Catalysts

About Foschini Group

Foschini Group is a diversified, omnichannel fashion and lifestyle retailer with operations across Africa, the U.K. and Australia.

What are the underlying business or industry changes driving this perspective?

- The rapid scale up of the high margin beauty ecosystem, including own brand ranges and BeautyBox formats, is expected to materially lift blended gross margins and drive structurally higher group earnings as beauty turnover approaches multi billion rand levels by FY 2030.

- Expansion of Bash as South Africa's leading fashion and lifestyle app, with fast growing omni sales, rising click and collect penetration and improving fulfillment efficiency, should lower per order costs, enhance channel profitability and support revenue and earnings growth.

- Rollout of exclusive JD Sports stores and the build out of private label sports ranges position the group to participate in the global sneaker and athleisure trend, supporting top line growth and a gradual rebuild in segment margins as branded price pressure normalizes.

- Ongoing optimization of trading space, including rapid closure of underperforming stores, high return revamps in Jet and disciplined new store rollout in higher productivity formats such as Volpes and Jet Home, is intended to increase sales densities, operating leverage and net margins.

- Advanced quick response capabilities, demand led supply chain initiatives and the Riverfield distribution center are improving stock turns and markdown discipline. As volumes recover, these developments are expected to contribute to higher gross margins and stronger free cash flow conversion.

Assumptions

This narrative explores a more optimistic perspective on Foschini Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

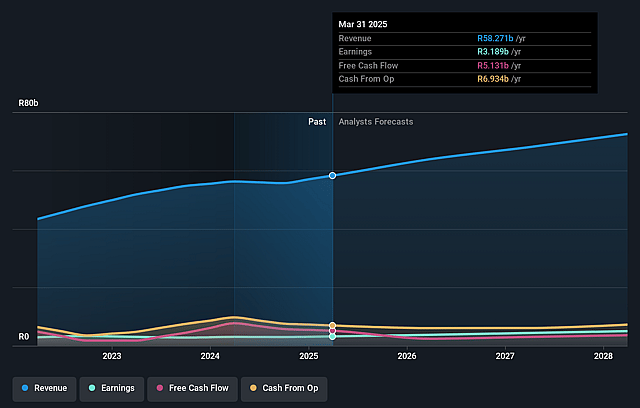

- The bullish analysts are assuming Foschini Group's revenue will grow by 8.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.8% today to 7.2% in 3 years time.

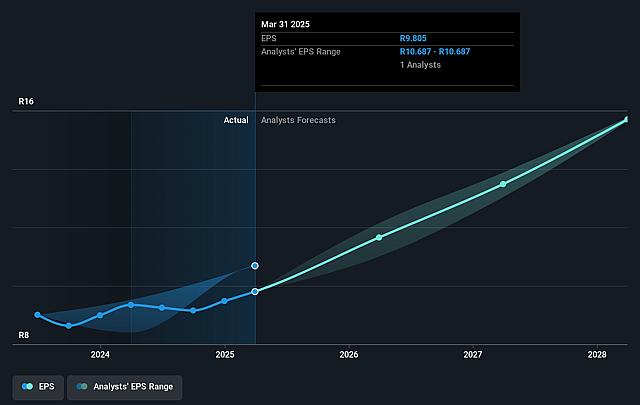

- The bullish analysts expect earnings to reach ZAR 5.6 billion (and earnings per share of ZAR 16.84) by about December 2028, up from ZAR 2.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ZAR3.6 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 9.0x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 9.0x.

- The bullish analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 24.26%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Prolonged macroeconomic weakness across South Africa, the U.K. and Australia, with GDP growth stuck around 1%, negative consumer confidence and household consumption below 1%, could keep discretionary spend depressed for longer than expected, constraining like for like growth and limiting the ability to deliver the anticipated acceleration in revenue and earnings.

- Structural shifts in South African consumer behavior, such as the rapid growth of online gambling now absorbing 1.6% of household spend and ongoing competition from international fast fashion platforms, risk permanently diverting wallet share away from apparel and footwear, putting sustained pressure on sales densities and group revenue.

- Persistent margin pressure from elevated promotional intensity, long lead times and global pricing inflation in branded sportswear, alongside rising regulated costs such as wages, rents and utilities, may prevent the forecast recovery in gross margin and operating leverage, capping net margins below the levels assumed in the bullish case.

- Execution risk in key growth initiatives including beauty, JD Sports rollout, Bash and international acquisitions such as White Stuff, where integration, cost inflation or weaker than expected customer uptake could dilute returns, resulting in lower than projected group earnings and return on capital employed.

- Rising credit exposure and potential deterioration in the health of the ZAR 11 billion debtors book as accept rates remain elevated into a weak macro environment, together with higher net bad debt charges over time, could erode the profitability of Financial Services and reduce group headline earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Foschini Group is ZAR167.53, which represents up to two standard deviations above the consensus price target of ZAR119.99. This valuation is based on what can be assumed as the expectations of Foschini Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR170.0, and the most bearish reporting a price target of just ZAR92.5.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be ZAR78.4 billion, earnings will come to ZAR5.6 billion, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 24.3%.

- Given the current share price of ZAR81.45, the analyst price target of ZAR167.53 is 51.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Foschini Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.