Key Takeaways

- Danaher's focus on life sciences and diagnostics through a spin-off and strategic acquisitions aims to secure durable growth in future revenue and earnings.

- Investments in new technologies and continuous improvements in cost structure and productivity initiatives are anticipated to enhance net margins and drive revenue growth.

- Challenges in pharma investment normalization, bioprocessing demand recovery, diagnostics volatility, operational issues in China, and anticipated revenue declines signal potential pressures on Danaher's earnings and net margins.

Catalysts

What are the underlying business or industry changes driving this perspective?

- A spin-off and focused strategy towards life sciences and diagnostics, enhancing Danaher's portfolio for durable secular growth markets, positively influencing future revenue and earnings.

- Continuous proactive initiatives towards improving the cost structure, optimized through the Danaher Business System, targeting an impact on net margins through process improvements and productivity initiatives.

- The introduction and investment in new technologies, like Cytiva's Xcellerex X-platform bioreactor and Beckman Coulter's DxI 9000 analyzer, aimed at supporting biologic drug production and faster patient diagnosis, potentially driving revenue growth from product innovation.

- A significant emphasis on strengthening the free cash flow generation, evidenced by a history of exceeding a 100% free cash flow to net income conversion ratio, indicating expected continued strong free cash flow that could underpin earnings growth.

- The strategic acquisition of Abcam, augmenting Danaher's exposure to attractive markets and supporting the expectation of higher margins along with stronger free cash flow generation in the future, impacting overall financial health and future growth.

Assumptions

How have these above catalysts been quantified?

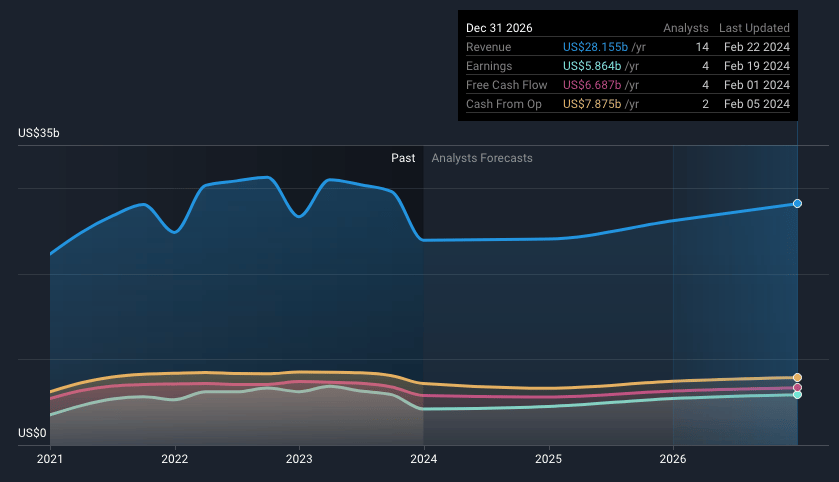

- Analysts are assuming Danaher's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.6% today to 20.6% in 3 years time.

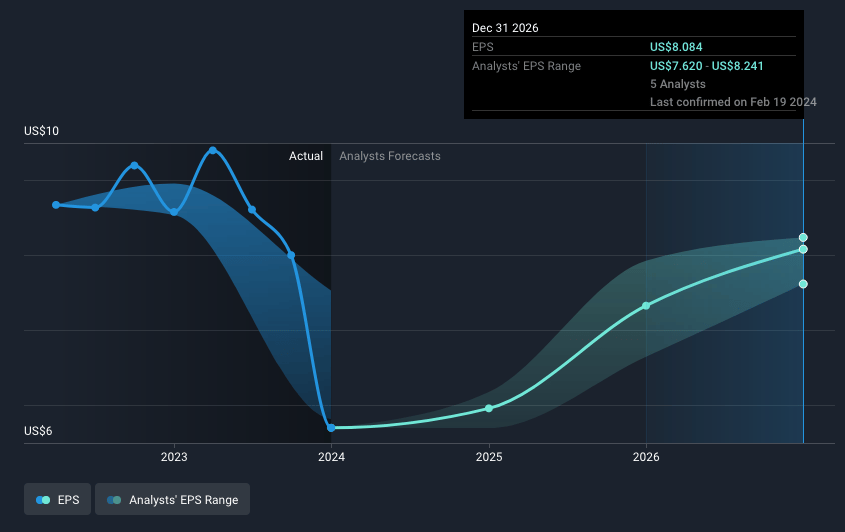

- Analysts expect EPS to reach $8.05 ($5.8 billion in earnings) by about February 2027, up from $5.68 today.

Risks

What could happen that would invalidate this narrative?

- The ongoing normalization of investment levels in pharma and biopharma, particularly in key markets like China and North America, could continue to impact the demand for Life Sciences instruments, affecting revenues in this segment.

- Bioprocessing projected to be down low to mid-single digits suggests a slower recovery in demand, potentially impacting revenues in the Biotechnology segment.

- The transition from pandemic to endemic state of COVID-19 and lower respiratory revenue expectations at Cepheid indicate possible volatility in Diagnostics segment revenue.

- Operational challenges in China, with the economic landscape remaining challenging and high single-digit revenue decline expected, could negatively impact overall revenues, especially considering China's significant role in the global market.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.