Last Update 15 Nov 25

Fair value Decreased 0.57%FNTN: Market Confidence Will Continue Supporting Share Performance Amid Mild Near-Term Adjustments

Freenet's analyst price target saw a slight decrease, dropping from approximately €32.03 to €31.85. Analysts cite minor adjustments in growth and discount rate assumptions following recent updates from major research firms.

Analyst Commentary

Recent analyst activities reflect a moderate adjustment in outlook for Freenet. Updates to price targets show both optimism about the company’s prospects and recognition of ongoing challenges.

Bullish Takeaways

- Bullish analysts continue to highlight Freenet's strong fundamentals. This has supported upward adjustments to certain price targets despite minor overall declines.

- Recent increases to price targets reflect confidence in the company’s ability to execute on its current strategy and meet near-term growth objectives.

- Maintained buy and equal weight ratings signal ongoing belief in Freenet’s resilience and steady market position. This reinforces positive sentiment on long-term valuation.

- The upward revision by some analysts, even if slight, suggests an expectation of revenue growth and persistent demand for Freenet’s core services.

Bearish Takeaways

- Bearish analysts cite minor downgrades to price targets, indicating some caution regarding the company’s growth outlook and possible market headwinds.

- The modest reductions in targets reflect concerns about reduced momentum in earnings or lower-than-expected execution in the short term.

- There is some uncertainty regarding discount rate assumptions, which has led analysts to adjust their forecasts conservatively.

- Ongoing adjustments hint at cautious sentiment toward valuation expansion. This signifies the need for Freenet to consistently deliver on operational improvements to drive share appreciation.

Valuation Changes

- Consensus Analyst Price Target decreased marginally from €32.03 to €31.85.

- Discount Rate increased slightly from 4.76% to 4.93%.

- Revenue Growth expectation rose from 1.64% to 1.98%.

- Net Profit Margin improved modestly, moving from 11.77% to 11.84%.

- Future P/E ratio fell slightly from 13.63x to 13.19x.

Key Takeaways

- Accelerated AI integration, stronger digital and postpaid growth, and strategic partnerships are driving operational efficiency, higher margins, and more predictable recurring revenues.

- Diversification into subscription-based TV streaming and a shift to performance-driven marketing enhance customer acquisition efficiency and support sustained margin expansion.

- Competitive pricing pressure, uncertain partner recovery, and unproven digital strategies threaten revenue growth, profitability targets, and investor confidence despite efforts to optimize costs and subscriber gains.

Catalysts

About freenet- Provides telecommunications, broadcasting, and multimedia services for mobile communications/mobile internet, and digital lifestyle sectors in Germany.

- The company is accelerating its adoption of AI across pricing, customer management, and churn reduction processes, which is expected to drive higher conversion rates, lower churn, and improved operational efficiency-supporting revenue growth and expanding net margins over time.

- Ongoing growth in mobile data and connectivity demand, alongside strong increases in postpaid subscribers and waipu.tv customers, positions freenet to benefit from sustainable volume growth and increased ARPU opportunities, despite short-term ARPU pressures-bolstering recurring revenues.

- Strategic partnerships and long-term contracts with network operators are providing optimized network costs and higher-margin revenue streams; management states these agreements are multi-year in nature (5–10 years), enabling durable improvements to gross profit and net margins.

- The company's shift to a performance-based brand marketing model, alongside an increased focus on online channel optimization and cost discipline, is expected to lift customer acquisition efficiency and reduce unnecessary marketing spend-helping stabilize or enhance earnings and free cash flow.

- Diversification into digital lifestyle and TV streaming verticals (notably waipu.tv, which has shown ~25% revenue growth and significant EBITDA contribution) leverages the long-term shift to subscription models, increasing revenue predictability and supporting higher margin expansion over time.

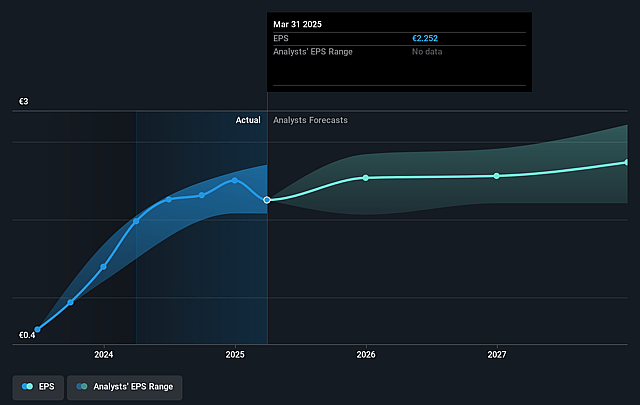

freenet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming freenet's revenue will grow by 2.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 11.7% in 3 years time.

- Analysts expect earnings to reach €312.7 million (and earnings per share of €2.96) by about September 2028, up from €256.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €368 million in earnings, and the most bearish expecting €263.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 12.9x today. This future PE is lower than the current PE for the GB Wireless Telecom industry at 18.1x.

- Analysts expect the number of shares outstanding to decline by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.76%, as per the Simply Wall St company report.

freenet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained pressure on average revenue per user (ARPU) due to heightened competition and a market-wide shift toward discount and price-sensitive customer segments may outweigh subscriber growth and negatively impact future revenue and earnings.

- Continued reliance on postpaid subscriber growth while ARPU declines, combined with uncertainty around recovering high-volume partnership channels (like the loss of O2/Telefonica for waipu.tv), poses a risk to long-term topline growth and may constrain EBITDA targets if replacement partners are not secured in a timely manner.

- The company's stated strategy to optimize costs through reduced brand marketing may face limits in a competitive industry, and if performance-based marketing does not sufficiently increase conversion or reduce churn, margin improvement could stagnate and earnings growth may not materialize.

- Delayed realization of new partner agreements or slower-than-projected recovery of waipu.tv net additions (especially with the O2 headwind expected to last until at least 2026) increases the risk that ambitious mid-term targets will not be met, pressuring revenue forecasts and investor confidence.

- The heavy emphasis on leveraging AI and digital transformation is at an early stage and, without demonstrated, quantifiable impacts on customer retention, conversion, or cost efficiency, could lead to higher upfront investment and operational risk without near-term benefit to net margins or cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €32.936 for freenet based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €39.4, and the most bearish reporting a price target of just €26.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.7 billion, earnings will come to €312.7 million, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 4.8%.

- Given the current share price of €28.14, the analyst price target of €32.94 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.