Last Update 04 Sep 25

Fair value Increased 1.11%PEXA Group's consensus revenue growth forecasts have been notably downgraded while its future P/E multiple has risen significantly, resulting in only a marginal increase in the analyst price target from A$17.22 to A$17.41.

What's in the News

- PEXA Group issued earnings guidance for fiscal year 2026, projecting group revenue between $405 million and $430 million.

- CFO Scott Butterworth will step down effective 31 July 2025; Deputy CFO Liz Warrell will serve as Acting CFO while a formal search for a permanent replacement is conducted.

Valuation Changes

Summary of Valuation Changes for PEXA Group

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from A$17.22 to A$17.41.

- The Consensus Revenue Growth forecasts for PEXA Group has significantly fallen from 13.8% per annum to 10.9% per annum.

- The Future P/E for PEXA Group has significantly risen from 40.11x to 47.58x.

Key Takeaways

- Expansion into the UK, regulatory support, and partnerships with major lenders are set to accelerate adoption and diversify revenue sources.

- Investments in compliance, automation, and data-driven solutions position the company for higher-margin growth and increased customer retention.

- Heavy upfront investment, regulatory pressures, and region-specific risks pose ongoing challenges to PEXA's earnings growth, margin stability, and diversification ambitions.

Catalysts

About PEXA Group- Operates a digital property settlements platform in Australia.

- The company's expansion into the UK, leveraging its proven Australian platform and with the recent onboarding of Tier 1 lender NatWest, represents a significant near-term catalyst for increased adoption, market share gains, and revenue diversification as more lenders and conveyancers are targeted and integrated.

- Regulatory momentum and government mandates in both Australia and the UK toward transparent, efficient, and paperless property transactions are likely to drive continued acceleration of electronic settlements, thereby supporting long-term growth in transaction volumes and recurring revenue streams.

- PEXA's strategic investment in next-generation AML solutions and enhanced cybersecurity-aligned with incoming AML regulations (effective July 2026) and greater industry focus on data security-positions the company to capture higher-margin, value-added service revenue from its established customer base as compliance obligations intensify.

- Ongoing operational automation, platform modernization (through modular architecture), and productivity initiatives are expected to further reduce cost per transaction and enhance group EBITDA and Exchange margins over time, supporting disproportionate earnings growth relative to revenue.

- Emerging demand for robust property data analytics and integrated digital solutions (e.g., expanded API offerings and automated valuation models) provides additional cross-sell and upsell opportunities, supporting margin expansion and user stickiness, which are undervalued in current financials.

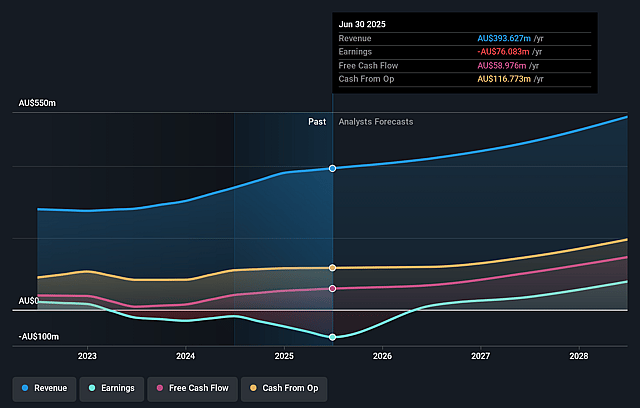

PEXA Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PEXA Group's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -19.3% today to 14.6% in 3 years time.

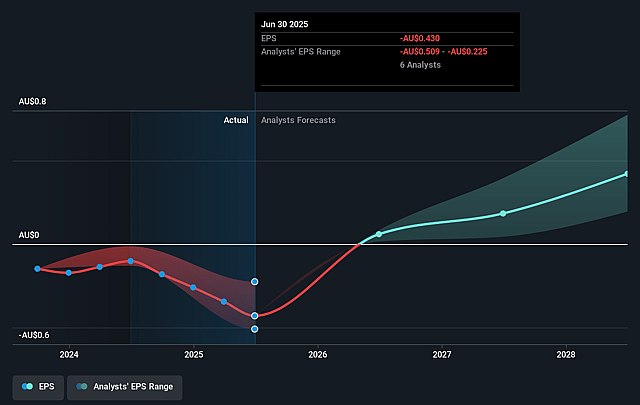

- Analysts expect earnings to reach A$78.6 million (and earnings per share of A$0.42) by about September 2028, up from A$-76.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$138.4 million in earnings, and the most bearish expecting A$34.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.1x on those 2028 earnings, up from -36.5x today. This future PE is greater than the current PE for the AU Real Estate industry at 13.2x.

- Analysts expect the number of shares outstanding to decline by 0.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.11%, as per the Simply Wall St company report.

PEXA Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- PEXA's long-term success is highly dependent on adoption in the UK market, but management notes that operating and onboarding costs will outpace revenue for several years; if lender and conveyancer adoption is slower than anticipated, or if network effects don't materialize, projected diversification and revenue growth could stall, weighing on both revenue and net margins.

- Ongoing high levels of investment in technology, international expansion, platform modernization, and regulatory compliance (e.g., cybersecurity and AML readiness) lead to persistently elevated CapEx and OpEx, which may constrain free cash flow generation and limit near

- to medium-term earnings growth.

- PEXA's financial performance is closely tied to property transaction volumes in Australia and the UK; macroeconomic factors such as slow housing stock growth, interest rate uncertainty, and affordability constraints could dampen volumes in both markets over the long term, directly impacting revenue and earnings growth prospects.

- Despite strong current market share in Australia (≈90% digitization), management guides only slow incremental penetration and notes potential commoditization risks and regulatory reviews (e.g., IPART pricing review), which could pressure pricing and thus lower net margins over time.

- The company's digital solutions segment is under strategic review, with possible divestment under consideration; lack of scale or unclear fit within the group could result in foregone cross-selling opportunities or one-off impairments, both of which may adversely affect longer-term revenue streams and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$17.411 for PEXA Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$20.0, and the most bearish reporting a price target of just A$15.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$537.2 million, earnings will come to A$78.6 million, and it would be trading on a PE ratio of 48.1x, assuming you use a discount rate of 8.1%.

- Given the current share price of A$15.62, the analyst price target of A$17.41 is 10.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PEXA Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.