Last Update 07 Nov 25

Fair value Increased 13%HRTG: Improved Clarity On Reinsurance Costs Will Support Future Upside

The analyst price target for Heritage Insurance Holdings has increased from $31.50 to $35.50. Analysts cite greater clarity on lower reinsurance costs and expectations for enhanced capital management initiatives to support the higher valuation.

Analyst Commentary

Bullish Takeaways

- Bullish analysts highlight the company’s stronger visibility into lower reinsurance costs, which is expected to support improved margins and profitability.

- There is growing confidence in Heritage Insurance Holdings’ capital management strategies, providing a foundation for possible shareholder returns and increased financial flexibility.

- Recent investor meetings suggest a more transparent outlook on the company’s growth trajectory, and analysts have adjusted their price targets upward.

- Potential increases in capital management activity, such as buybacks or dividend initiatives, are viewed as positive contributors to future valuation gains.

Bearish Takeaways

- Bearish analysts remain mindful that further execution risk could arise if reinsurance cost improvements do not materialize as anticipated.

- Uncertainty around the timing and scale of potential capital management actions continues to weigh on the more cautious outlooks.

- Market conditions and external factors affecting reinsurance pricing trends remain a point of concern for forecasting sustainable earnings growth.

Valuation Changes

- Consensus Analyst Price Target has increased from $31.50 to $35.50, reflecting higher expectations for the company's future value.

- Discount Rate has risen slightly from 6.78% to 6.96%, indicating a minor increase in the required rate of return.

- Revenue Growth estimates have increased from 4.33% to 6.02%, signaling stronger anticipated top-line expansion.

- Net Profit Margin projection has declined from 16.61% to 13.40%, suggesting reduced profitability expectations.

- Future Price-to-Earnings (P/E) ratio has risen from 7.0x to 11.6x, which points to higher valuation multiples placed on future earnings.

Key Takeaways

- Accelerating policy growth, favorable demographic shifts, and geographic expansion are boosting premium revenue, market size, and long-term earnings potential.

- Digital upgrades, regulatory reforms, and reinsurance diversification are improving margins, operational efficiency, and revenue stability.

- Heavy exposure to catastrophe-prone regions, limited scale, and rising competitive and regulatory pressures threaten long-term profitability and growth despite diversification efforts.

Catalysts

About Heritage Insurance Holdings- Through its subsidiaries, provides personal and commercial residential insurance products.

- Heritage is approaching an inflection point in policy count growth after several years of contraction; new business production is up 46% YoY and policy growth is expected to accelerate in 2026 as most geographies are now open for new business, supporting a robust rebound in premium revenue and long-term earnings.

- Favorable demographic trends, particularly migration and population growth in Florida and other key Sun Belt/coastal states, continue to grow the insurable asset base in Heritage's core and expansion markets, providing a secular tailwind to policy and premium growth over the coming years-positively impacting topline revenue and addressable market size.

- Recent and ongoing investments in digital infrastructure, including the multi-year Guidewire IT conversion (to be completed next year), will enable greater operational scalability, faster market execution, and more efficient cost structure over time-supporting improvement in expense ratios and net margins.

- Beneficial legislative and regulatory reforms in Florida have materially reduced litigation and frivolous lawsuits, improving loss ratios and the economics of new business in this core market; further, these reforms are expected to exert downward pressure on reinsurance costs in 2026, enhancing underwriting profitability and net margins.

- Prudent reinsurance management and book diversification-including geographic expansion into the Northeast, Mid-Atlantic, and West-reduces concentration risk and earnings volatility from local catastrophes, thereby improving revenue stability, capital efficiency, and long-term return on equity.

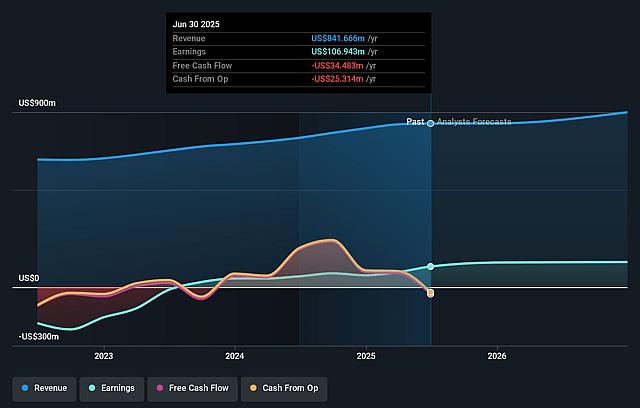

Heritage Insurance Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Heritage Insurance Holdings's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.7% today to 16.6% in 3 years time.

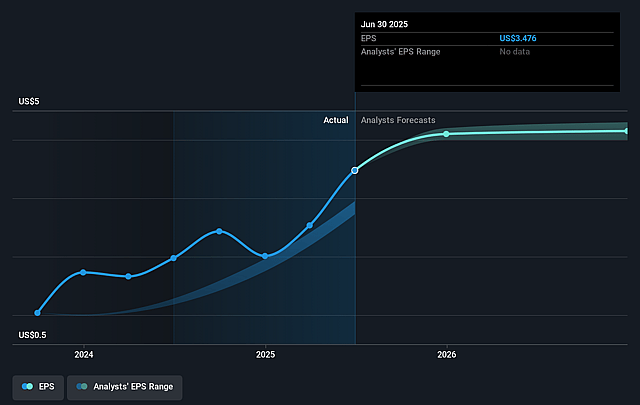

- Analysts expect earnings to reach $158.8 million (and earnings per share of $4.99) by about September 2028, up from $106.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.4x on those 2028 earnings, down from 6.5x today. This future PE is lower than the current PE for the US Insurance industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Heritage Insurance Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heritage's long-term concentration in catastrophe-prone regions like Florida and select coastal states, despite efforts to diversify, exposes the company to significant revenue and net margin volatility from increasingly frequent and severe natural disasters linked to climate change.

- While the company expects growth from new geographies and reopening of previously closed territories, intensifying competition from new and established carriers-especially in depopulating state pools like Citizens-threatens customer acquisition and retention, which could pressure premium revenue and long-term growth prospects.

- Heritage's relatively modest scale compared to larger insurers limits its ability to spread risk, negotiate favorable reinsurance terms, and invest in advanced digital technologies, ultimately constraining operational efficiency, underwriting profitability, and expense ratios over the long term.

- Long-term upward trends in property claim severity, coupled with persistent inflation and the potential for rising reinsurance costs in future years, risk eroding underwriting margins and net profitability even as current loss ratios appear favorable.

- Sustained regulatory scrutiny and ongoing changes-especially around pricing and capital requirements in catastrophe-prone states-could constrain Heritage's flexibility to adjust rates, increase compliance costs, and limit its ability to maintain profitable underwriting standards, ultimately impacting long-term earnings quality.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.0 for Heritage Insurance Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $955.9 million, earnings will come to $158.8 million, and it would be trading on a PE ratio of 6.4x, assuming you use a discount rate of 6.8%.

- Given the current share price of $23.81, the analyst price target of $29.0 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.