Key Takeaways

- Strong pipeline with positive results from clinical trials expected to drive revenue growth through innovative treatments and expanded product offerings.

- Strategic acquisitions, collaborations, and manufacturing investments indicate a focus on enhancing R&D capabilities and production capacity for future growth.

- Eli Lilly's strategies around acquisitions, pipeline development, and market expansion are fraught with risks including financial strain, regulatory hurdles, and competitive pressures.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Positive Phase III results for donanemab, tirzepatide, mirikizumab, and pirtobrutinib, coupled with positive Phase II results for orforglipron and retatrutide, indicate a strong pipeline expected to drive revenue growth. - Impact on revenue and earnings

- Continued emphasis on external innovation through acquisitions and collaborations, as seen with the acquisition of DICE Therapeutics, POINT Biopharma, and others, enhancing the company's R&D capabilities and future product offerings. - Impact on revenue and earnings potential

- Announced substantial investments in manufacturing, including new facilities in Germany and Indiana, aimed at expanding global product and device manufacturing network, especially for diabetes and obesity portfolio, aligning with future revenue growth expectations. - Impact on revenue through increased production capacity

- Regulatory approvals for Zepbound, Jaypirca, Omvoh, and Ebglyss, along with expanded indications for Verzenio and Jardiance, strengthening the portfolio and setting a foundation for sustained top-tier revenue growth and potential margin expansion. - Impact on revenue

- Execution of a 15% dividend increase for the sixth consecutive year, reflecting confidence in future earnings growth and commitment to returning capital to shareholders. - Impact on earnings per share growth

Assumptions

How have these above catalysts been quantified?

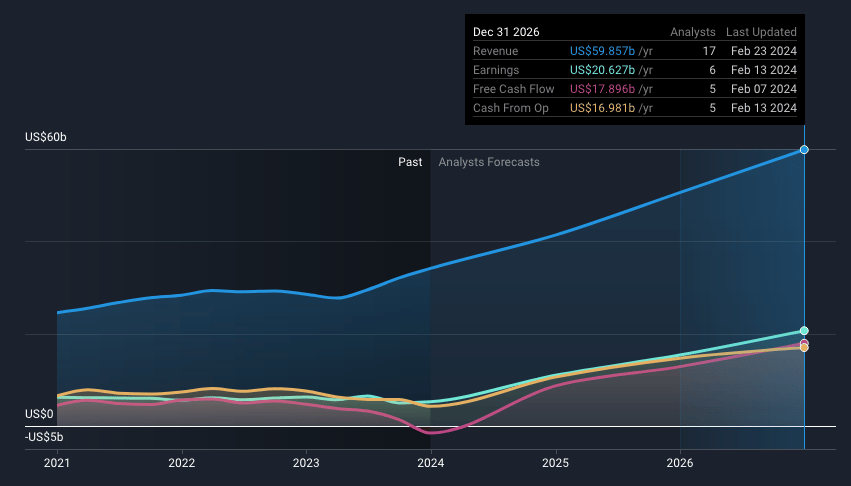

- Analysts are assuming Eli Lilly's revenue will grow by 20.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.4% today to 34.5% in 3 years time.

- Analysts expect EPS to reach $23.06 ($20.6 billion in earnings) by about February 2027, up from $5.82 today.

Risks

What could happen that would invalidate this narrative?

- The reliance on acquisitions for pipeline enrichment and the substantial investments in manufacturing could strain financial resources or lead to integration challenges, potentially impacting net margins.

- The heavy investment in external innovation and acquisitions for pipeline development signals a potential risk if these bets do not pan out as expected, which could affect future revenues and earnings.

- The focus on incretin-based therapies and the expansion in manufacturing capacities highlight potential risks around market saturation or unforeseen production issues impacting revenue growth.

- The company's development and expansion strategies hinge significantly on regulatory approvals, where any delays or negative outcomes could impact anticipated revenue streams and affect net margins.

- Eli Lilly's aggressive push into new therapeutic areas and international markets could face execution risks, regulatory challenges, and stiff competition, potentially dampening expected earnings growth.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.