Last Update 05 Dec 25

Fair value Decreased 3.64%SKA B: Richer Price Views And Project Pipeline Will Support Margins

Analysts have modestly reduced their fair value estimate for Skanska from SEK 275 to SEK 265, reflecting slightly lower long term revenue growth expectations that are only partly offset by a marginally stronger profit margin outlook and a richer external price target backdrop.

Analyst Commentary

Recent research updates show a generally constructive stance on Skanska, with incremental adjustments to price targets that align with slightly improved profitability assumptions but only modestly higher growth expectations.

Bullish Takeaways

- Bullish analysts highlight the recent price target increase to SEK 270 as evidence that near term execution and earnings visibility are improving, even if broader ratings remain neutral.

- The higher target implies confidence that Skanska can sustain healthier margins in key construction and development segments, supporting a valuation premium versus prior assumptions.

- Analysts also point to a richer external price target backdrop as a sign that market expectations are gradually catching up with the company’s operational progress and capital discipline.

- There is an emerging view that Skanska’s balance of steady order intake and disciplined project selection can underpin more resilient free cash flow generation, supporting upside to the current share price.

Bearish Takeaways

- Bearish analysts remain cautious on the long term revenue growth outlook, which tempers the impact of higher price targets and caps potential valuation re rating.

- The persistence of Equal Weight or equivalent ratings suggests lingering concerns around cyclical exposure, project risk, and the ability to consistently deliver above market growth.

- Some analysts see limited upside from current levels, arguing that much of the near term margin improvement is already reflected in the share price, leaving less room for further multiple expansion.

- There is also wariness that a weaker macro backdrop in certain construction markets could pressure new orders and delay project starts, challenging the durability of recent positive revisions.

What's in the News

- Skanska appointed long time insider Pontus Winqvist as Group CFO, succeeding Jonas Rickberg, with effect from November 27, 2025. The move reinforces continuity in the finance organization and leadership team (Key Developments).

- Skanska secured two large US data center contracts worth a combined USD 519 million, about SEK 5.1 billion, with construction slated to start in early 2026 and complete in 2027, boosting the US order backlog in Q4 2025 (Key Developments).

- The company won a NOK 950 million, about SEK 900 million, contract from Hydro for the Illvatn pumped storage hydropower plant in Norway, a complex tunnel heavy project that will add around 84 GWh of annual renewable power when completed in 2030 (Key Developments).

- Skanska is investing about EUR 74 million, about SEK 820 million, in Nowy Rynek C in Poznan, Poland, targeting net zero CO2 emissions in operation and advanced green certifications. This underlines its strategy in sustainable commercial development (Key Developments).

- Multiple Nordic and European infrastructure and education projects, including the D3 motorway in Slovakia and a new NTNU university building in Trondheim, Norway, are adding multi billion SEK to regional order bookings and broadening Skanska's public sector pipeline (Key Developments).

Valuation Changes

- Fair Value Estimate was reduced modestly from SEK 275 to SEK 265, reflecting lower long term growth assumptions partly offset by a slightly better margin outlook.

- The Discount Rate edged up slightly from 6.82 percent to 6.84 percent, implying a marginally higher required return and a small drag on valuation.

- Revenue Growth was revised down meaningfully from about 4.98 percent to 4.12 percent, signaling a more cautious stance on Skanska’s long term top line trajectory.

- Net Profit Margin increased slightly from about 4.40 percent to 4.46 percent, incorporating expectations for modestly improved profitability.

- Future P/E was lowered from 15.1 times to about 14.7 times, indicating a slightly less generous earnings multiple in the updated valuation framework.

Key Takeaways

- Strong order backlog, favorable market trends, and alignment with public investments position Skanska for sustained revenue and earnings growth across geographies.

- Emphasis on ESG leadership, selective project focus, and resilient financial health enhance margins, stability, and shareholder value despite regional market fluctuations.

- Weak property markets, delayed asset sales, higher restructuring costs, and industry risks threaten Skanska's margins, earnings stability, and ability to generate reliable cash flow.

Catalysts

About Skanska- Operates as a construction and project development company in the Nordics, Europe, and the United States.

- Skanska's record-high order backlog (19 months of production, SEK 268 billion) and strong book-to-bill ratios (>100% across all geographies) position the company to benefit from sustained government infrastructure spending, especially in the US and Europe, supporting future revenue growth.

