Last Update 25 Feb 26

FFIC: Future Returns Will Reflect Merger Progress And Stable Earnings Assumptions

Analysts have lifted their price target on Flushing Financial by $2.30, with the change grounded in updated assumptions around discount rate, revenue growth, profit margin and future P/E that collectively support a fair value estimate of $17.15.

Analyst Commentary

Analysts revisiting their models point to the revised fair value of $17.15 as a reflection of updated views on discount rate, revenue trajectory, profit margin assumptions and the P/E they are willing to apply to Flushing Financial.

Bullish Takeaways

- Bullish analysts view the higher price target as consistent with their updated discount rate assumptions, suggesting they see the risk profile as aligned with a valuation closer to $17.15.

- The adjustment incorporates refreshed revenue assumptions, which bullish analysts see as supportive of Flushing Financial’s ability to justify the revised fair value over time.

- Improved margin expectations in their models are a key driver behind the higher target, with bullish analysts arguing that these profitability assumptions help support the P/E they are using.

- The willingness to underwrite a higher future P/E in their valuation work signals that bullish analysts are comfortable assigning more value to Flushing Financial’s earnings stream than before.

Bearish Takeaways

- More cautious analysts highlight that the fair value estimate of $17.15 still depends heavily on achieving the modeled profit margins, leaving limited room for execution missteps.

- The updated target is sensitive to the chosen discount rate, and bearish analysts flag that any change in funding costs or perceived risk could weigh on that valuation.

- Some remain wary of the reliance on assumed revenue outcomes, noting that if actual results track below these inputs, the current P/E assumptions could appear demanding.

- There is also caution that the higher target may narrow the margin of safety for new investors if earnings or valuation multiples do not align with the modeled scenario.

What's in the News

- OceanFirst Financial Corp. signed a definitive merger agreement to acquire Flushing Financial for approximately $570 million in common equity on December 29, 2025. The transaction is expected to close in the second quarter of 2026, subject to regulatory and shareholder approvals (Key Developments).

- Under the merger agreement, a termination fee of approximately $21.4 million is payable by either Flushing Financial or OceanFirst in certain circumstances. OceanFirst would be required to pay Flushing Financial a termination fee of approximately $46.3 million if specific conditions are triggered (Key Developments).

- Flushing Financial reported net charge offs of $1.8 million for the fourth quarter ended December 31, 2025, compared to $4.7 million in the fourth quarter of 2024 (Key Developments).

- From October 1, 2025 to December 31, 2025, the company repurchased 0 shares for $0 million and has completed the repurchase of 3,192,036 shares, representing 10.74%, for $65.29 million under the buyback announced on February 27, 2018 (Key Developments).

- A special or extraordinary shareholders meeting for Flushing Financial is scheduled for April 2, 2026. This meeting is expected to be relevant for the proposed OceanFirst merger (Key Developments).

Valuation Changes

- Fair Value: Unchanged at $17.15, with the revised inputs aligning to the same overall equity value estimate.

- Discount Rate: Fallen slightly from 7.75% to 7.71%, which implies a marginally lower required return in the refreshed model.

- Revenue Growth: Essentially unchanged at about 9.30%, which reflects a steady view on Flushing Financial’s top line trajectory in the valuation work.

- Net Profit Margin: Effectively flat at about 30.25%, which indicates minimal change in modeled profitability assumptions.

- Future P/E: Eased slightly from 7.92x to 7.92x, which signals only a small adjustment to the earnings multiple used in the updated valuation.

Key Takeaways

- Expanding non-interest-bearing deposits and repricing loans are poised to improve net interest margins and drive revenue growth.

- Growing presence in Asian markets and diversifying revenue streams can enhance deposit growth and support earnings expansion.

- Flushing Financial faces profitability challenges from restructuring losses, regulatory costs, increased expenses, and competitive market pressures, potentially impacting future earnings and margins.

