Key Takeaways

- Pfizer's leadership in oncology, enhanced by the Seagen acquisition, aims to significantly expand its R&D resources and U.S. operations.

- Strategic focus on pipeline innovation and improving operational efficiency is expected to drive growth in revenue, net margins, and earnings.

- Relying too heavily on the Seagen acquisition for oncology strategy, decreasing COVID-19 sales, R&D costs, realigning costs, and regulatory challenges may affect profits and innovation.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Pfizer's leadership in oncology, particularly with the completion of the Seagen acquisition, is poised to double its research resources and expand its commercial and medical footprint in the U.S., enhancing top-line growth.

- The product pipeline, marked by record FDA approvals in 2023 and a focus on oncology, among other areas, is expected to further drive revenue growth.

- Strategic realignment of the cost base aims to expand margins, potentially improving net margins through increased operational efficiency.

- Capital allocation strategies, including investments in internal R&D and completed business development transactions, are expected to contribute to earnings growth.

- The deliberate efforts to focus on strategic priorities such as achieving world-class oncology leadership, delivering the next wave of pipeline innovation, and maximizing new product performances are aimed at driving company-wide growth, potentially impacting revenue, net margins, and earnings positively.

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming Pfizer's revenue will grow by 2.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 17.5% in 3 years time.

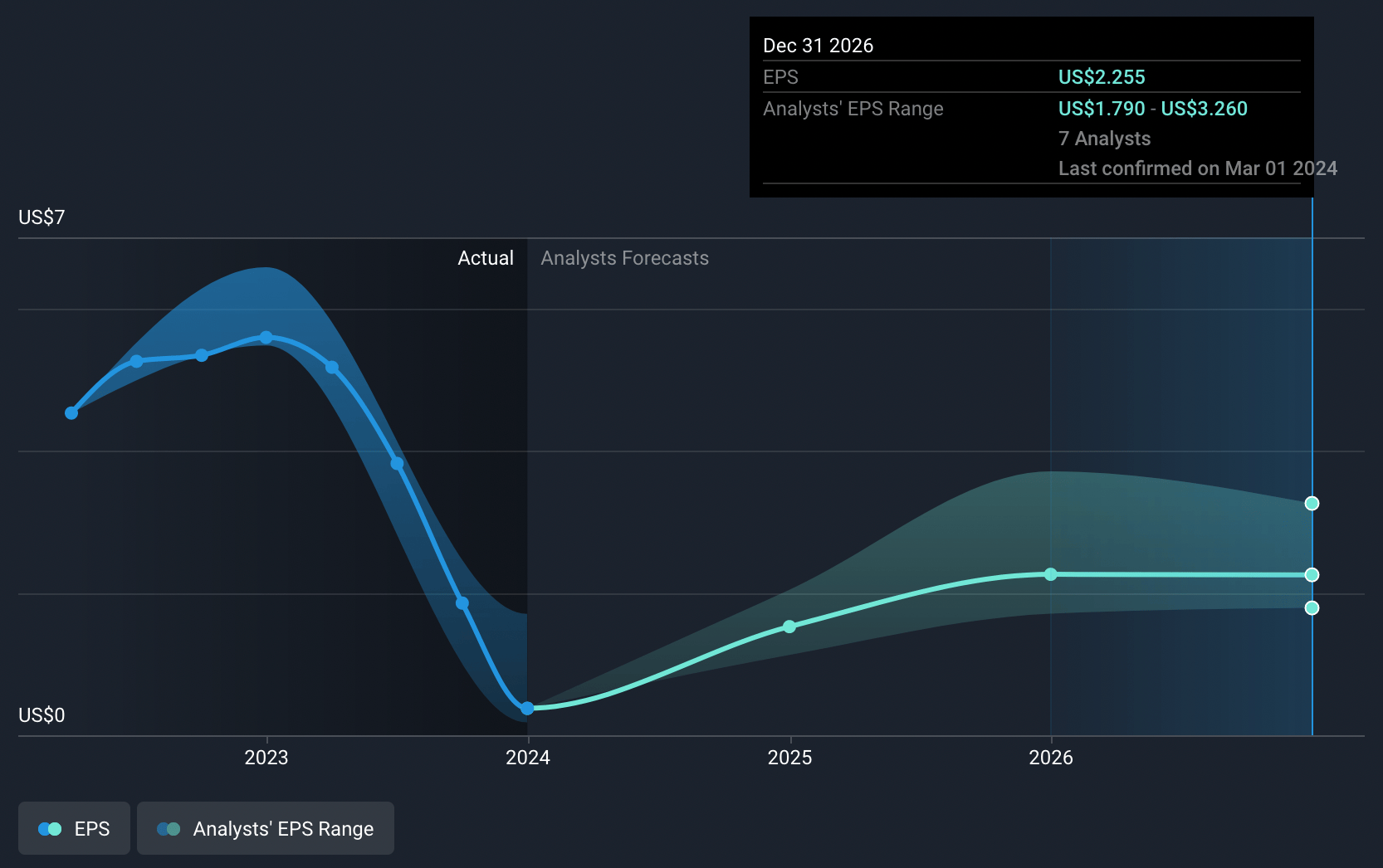

- Analysts expect earnings to reach $11.1 billion (and earnings per share of $2.25) by about March 2027, up from $2.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.3x on those 2027 earnings, down from 74.4x today.

- To value all of this in today’s dollars, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The reliance on successful integration and growth of the Seagen acquisition to achieve strategic objectives in oncology could pose financial risks if not executed properly, affecting revenue and net margins.

- The expectation that COVID-19 product sales will continue declining could negatively impact overall revenue, particularly if no new product or indication compensations are effectively commercialized.

- The substantial investments in R&D, though potentially boosting long-term innovation, could strain short-term financial performance by increasing operational costs.

- The ongoing necessity to adjust and realign cost base in response to shifting revenue streams could lead to short-term margin pressures, impacting net earnings.

- Potential regulatory challenges or changes in market access and competition across key product areas, including oncology and vaccines, could impact revenue growth and profitability.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $32.71 for Pfizer based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $63.8 billion, earnings will come to $11.1 billion, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 6.0%.

- Given the current share price of $28.13, the analyst's price target of $32.71 is 14.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.