Key Takeaways

- Skanska's strong backlog and leadership in sustainable, high-value projects are set to drive higher margins, premium pricing, and expand market share amid growing regulatory demand.

- Enhanced performance in North America and infrastructure markets, combined with digitalization, will lower costs and structurally elevate revenues and operational leverage beyond analyst expectations.

- Macroeconomic headwinds, regulatory pressures, cost overruns, and operational inefficiencies threaten Skanska's profitability, margin stability, and earnings consistency across key segments.

Catalysts

About Skanska- Operates as a construction and project development company in the Nordics, Europe, and the United States.

- While analysts broadly agree that Skanska's record order backlog strongly supports future revenue, their estimates may understate just how fast and substantially this quality and duration-rich backlog will convert into both higher revenues and structurally elevated operating margins, given the exceptional 19 months of production cover and high-value project mix.

- Analyst consensus highlights robust order trends in the US and Europe; however, these trends may lead to a material outperformance in operating income as Skanska's North American operations, currently delivering increased margins and economic contribution, are poised to benefit more than expected from historic infrastructure investment and rapid urbanization, driving sustained double-digit revenue growth.

- Skanska's leadership in sustainable and resilient construction, underscored by a 62 percent reduction in Scope 1 and 2 emissions and a strong portfolio of green-certified projects, positions the company to capture premium pricing, enhanced contract win rates, and market share growth as regulatory and customer preferences for low-carbon, energy-efficient buildings rapidly intensify, expanding both topline and margins.

- The accelerating demand for major infrastructure renewal in developed economies, especially in civil markets across the US and Europe, ensures that Skanska's specialized expertise and strong financial position will secure a disproportionately large share of multiyear, high-margin public projects, offering unmatched long-term revenue visibility and free cash flow durability.

- Skanska's aggressive digitalization and modular construction strategies-coupled with ongoing cost discipline and integrated project delivery-are set to meaningfully lower project costs and SG&A as a percentage of revenue, structurally increasing net margins and delivering operational leverage above what is currently forecast.

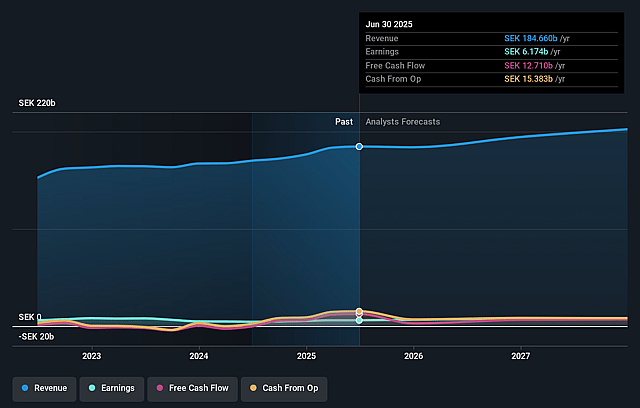

Skanska Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Skanska compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Skanska's revenue will grow by 5.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.4% today to 4.3% in 3 years time.

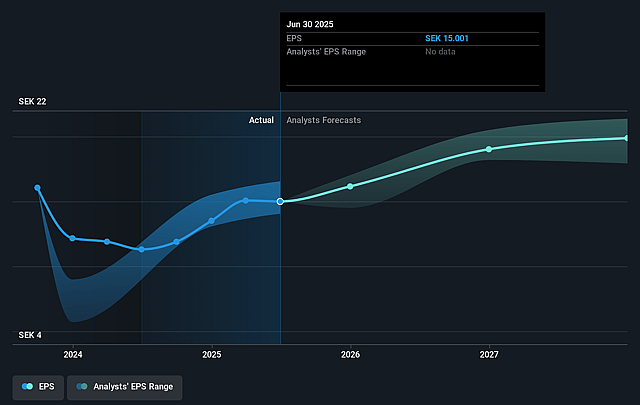

- The bullish analysts expect earnings to reach SEK 9.2 billion (and earnings per share of SEK 22.45) by about July 2028, up from SEK 6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.5x on those 2028 earnings, up from 15.0x today. This future PE is lower than the current PE for the GB Construction industry at 15.9x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.55%, as per the Simply Wall St company report.

Skanska Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Skanska's Residential Development segment is experiencing reduced revenues and profitability, particularly in the Nordics, due to declining consumer confidence and unsold inventory, which could constrain revenue growth and reduce net margins over the long term.

- Heightened macroeconomic uncertainty, sluggish residential demand, and delays in investment decisions for commercial projects-especially in the U.S.-raise risks of a prolonged slowdown in order intake and increased earnings volatility.

- The sector's accelerating decarbonization and regulatory compliance demands may increase Skanska's operating costs and restrict the types of projects it can pursue, negatively impacting long-term profitability and margins.

- High exposure to large, fixed-price infrastructure contracts increases the chance of cost overruns, which exposes Skanska to margin compression and may lead to greater fluctuations in earnings and weaker net margins.

- Persistent talent shortages and operational inefficiencies, combined with overreliance on public sector spending, could drive up labor costs, create project delays, and increase Skanska's vulnerability to government budget cuts, all risking both revenue stability and long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Skanska is SEK285.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Skanska's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK285.0, and the most bearish reporting a price target of just SEK160.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK213.9 billion, earnings will come to SEK9.2 billion, and it would be trading on a PE ratio of 15.5x, assuming you use a discount rate of 6.6%.

- Given the current share price of SEK225.3, the bullish analyst price target of SEK285.0 is 20.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.