Key Takeaways

- Anticipated growth in net interest income due to strong loan growth in card services, offsetting the impact of lower rates.

- Investments in technology and marketing aim to capture greater market share in card services and wealth management, suggesting potential revenue and income increases.

- Anticipated Federal Reserve interest rate cuts and increasing operating expenses may challenge JPMorgan Chase's revenue growth and profit margins amidst regulatory changes.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The company anticipates net interest income (NII) ex-Markets to be approximately $88 billion in 2024, assuming rates follow the forward curve which includes 6 cuts this year. This is driven by expected strong loan growth in card services, albeit at a slower pace than 2023, which should help offset some impact of lower rates, thus potentially enhancing revenue.

- Investments in technology and marketing, despite increasing expenses, are aimed at fueling business growth and capturing greater market share, particularly in card services and wealth management, suggesting potential for higher revenue and income in these areas.

- First Republic's integration is expected to contribute to JPMorgan's revenue and net income, reflecting in the NII ex-Markets' run rate of $94 billion for the quarter. The full year integration could enhance revenue and profitability, despite the forward-looking declines to $88 billion in NII ex-Markets for 2024.

- JPMorgan's plan to expand its debit and credit card spend, driven by strong account growth and consumer spend stabilization, projects a favorable outlook for revenue growth in card services. This is backed by an 8% year-on-year revenue increase in Card Services & Auto for the fourth quarter.

- The effort to remain competitive with private credit providers by offering both traditional syndicated lending and head-to-head with unitranche structures could retain and attract clients looking for flexible financing options, potentially boosting revenue in this competitive landscape.

Assumptions

How have these above catalysts been quantified?

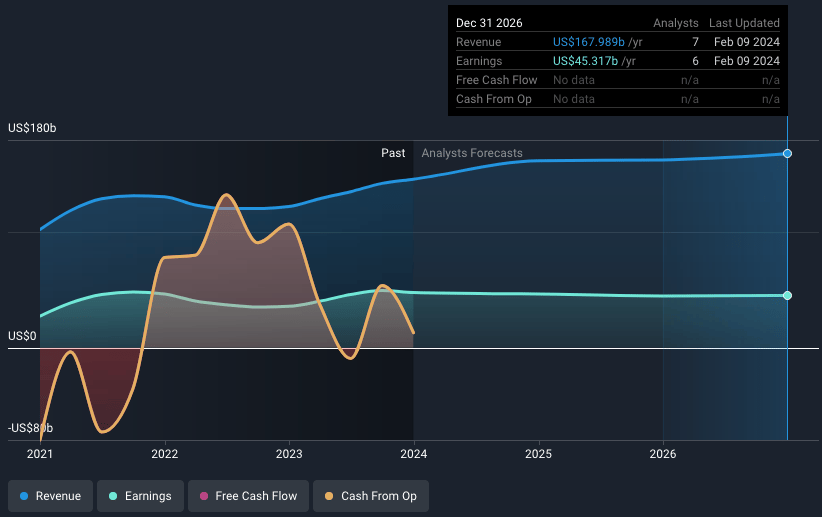

- Analysts are assuming JPMorgan Chase's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 32.7% today to 27.0% in 3 years time.

- Analysts expect EPS to reach $16.88 ($45.3 billion in earnings) by about February 2027, up from $16.6 today.

Risks

What could happen that would invalidate this narrative?

- The projected Federal Reserve interest rate cuts (anticipated to be six) could lead to a decrease in net interest income (NII), affecting JPMorgan Chase's revenue growth and profit margin.

- Increased operating expenses, forecasted at $90 billion for 2024 due to investments and compensation, could pressure the bank's net margins if revenue growth does not outpace these rising costs.

- The uncertainty surrounding the impact of Basel III end-game requirements and regulatory changes on capital may affect the firm's ability to generate returns and allocate capital effectively, potentially hindering earnings growth.

- The outlook for soft landing and strong consumer credit hinges on a stable labor market; any deviation from this scenario could adversely impact loan performance and increase credit costs, affecting net income.

- The shift of lending activity towards private credit markets, as seen in areas like middle-market lending and possibly asset-backed finance, represents a competitive threat that may impact JPMorgan Chase's market share and revenue in certain business lines.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.