Last Update 26 Jan 26

Fair value Increased 6.25%FLS: Capital Markets Day And Index Inclusion Will Shape Balanced Outlook

Analysts have lifted their fair value estimate for FLSmidth from DKK 470.78 to about DKK 500.20, citing recent price target moves around DKK 505 to DKK 540 and upcoming company events as key support for the revised view.

Analyst Commentary

Bullish Takeaways

- Bullish analysts point to the higher price target of DKK 540 as support for a valuation view that still sees upside potential versus the current fair value estimate of about DKK 500.20.

- The upcoming capital markets day in March is seen as a potential event for management to clarify medium term execution priorities, which bullish analysts expect could help justify higher valuation multiples if the plan is well received.

- Despite the Q3 report missing estimates, bullish analysts appear focused on the forward looking message and upcoming disclosures rather than the single quarter, suggesting they see execution risk as manageable at this stage.

Bearish Takeaways

- Bearish analysts have shifted to a Hold stance with a DKK 505 price target, indicating they see the current share price as closer to fair value with more limited upside from here.

- The downgrade to Hold reflects caution around execution following the Q3 miss, with some concern that delivery against expectations may be uneven.

- With price targets clustered in the DKK 505 to DKK 540 range, bearish analysts appear reluctant to assume that upcoming events will translate into a material re rating without clearer proof points.

- The mix of a higher target from bullish analysts and a Hold rating from more cautious voices highlights a split view on growth visibility and execution, which investors may want to factor into their own risk tolerance and time horizon.

What's in the News

- FLSmidth & Co. A/S is being added to the OMX Copenhagen 20 Index, placing the shares in a key Danish blue chip benchmark that many index and ETF products track (Index Constituent Adds).

- The company received an order valued at about DKK 405 million to supply comminution technologies, including crushers, SAG and ball mills and cyclones, for a greenfield copper concentrator in South America, with equipment delivery planned for 2027 and the order booked in Q4 2025 (Client Announcements).

- Azumah Resources Gh Limited selected FLS as technology partner for the Black Volta gold project in Ghana, with an order of around DKK 235 million for long lead equipment, technical support and performance guarantees, booked in Q4 2025 and scheduled to be delivered during 2026 ahead of a 2027 mine start up (Client Announcements).

- Chief Executive Officer Mikko Keto has informed the Board that he will step down to take an executive role at a non competing company, with his departure expected in the first half of 2026 as the Board runs a succession process and prepares to appoint a new CEO (Executive Changes).

- FLSmidth & Co. A/S updated its full year 2025 earnings guidance and now expects revenue of around DKK 14.5 billion, compared with the prior range of DKK 14.5 billion to DKK 15.0 billion (Corporate Guidance).

Valuation Changes

- The Fair Value Estimate has risen slightly from DKK 470.78 to about DKK 500.20, reflecting a modest uplift in the central valuation point used in the analysis.

- The Discount Rate has edged down slightly from 6.51% to about 6.48%, implying a marginally lower required rate of return in the updated model.

- The Revenue Growth assumption has moved from about a 5.39% decline to about a 5.18% decline, indicating a slightly less negative revenue trend incorporated into the forecasts.

- The Net Profit Margin assumption has eased slightly from 10.65% to about 10.57%, suggesting a small reduction in expected profitability levels.

- The Future P/E has risen from about 17.06x to about 18.13x, pointing to a higher valuation multiple being applied to the company’s projected earnings.

Key Takeaways

- Expansion of resilient, high-margin service and aftermarket operations, alongside cost base optimization, sets the stage for sustainable earnings growth and improved margins.

- Streamlined focus on mining, brownfield upgrades, and decarbonization strengthens market leadership, positioning the company for enhanced cash flow and shareholder returns.

- Heavy reliance on cyclical mining capex and slow structural transition to services leave FLSmidth exposed to volatile revenue, margin pressure, and risks from industry shifts or poor execution.

Catalysts

About FLSmidth- Provides flowsheet technology and service solutions for the mining and cement industries in Denmark, the United States of America, Canada, Chile, Brazil, Peru, Australia, North and South America, Europe, the Middle East, Africa, and Asia.