- The company is seeing robust demand and improved outlooks in key markets (Swedish civil, Central European residential), which are driven by continued urbanization, population growth, and increased public investments in defense, energy, and water infrastructure, laying the groundwork for mid

- and long-term earnings expansion.

- Skanska's focus on high-quality, sustainable (LEED/green) projects and a strong track record on decarbonization (62% emissions reduction since 2015) aligns it with rising ESG standards, positioning it to capture higher-margin projects as green building becomes increasingly mandated-supporting both revenue and net margin improvement.

- Healthy cash flow, a strong balance sheet (net cash, 37% equity ratio), and prudent project selection enable Skanska to remain resilient in volatile markets, invest in technology, and return capital to shareholders, providing a buffer and potential for increased shareholder returns.

- Despite weak Nordic residential markets, Skanska has shown flexibility and selectivity-emphasizing higher-margin Central European projects and maintaining a solid pipeline-allowing for operational recovery in softer regions and supporting the stability of group-wide margins and earnings.

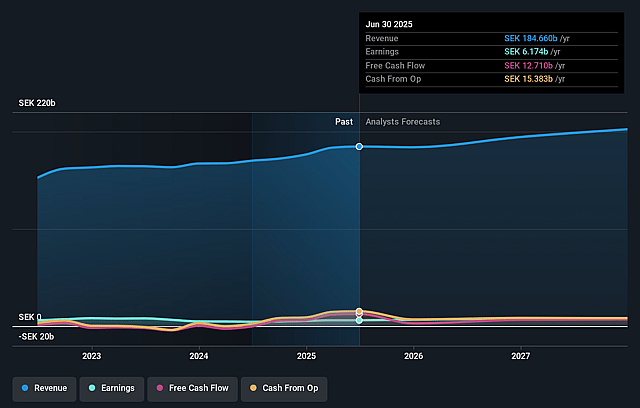

Skanska Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Skanska's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 4.3% in 3 years time.

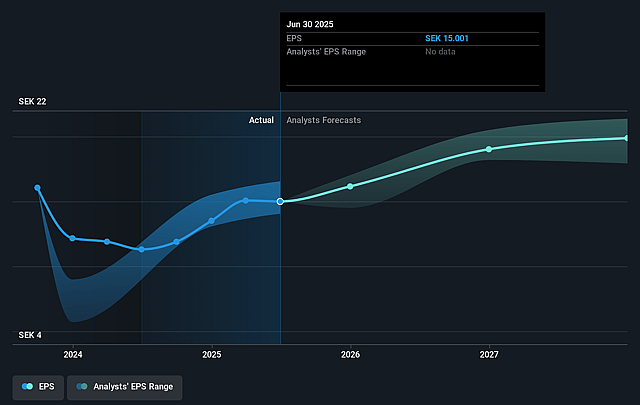

- Analysts expect earnings to reach SEK 9.0 billion (and earnings per share of SEK 19.88) by about September 2028, up from SEK 6.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, down from 15.4x today. This future PE is lower than the current PE for the GB Construction industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 0.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.6%, as per the Simply Wall St company report.

Skanska Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness and slow recovery in the Nordic residential and commercial property markets, driven by low consumer confidence and broader macroeconomic uncertainties, could continue to depress volumes and margins in these core geographies, impacting overall revenue growth and earnings.

- The continued hesitancy and lack of transactions in the U.S. commercial property divestment market-primarily due to sustained high long-term interest rates-may delay planned asset sales, limiting Skanska's ability to recycle capital efficiently and suppressing earnings from property development.

- Elevated investment and restructuring costs, particularly those related to IT transformation and outsourcing of infrastructure, are causing central expenses to rise, potentially eroding net margins and limiting free cash flow available for dividends or reinvestment.

- The project development segment is currently in a net divestment cycle, and with a shallow transaction market and lumpy sales profile, there is heightened risk of irregular revenue recognition and increased earnings volatility over the medium term.

- Beyond company-specific execution, ongoing industry-wide risks such as construction labor shortages and potential cost inflation from regulatory demands or material prices could squeeze margins on both existing backlog and future projects, placing downward pressure on operating income and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK254.25 for Skanska based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK285.0, and the most bearish reporting a price target of just SEK240.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK206.4 billion, earnings will come to SEK9.0 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.6%.

- Given the current share price of SEK230.7, the analyst price target of SEK254.25 is 9.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Skanska?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.