Catalysts

About Flushing Financial- Operates as the bank holding company for Flushing Bank that provides banking products and services primarily to consumers, businesses, and governmental units.

- The company's balance sheet restructuring and recent $70 million equity raise are expected to enhance net interest margin (NIM) by 10 to 15 basis points in the first quarter, likely improving profitability and earnings.

- The planned repricing of approximately $750 million in loans in 2025 to higher rates is anticipated to support net interest income and drive future revenue growth.

- Flushing Financial's focus on expanding non-interest-bearing deposits through revamped customer relationship strategies and incentives could reduce funding costs, thus potentially increasing net interest margins and earnings.

- The expansion of the SBA team and planned sales of SBA loans in 2025 are expected to diversify revenue streams and increase non-interest income, supporting earnings growth.

- The company’s strategy to grow its presence in Asian markets, which currently make up 18% of total deposits, by opening new branches and leveraging cultural ties is positioned to capture additional market share and boost deposit growth, supporting revenue expansion.

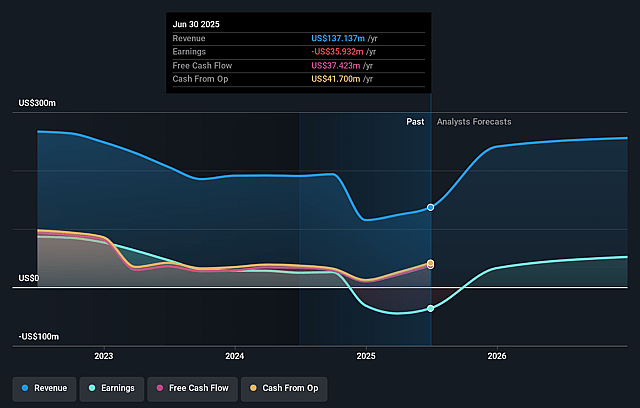

Flushing Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Flushing Financial's revenue will grow by 14.7% annually over the next 3 years.

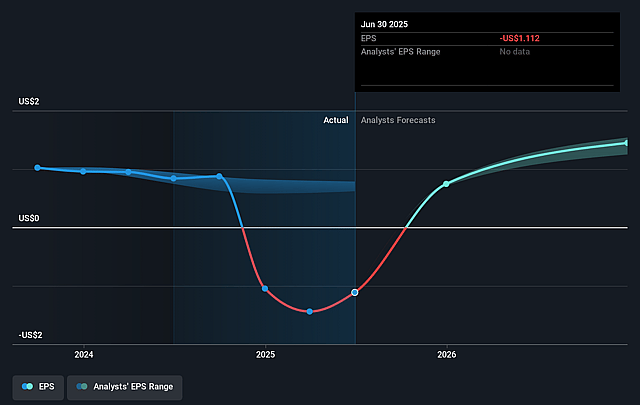

- Analysts assume that profit margins will increase from 13.4% today to 25.9% in 3 years time.

- Analysts expect earnings to reach $75.7 million (and earnings per share of $2.07) by about January 2028, up from $26.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, down from 18.5x today. This future PE is lower than the current PE for the US Banks industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Flushing Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a GAAP loss per share of $1.61, primarily due to a $76 million pre-tax loss from balance sheet restructuring, which could affect future earnings and net margins.

- Non-interest expense is projected to increase by 5% to 8% in 2025 due to new branch openings and business investments, which could pressure net margins.

- A significant portion of deposits are in the Asian markets, where they hold only a 3% market share, implying potential market challenges that could affect revenue growth.

- The company faces competition for deposits in the New York metro market, which could impact their ability to reduce funding costs and pressure net interest margins.

- The crossing of the $10 billion asset threshold will involve regulatory challenges and costs, potentially impacting profitability and operating expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.83 for Flushing Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $292.6 million, earnings will come to $75.7 million, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $14.32, the analyst's price target of $17.83 is 19.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Flushing Financial?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.