Last Update 03 Nov 25

Fair value Increased 2.09%Analysts have raised their price target for Ultrapar Participações from R$23.88 to R$24.38, citing improved profitability and a recent upgrade in outlook by the Street as supporting factors.

Analyst Commentary

Bullish Takeaways

- Bullish analysts highlight the recent upgrade of Ultrapar’s rating, which reflects rising confidence in the company’s execution and market positioning.

- Strong profitability trends and margin improvements have strengthened the outlook for future earnings growth.

- The revised price target is based on anticipated operational efficiencies and favorable industry dynamics, which are expected to support long-term value creation.

- Continued disciplined capital allocation and focus on core businesses are seen as positive catalysts for further increases in valuation.

Bearish Takeaways

- Bearish analysts remain cautious on the sustainability of recent profitability gains, noting the potential for cost inflation to impact margins.

- Concerns persist around execution risks tied to ongoing strategic initiatives, such as integration of new business units.

- Uncertainty in macroeconomic conditions may constrain top-line growth and present downside risks to current valuation levels.

What's in the News

- The Board of Directors will meet on September 17, 2025, to review changes to internal bylaws for the lead independent director appointment and to consider proposed amendments to the Corporate Risk Management Policy (Board Meeting).

- An Analyst/Investor Day event has been scheduled to provide updates and engage with the investor community (Analyst/Investor Day).

- Bernardo Sacic has resigned from his director position as of August 14, 2025. The Board has acknowledged his service and will leave the position temporarily vacant (Board Meeting).

Valuation Changes

- Fair Value has increased slightly, moving from R$23.88 to R$24.38.

- Discount Rate has fallen marginally, from 23.26% to 23.11%.

- Revenue Growth estimate has decreased, shifting from 1.95% to 1.78%.

- Net Profit Margin has risen modestly, improving from 1.72% to 1.77%.

- Future P/E ratio has edged lower, decreasing from 17.90x to 17.76x.

Key Takeaways

- Stricter regulation and middle-class growth in Brazil boost Ultrapar's margins, recurring revenue, and enable further expansion in retail and fuel segments.

- Logistics and clean energy initiatives diversify earnings, while financial discipline allows targeted investment and flexibility to enhance shareholder value.

- Ultrapar faces increased competition, regulatory uncertainty, operational margin pressures, reliance on one-off gains, and slow progress in energy transition, threatening long-term growth sustainability.

Catalysts

About Ultrapar Participações- Through its subsidiaries, operates in the energy and infrastructure business in Brazil.

- Increased regulatory enforcement in Brazil against tax evasion, including the implementation of single-phase taxation and the solidarity principle in São Paulo, is expected to reduce unfair competition and improve industry margins and profitability-supporting higher net margins and potentially lifting returns on capital over time.

- Growth of the urban middle class in Brazil is driving expansion of convenience retail and value-added services at Ipiranga fuel stations, as evidenced by 10% same-store sales growth at AmPm; this structural demand shift should support recurring revenue growth and improved margin mix.

- The consolidation of Hidrovias and Ultracargo's ongoing logistics infrastructure expansion positions Ultrapar to benefit from Brazil's rising commodity exports and sustained energy demand in Latin America, providing a platform for stable top-line revenue growth and EBITDA expansion as new terminals mature through 2026.

- Ultragaz's ongoing focus on efficiency, growth in bulk segment, and introduction of new energies (such as biomethane and distributed generation) taps into the market transition towards cleaner fuels, supporting a higher share of EBITDA from these areas and providing diversification to underpin long-term earnings growth.

- Strengthened balance sheet discipline-with leverage trending back toward 1.5x–2x net debt/EBITDA and robust operating cash flow-creates financial flexibility for Ultrapar to selectively invest in higher-return segments or return more capital via dividends or buybacks, supporting both earnings growth and shareholder returns.

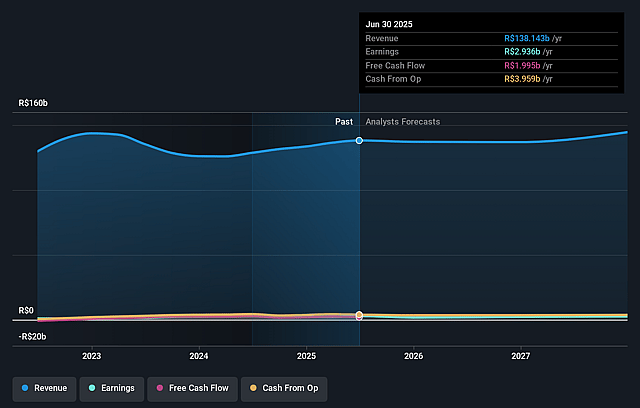

Ultrapar Participações Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ultrapar Participações's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 2.1% today to 1.7% in 3 years time.

- Analysts expect earnings to reach R$2.6 billion (and earnings per share of R$2.28) by about September 2028, down from R$2.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting R$3.0 billion in earnings, and the most bearish expecting R$1.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, up from 7.2x today. This future PE is greater than the current PE for the US Oil and Gas industry at 5.7x.

- Analysts expect the number of shares outstanding to decline by 1.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.83%, as per the Simply Wall St company report.

Ultrapar Participações Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential regulatory change under consideration by the ANP to end brand respect and allow partial LPG refilling could increase competition from unlawful or opportunistic players, erode investment incentives for bottle distributors like Ultragaz, and increase logistical costs and safety risks-pressuring margins and possibly reducing long-term EBITDA in the LPG segment.

- Ipiranga continues to face challenges from informal practices, such as irregular imports of naphtha and noncompliance with biodiesel blends in diesel, as well as persistent tax evasion; these undermine both volume and pricing power, and may continue to compress fuel distribution margins and impair long-term revenue growth.

- Extraordinary earnings in the quarter were boosted by one-off tax credits (R$677 million); reliance on such nonrecurring items for net income highlights the risk of future earnings normalization, which could weigh on investor sentiment and share price if core operational profits do not improve.

- Slow progress in the energy transition and only modest contribution from "new energies" (biomethane, distributed generation, etc.)-currently making up just 3–5% of EBITDA-may leave Ultrapar overly reliant on legacy fuel and LPG businesses, exposing it to secular declines in fossil fuel demand and threatening long-term revenue sustainability.

- Ultracargo's reported decrease in cubic meters sold (-14% YoY) and EBITDA (-15% YoY), combined with ongoing expansion costs and industry-wide storage and import reductions, suggest sector overcapacity and margin pressure in logistics, which could limit future revenue growth in the company's infrastructure business.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$22.5 for Ultrapar Participações based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$28.0, and the most bearish reporting a price target of just R$16.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$153.7 billion, earnings will come to R$2.6 billion, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 19.8%.

- Given the current share price of R$19.67, the analyst price target of R$22.5 is 12.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.