Last Update 15 Nov 25

TSCO: Upgraded Outlook May Drive Momentum Ahead Of Earnings Update

Analysts have increased their price target for Tesco to £4.50 from £4.00, citing stronger than expected earnings estimates and an improved profit outlook.

Analyst Commentary

Bullish analysts have raised their price targets for Tesco, reflecting increased confidence in the company's outlook. They highlight several positive developments that support the stock's upward momentum.

Bullish Takeaways- Recent earnings estimates were raised significantly, with upgrades to both first half and full year expectations. This suggests momentum is stronger than previously anticipated.

- Forecasts for the next few years are now quoted as "comfortably above guidance," which indicates analysts believe Tesco can outperform its stated targets.

- The company has been placed on "Positive Catalyst Watch." There is an expectation that upcoming earnings could drive further share price gains if results continue to exceed estimates.

- An improved profit outlook supports a higher valuation as confidence in Tesco's ability to deliver growth and margin expansion increases.

- Despite the upgrades, some caution remains regarding the sustainability of elevated earnings growth beyond the near term.

- There are ongoing questions about Tesco's ability to consistently deliver above-guidance performance amid broader retail sector challenges.

- Potential risks include margin pressure from rising costs and intensely competitive market conditions, which could impact longer-term profitability if not managed effectively.

What's in the News

- Pacvue has launched a new partnership with Tesco Media to enhance retail media activation. This partnership will provide brands with advanced reporting, automation, and optimization tools for campaigns on Tesco (Key Developments).

- Solution International has expanded its 'Grow with Peppa' character merchandise range in Tesco stores and online. The initiative aims to drive engagement in the baby feeding category, with products available in up to 510 stores across the UK and Ireland (Key Developments).

- Tesco PLC announced an interim dividend of 4.80 pence per ordinary share for the 26 weeks ending August 23, 2025, maintaining its policy of setting the interim dividend at 35 percent of the prior full year dividend (Key Developments).

Valuation Changes

- Fair Value remains unchanged at £4.70 per share, indicating no adjustment in analysts' fundamental estimate of Tesco's intrinsic worth.

- The discount rate has risen slightly from 7.78 percent to 7.99 percent, reflecting a modest increase in perceived risk or required return for investors.

- Revenue growth projections are virtually unchanged, holding steady at approximately 2.81 percent.

- Net profit margin estimates remain stable at around 2.76 percent, suggesting expectations for Tesco's profitability have not shifted.

- The future P/E has increased marginally from 16.43x to 16.53x, signaling a slightly higher multiple being applied to Tesco's expected earnings.

Key Takeaways

- Investments in quality, innovation, and digital expansion aim to boost customer satisfaction, market share, and top-line growth.

- Streamlined operations and personalized pricing strategies focus on enhancing net margins and customer loyalty, supporting revenue and earnings growth.

- Intense competition, economic uncertainty, regulatory changes, and supplier cost increases could compress Tesco's margins despite investments in quality, service, and colleague pay.

Catalysts

About Tesco- Operates as a grocery retailer in the United Kingdom, Republic of Ireland, the Czech Republic, Slovakia, and Hungary.

- Tesco's focus on boosting customer satisfaction through investments in quality, innovation, and enhanced shopping experiences is expected to drive future market share gains, potentially increasing revenue growth.

- Sustained efforts in streamlining operations and achieving cost savings under their 'Save to Invest' program are likely to enhance net margins by improving operational efficiency and offsetting cost pressures.

- The decision to continue expanding their digital presence and capabilities, including the Tesco Whoosh rapid delivery service and Marketplace, is poised to boost orders and basket sizes, contributing to top-line growth.

- The strategic emphasis on Clubcard and personalized pricing strategies, coupled with expanded promotional offers, aims to deepen customer loyalty and increase sales volume, positively impacting both revenue and net margins.

- A robust commitment to shareholder returns, as evidenced by significant share buybacks, supports confidence in EPS growth while maintaining a strong balance sheet allows for strategic investments that can drive future earnings.

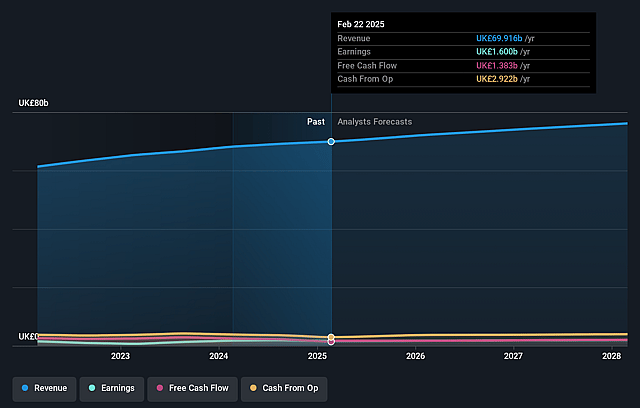

Tesco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tesco's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 2.6% in 3 years time.

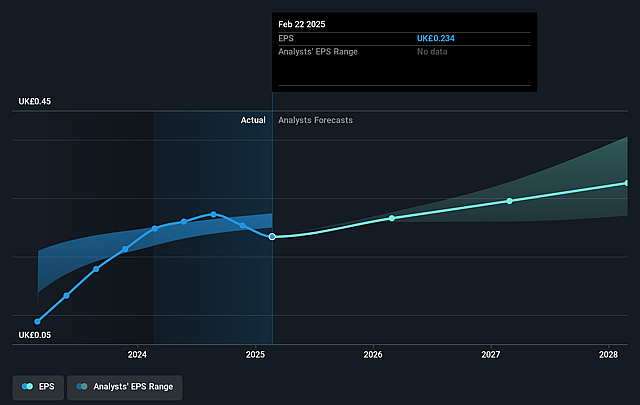

- Analysts expect earnings to reach £2.0 billion (and earnings per share of £0.33) by about September 2028, up from £1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, down from 17.5x today. This future PE is about the same as the current PE for the GB Consumer Retailing industry at 16.8x.

- Analysts expect the number of shares outstanding to decline by 1.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

Tesco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense competition in the U.K. food retail sector requires Tesco to maintain high levels of quality, value, and service, which could compress net margins as they invest heavily to stay competitive.

- The economic uncertainty and pressure on household budgets may negatively impact consumer sentiment and reduce overall consumer spending, potentially hindering revenue growth.

- Increased investment in U.K. colleague store pay and wages could elevate operating expenses, affecting net margins if not offset by revenue growth.

- Regulatory changes and tax increases could impose additional costs, affecting earnings and net income if not mitigated by price increases or operational efficiencies.

- The volatility in commodity markets and exchange rates, combined with increased supplier costs, could further squeeze margins if Tesco cannot pass these costs onto consumers without losing market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £4.292 for Tesco based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.75, and the most bearish reporting a price target of just £3.16.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £76.0 billion, earnings will come to £2.0 billion, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of £4.31, the analyst price target of £4.29 is 0.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.