- FLSmidth's focus on expanding its service and aftermarket business (which generates recurring, higher-margin revenue and is more resilient through cycles) positions it to sustainably grow net margins and earnings stability, especially as the company replicates successful practices from its high-growth, high-profitability PCV segment across its Service operation.

- The company is proactively streamlining its fixed cost base (SG&A and corporate overhead) and rightsizing the Product division to ensure a scalable platform; when capital equipment demand recovers (expected towards late 2026/2027), operating leverage should drive a step up in EBITA margin and earnings as volumes rebound.

- Strength in brownfield upgrades, process optimization, and digital solutions-closely aligned with mining clients' needs to improve resource efficiency and comply with stricter environmental standards-positions FLSmidth to capture a greater share of customer spend and grow both topline and gross margins as decarbonization and circularity become more important in the industry.

- FLSmidth's leading installed base and dominant market position in key growth geographies (notably Chile for copper), combined with the industry's long-term need for minerals essential to the energy transition, is set to boost order intake and revenue growth once major project sanctions resume and mining capex rebounds.

- Ongoing disposal of the low-margin Cement business, portfolio simplification, and a focus on high-aftermarket potential equipment will free up capital, reduce risk, and enhance overall return on invested capital, supporting improved cash generation and shareholder returns over time.

FLSmidth Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming FLSmidth's revenue will decrease by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.6% today to 9.9% in 3 years time.

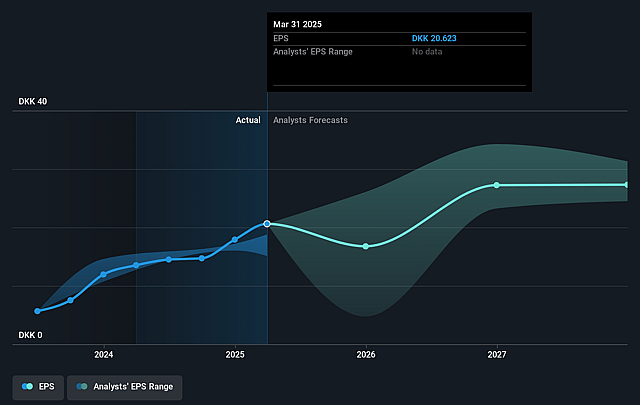

- Analysts expect earnings to reach DKK 1.6 billion (and earnings per share of DKK 30.04) by about September 2028, up from DKK 1.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as DKK1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 18.1x today. This future PE is greater than the current PE for the GB Machinery industry at 18.1x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.12%, as per the Simply Wall St company report.

FLSmidth Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent softness and volatility in the Product (capital equipment) business segment, with cyclical, lumpy demand, high fixed costs, and current negative EBITA, expose FLSmidth to prolonged periods of weak revenue and earnings, especially if the anticipated upturn in late 2026/2027 is delayed or softer than expected.

- Customer hesitancy and delays in sanctioning new mining projects-particularly in core markets like South America-reflect a broader global trend of capital expenditure caution, regulatory uncertainty, and potentially longer cycles, creating downside risk to order intake, revenue growth, and cash flow.

- FLSmidth's dependence on mining sector capex cycles and overexposure to large, one-off product orders heightens revenue volatility and limits resilience to structural shifts such as decarbonization policies, resource nationalism, or technological disruption (e.g., Industry 4.0, alternative processing solutions) that could shrink the addressable market or redirect investment to new solutions beyond FLSmidth's portfolio.

- Ongoing rightsizing and restructuring efforts in Products and SG&A reductions signal underlying challenges with adapting the legacy business model to a scalable, service-led operation; execution risk, slow transition, and failure to fully align cost base could result in margin compression and suboptimal profitability, especially in a capex-light market.

- The successful transformation to a higher-margin, recurring revenue service and PCV business is heavily reliant on replicating internal best practices and commercial excellence across regions; if these efforts fall short, or if intensified competition, substitution by alternative solutions, or supply chain disruptions increase, FLSmidth's net margins and earnings stability could be undermined.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of DKK446.75 for FLSmidth based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK500.0, and the most bearish reporting a price target of just DKK344.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be DKK16.2 billion, earnings will come to DKK1.6 billion, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 6.1%.

- Given the current share price of DKK421.0, the analyst price target of DKK446.75 is 5.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on FLSmidth?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.