Last Update 04 Oct 25

Fair value Decreased 6.96%Analysts have lowered their price target for Black Box from $647 to $602, citing slight moderation in profit margin projections and a slightly lower future P/E. However, revenue growth expectations remain strong.

What's in the News

- Board meeting scheduled for August 13, 2025, at 20:30 Indian Standard Time to consider and approve draft unaudited financial results for the quarter ended June 30, 2025 (Key Developments).

- The agenda also includes the appointment of M/s. Makarand M. Joshi & Co. as Secretarial Auditor for a five-year term beginning April 1, 2025 (Key Developments).

Valuation Changes

- The consensus analyst price target has decreased from ₹647 to ₹602, reflecting a moderate reduction in expectations.

- The discount rate has edged down slightly from 16.38 percent to 16.29 percent.

- The revenue growth projection has increased marginally from 16.54 percent to 16.73 percent.

- The net profit margin estimate has declined from 5.42 percent to 5.34 percent.

- The future P/E multiple has fallen from 34.86x to 32.71x.

Key Takeaways

- Strategic shift to larger, integrated contracts and industry verticals improves revenue visibility, recurring earnings potential, and strengthens competitive positioning in digital infrastructure.

- Operational focus on high-value customers, leadership changes, and cross-selling enhance profitability and position the company for long-term growth in emerging tech areas.

- Margin pressure, earnings volatility, and stagnant growth risk are heightened by intense competition, reliance on large contracts, slow service transformation, macroeconomic headwinds, and weak innovation investment.

Catalysts

About Black Box- Provides information and communications technology solutions in India, the United States, Ireland, the United Kingdom and internationally.

- Strong order book momentum and ongoing shift to larger, high-value contracts (including wins in data centers, financial services, OTT, and public sector) support robust revenue visibility and backlog growth; this positions the company to benefit as enterprises accelerate digital adoption and infrastructure investments, likely driving topline growth in upcoming quarters.

- Intensifying focus on providing integrated solutions to hyperscalers and global enterprises-coupled with increased engagement in high-growth verticals like data centers, healthcare, and government-aligns with industry-wide migration to cloud and hybrid environments, offering significant headroom for recurring revenues and earnings expansion through both project and annuity contracts.

- Implementation of an experienced leadership team and a new go-to-market strategy is resulting in higher win rates, greater customer wallet share, and improved cross-selling across solutions such as connectivity, cybersecurity, and managed services, which should drive both revenue growth and gradual net margin improvement.

- Ongoing rationalization of the long-tail customer base, with a pivot to focusing on fewer, higher-value customers, is streamlining operations and reducing SG&A costs, setting up better operating leverage and supporting sustained improvements in EBITDA margin.

- Long-term opportunities in AI-led infrastructure refresh, proliferation of IoT and edge computing, and 5G expansion will require significant new deployments and retrofits of IT architecture; Black Box's global presence and rising order pipeline in these domains make it well-positioned to capture incremental demand, underpinning future revenue growth and backlog expansion.

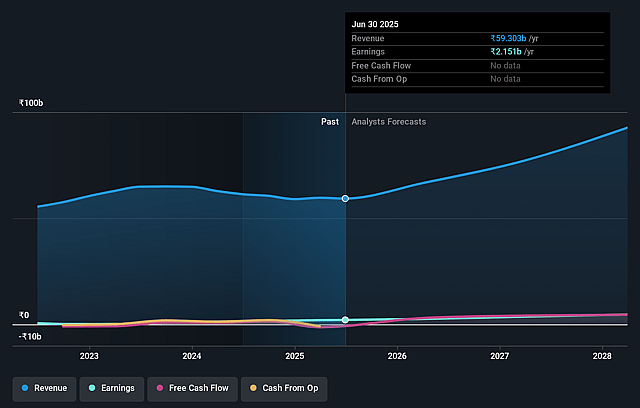

Black Box Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Black Box's revenue will grow by 16.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 5.4% in 3 years time.

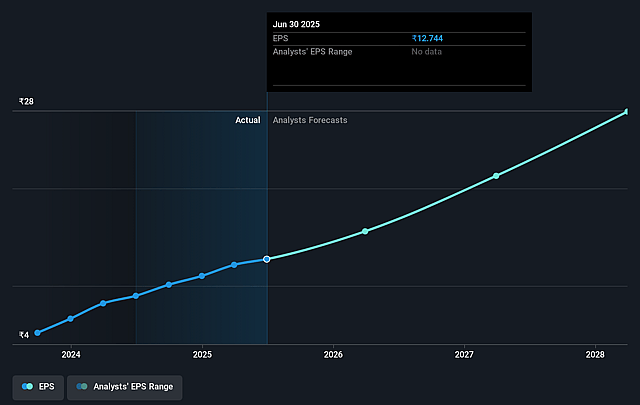

- Analysts expect earnings to reach ₹5.1 billion (and earnings per share of ₹26.24) by about September 2028, up from ₹2.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.9x on those 2028 earnings, down from 36.6x today. This future PE is greater than the current PE for the IN IT industry at 26.7x.

- Analysts expect the number of shares outstanding to grow by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.38%, as per the Simply Wall St company report.

Black Box Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition and price pressure in core IT infrastructure and network deployment services, driven by the commoditization of offerings and the proliferation of global managed services providers, could compress Black Box's service margins and top-line revenue growth in the long term.

- Heavy reliance on landing large, complex contracts and a shrinking long-tail client base increases earnings volatility risk: delays, cancellations, or failures to win such deals can create sharp fluctuations in quarterly revenues and cash flows, undermining long-term earnings stability.

- Slower-than-expected execution of transformation from traditional hardware-based solutions to higher-margin managed or software-defined services-due to extended project lead times, lagging Day 2/support annuity, and the legacy orientation of the backlog-may restrict net margin expansion and limit sustainable revenue growth.

- Prolonged or recurring macroeconomic uncertainties (such as tariffs, supply chain disruptions, client capital expenditure delays, or currency fluctuations) can stall project execution and revenue recognition, resulting in unpredictable quarterly financials and long-term revenue headwinds.

- Insufficient investment in innovation, R&D, and co-innovation/IP partnerships with hyperscalers and strategic clients risks Black Box's ability to capture edge computing, AI infrastructure, or new cloud-based opportunities-potentially eroding market share and pressuring both margins and overall earnings in the face of evolving secular technology trends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹647.0 for Black Box based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹93.9 billion, earnings will come to ₹5.1 billion, and it would be trading on a PE ratio of 34.9x, assuming you use a discount rate of 16.4%.

- Given the current share price of ₹462.65, the analyst price target of ₹647.0 is 28.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.