Key Takeaways

- Adjustments in reserving practices and rate increases indicate efforts towards improved financial discipline, profitability, and alignment of premiums with risks.

- Investments in technology and proactive management of catastrophe exposure suggest potential for reduced loss ratios, operational efficiencies, and improved financial stability.

- High dependence on personal auto insurance rate increases, exposure to severe weather, claims reserving risks, challenging market conditions, and strategic cutbacks in advertising could impact profits and growth.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Adjustments in reserving practices and moderation of loss cost trends suggest improved financial discipline and profitability, potentially reflecting positively on future earnings and underwriting margins.

- The significant rate increases in personal auto and other lines indicate efforts to counteract adverse trends and align premium levels more closely with risk, potentially boosting near-term revenue and stabilizing long-term profitability.

- The proactive approach to managing exposure in catastrophe-prone areas, especially with property lines, could lead to reduced volatility in loss ratios and improved combined ratios over time.

- Investments in technology and segmentation, specifically mentioned in relation to the property business and usage-based insurance, hint at operational efficiencies and enhanced risk selection, possibly leading to better loss ratios and customer retention rates.

- Higher interest rates benefiting the investment portfolio suggest an indirect boost to net income, pointing towards an improved overall financial position that could be reflected in stock valuation over time.

Assumptions

How have these above catalysts been quantified?

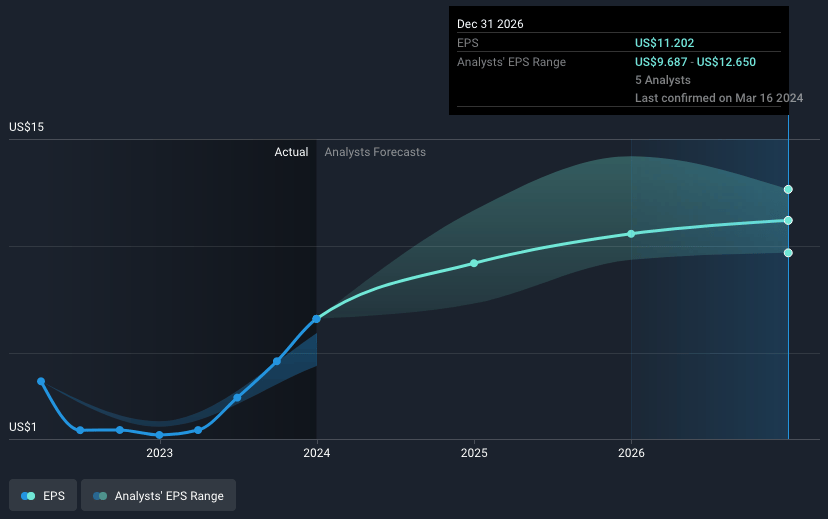

- Analysts are assuming Progressive's revenue will grow by 11.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.2% today to 7.8% in 3 years time.

- Analysts expect earnings to reach $6.7 billion (and earnings per share of $11.1) by about March 2027, up from $3.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.3x on those 2027 earnings, down from 30.6x today.

- To value all of this in today’s dollars, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- High dependence on rate increases in personal auto insurance (approximately 19% for the full year) due to ongoing pressures such as attorney representation rates and vehicle repair costs, indicating vulnerability to profitability if rate increases are insufficient or customer retention is affected.

- Exposure to severe weather events and natural disasters, as highlighted by past catastrophic weather events, could lead to significant loss costs exceeding reserves, impacting earnings negatively.

- Risks associated with the reserving for claims, particularly in states like Florida where legislative reforms and claims practices can unpredictably influence loss costs, potentially affecting net income through reserve adjustments.

- The company's growth strategy may be dampened by the hard market conditions, with increased premiums potentially leading to reduced policy renewals or new business if competitors adjust pricing more aggressively, impacting revenue growth.

- Strategic pull-backs in advertising spending to manage profitability could temporarily slow down policy growth rates, impacting top-line revenue growth if market conditions or competitive actions necessitate rapid re-engagement in marketing spend.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $191.22 for Progressive based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $85.2 billion, earnings will come to $6.7 billion, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 6.0%.

- Given the current share price of $201.87, the analyst's price target of $191.22 is 5.6% lower. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.