Key Takeaways

- The Marcum acquisition and digital investments enhance CBIZ's scale, capabilities, and efficiency to support revenue growth and margin expansion.

- Resilient demand for essential advisory services and industry outsourcing trends underpin CBIZ's stable, recurring earnings and long-term growth outlook.

- Persistent pricing pressures, heavy acquisition reliance, technological disruption, and elevated leverage collectively threaten revenue growth, margin stability, and long-term earnings resilience.

Catalysts

About CBIZ- Provides financial, insurance, and advisory services in the United States and Canada.

- The Marcum acquisition has significantly expanded CBIZ's client base, increased scale, and strengthened capabilities in core tax, accounting, and advisory services-enabling the firm to leverage cross-selling, deepen client relationships, and improve its competitive position in target middle-market segments; this is expected to fuel higher future revenue growth and structural margin expansion as integration synergies are realized.

- Demand for essential, recurring business advisory and compliance services remains resilient in all market climates, underpinned by ongoing complexity in regulation and frequent tax code changes. This structural tailwind supports stable, recurring revenue and earnings growth potential, despite near-term headwinds in discretionary, project-based work.

- The industry-wide shift among small

- and mid-sized businesses toward outsourcing non-core functions like HR, payroll, and finance is expanding CBIZ's addressable market and should drive sustained, long-term organic revenue growth as these businesses seek efficiency gains from third-party providers.

- Continued investment in digital transformation, workflow automation, and client-facing technology (supported by the scale benefits of the Marcum deal) is expected to drive further operating leverage and incremental margin improvement, boosting profitability over the long term.

- Enhanced pricing discipline and integration of Marcum's operations provide a catalyst for higher realized rate increases and improved profitability once market conditions normalize, which will drive top line revenue growth and net margin improvement going forward.

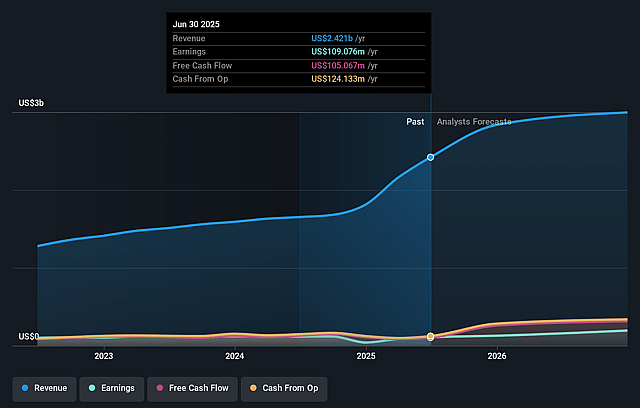

CBIZ Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CBIZ's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.5% today to 7.8% in 3 years time.

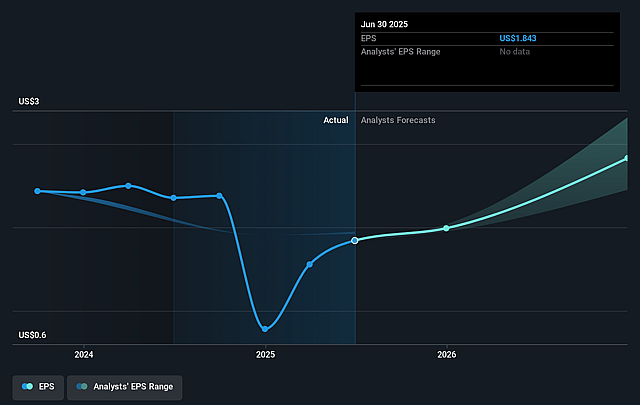

- Analysts expect earnings to reach $257.7 million (and earnings per share of $3.71) by about September 2028, up from $109.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.4x on those 2028 earnings, up from 28.0x today. This future PE is greater than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to grow by 6.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

CBIZ Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces significant pricing pressure, with recent rate increases averaging 4%-200 to 300 basis points below expectations and historical levels-which, if structural rather than cyclical, could indicate persistent limitations on future revenue growth and ultimately lower earnings power.

- A substantial portion of CBIZ's revenue mix remains nonrecurring and market-sensitive (now about 28% including the SEC-related practice), making future revenues vulnerable to economic slowdowns, reduced deal activity, or client reluctance to engage in discretionary projects, affecting both top-line growth and overall earnings stability.

- CBIZ's reliance on acquisitions for growth (notably the large Marcum acquisition) introduces ongoing integration risks, as evidenced by continued integration costs anticipated into at least 2026 and the potential for future acquisition-driven disruptions or margin pressures.

- Elevated leverage from the Marcum acquisition (3.7x net debt/EBITDA post-deal, above the long-term target of 2.5x) increases financial risk, constrains capital allocation flexibility, and raises interest expense, potentially compressing net margins and dampening earnings if deleveraging is slower than projected.

- The professional services industry is experiencing rapid technological shifts (AI, automation, workflow platforms) and increased self-service capabilities for SMB clients, which could commoditize core accounting and consulting offerings and challenge CBIZ's ability to maintain current revenue and margin levels in the face of changing client expectations and digital-first competitors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $95.0 for CBIZ based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $257.7 million, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 8.2%.

- Given the current share price of $57.67, the analyst price target of $95.0 is 39.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.