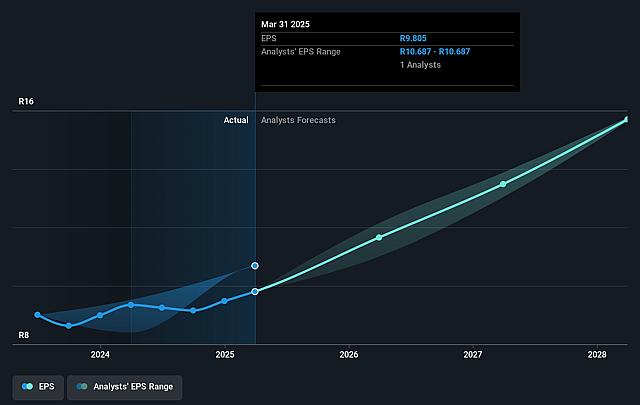

- Analysts expect earnings to reach ZAR 5.0 billion (and earnings per share of ZAR 15.7) by about September 2028, up from ZAR 3.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 10.6x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 8.9x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 22.46%, as per the Simply Wall St company report.

Foschini Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The overall economic environment in TFG's major geographies has been challenging, with low consumer confidence, elevated inflation, and interest rates, which could impact future revenue growth.

- TFG Africa's revenue was flat, and this is partly attributed to an artificially high sales base from the prior year and a challenging operating environment, indicating a risk in maintaining revenue growth.

- The international business segments in the U.K. and Australia have experienced revenue contraction despite improvements in margins, posing a risk to overall earnings stabilization.

- Tapestry and Jet, despite recent improvements, are still navigating through rightsizing and store portfolio adjustments. Any missteps could lead to volatile revenue streams or increased costs.

- There is a reliance on optimizing costs to maintain profitability amid shrinking or flat revenues, which inherently carries the risk of future cost cutting impacting business capabilities or growth potential, potentially affecting net margins negatively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR159.775 for Foschini Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR178.0, and the most bearish reporting a price target of just ZAR141.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR72.5 billion, earnings will come to ZAR5.0 billion, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 22.5%.

- Given the current share price of ZAR103.99, the analyst price target of ZAR159.78 is 34.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Foschini Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.