Key Takeaways

- EYLEA HD's approval and strong market launch positions it for significant revenue boost in treating wet age-related macular degeneration and diabetic eye diseases.

- Strategic focus on oncology, highlighted by bispecific antibodies submissions, aims to diversify and expand revenue in the high-value oncology market.

- Leadership changes, FDA delays, competition, litigation, and high R&D costs could strain Regeneron Pharmaceuticals' financial health and market position.

Catalysts

What are the underlying business or industry changes driving this perspective?

- EYLEA HD's successful FDA approval and strong market launch position it to potentially become the new standard of care for patients with wet age-related macular degeneration and diabetic eye diseases, likely to significantly boost revenue.

- The defense of intellectual property related to EYLEA, particularly the favorable court decision on formulation patents, could delay the entry of biosimilar competitors, protecting revenue and market share.

- Accelerated growth and market penetration of Dupixent across multiple indications, including the significant potential expansion into COPD treatment, are expected to contribute to substantial increases in revenue.

- The strategic focus on becoming a global leader in oncology, underscored by regulatory submissions for bispecific antibodies linvoseltamab and odronextamab, could diversify and expand revenue streams in the high-value oncology market.

- Advancements in the early-stage pipeline, including potential first or best-in-class opportunities in areas like obesity and genetic medicines, suggest long-term growth prospects, likely impacting future earnings positively.

Assumptions

How have these above catalysts been quantified?

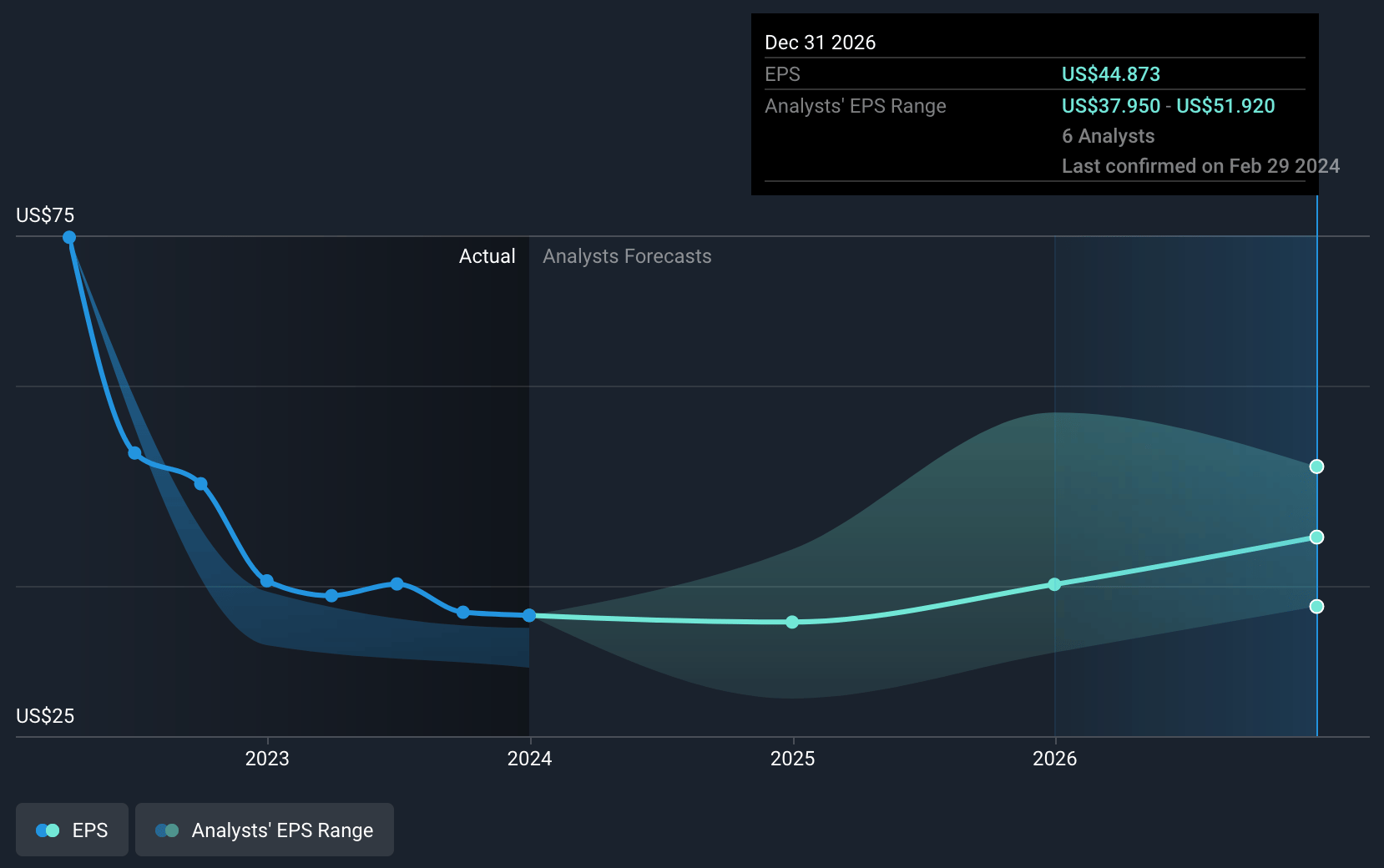

- Analysts are assuming Regeneron Pharmaceuticals's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 30.1% today to 33.2% in 3 years time.

- Analysts expect EPS to reach $44.87 ($5.3 billion in earnings) by about February 2027, up from $36.79 today.

Risks

What could happen that would invalidate this narrative?

- The retirement of Bob Landry and subsequent leadership transition could potentially introduce risks related to strategic financial planning and execution, affecting the company's financial health.

- Delays in FDA approvals and regulatory challenges, as noted with the initial delay of EYLEA HD, can impact product launch timelines, revenue, and net margins.

- Competition from biosimilars and other innovative treatments, especially in the anti-VEGF and oncology markets, could negatively impact Regeneron's market share and earnings.

- Intellectual property litigation could incur significant costs and, if lost, could lead to revenue loss due to competition from biosimilars, particularly mentioned in the context of defending EYLEA patents.

- High R&D expenses and investment into the pipeline, although necessary for long-term growth, might strain short-term financial results by reducing net income and affecting earnings.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.